The World Development Report 2022, released by the World Bank on February 15, warns of the dangers of increased public and private debt burdens caused by the COVID-19 pandemic and the urgent need for countries, particularly developing ones, to improve the health of their financial sectors.

The following are four key charts illustrating the economic destruction caused by the pandemic and the size of the task ahead of governments across the world due to the deterioration in their finances.

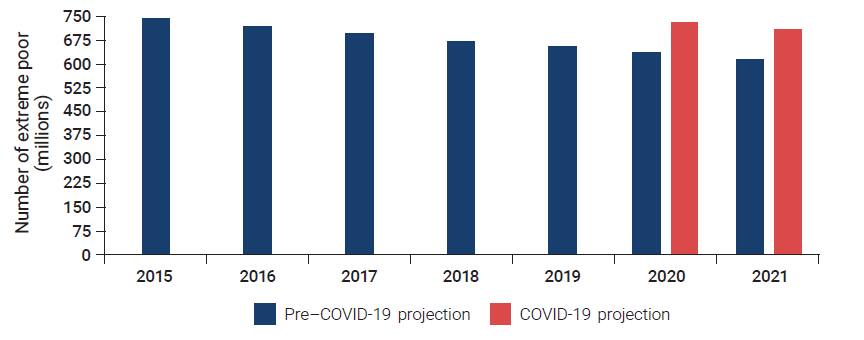

Poverty

That there has been loss of jobs and incomes due to the pandemic is not news. Households at the bottom of the income pyramid have been hurt particularly hard.

Using the international poverty line of $1.90 per person per day, the World Development Report 2022's projections suggest a reversal in the poverty trend following the onset of the pandemic.

Note: The year 2017 is the latest with sufficient population coverage for a global poverty estimate. Subsequent years are projected.

"Whereas before the pandemic 635 million people were projected to live in extreme poverty in 2020, after the onset of the pandemic the projected number of poor increased to 732 million," the report said.

The World Bank calls the difference between the two, or 9.7 crore people, as the "COVID-19–induced poor".

"These numbers suggest that COVID-19 set back progress on poverty reduction at the global level by nearly half a decade, making the goal of eliminating extreme poverty by 2030 unattainable."

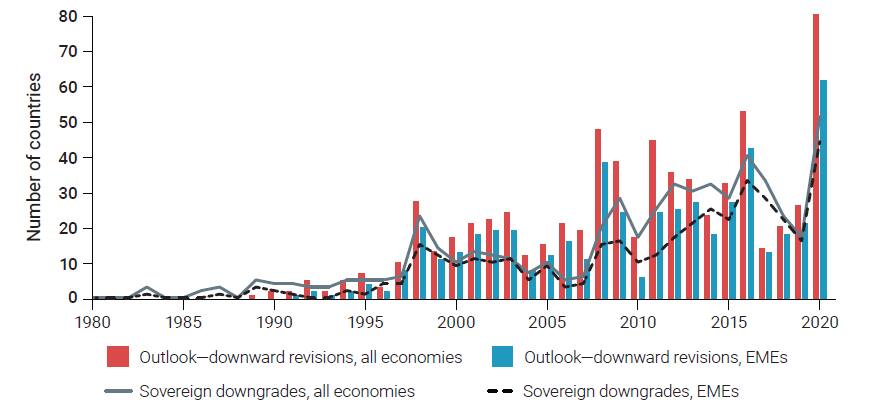

Sovereign downgrades

Governments have tried to tackle the economic fallout of the pandemic by piling up debt and spending where needed. However, with sustainability of debt a concern, 2020 saw 51 countries - of which 44 were emerging economies - experience a rating downgrade.

"Although advanced economies have not been spared, sovereign downgrades are much more consequential for emerging economies, where credit ratings are at or near junk grade, and where the rating of the sovereign has a direct impact on the ratings of state-owned banks and state-owned enterprises," the report said.

Note: Figures for which ratings data could be obtained. Emerging market economies defined as in International Monetary Fund's World Economic Outlook: A Long and Difficult Ascent (IMF 2020).

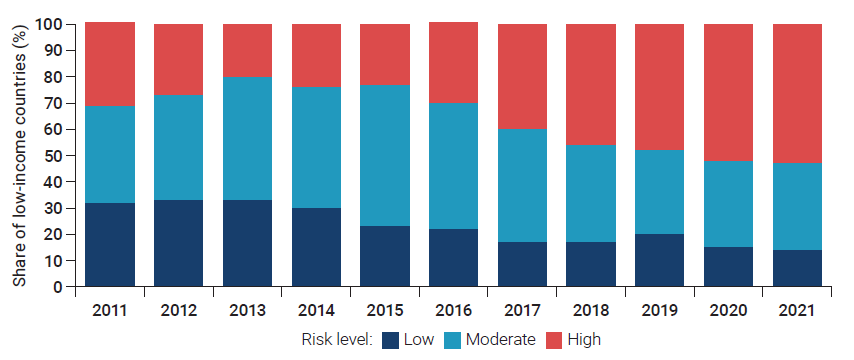

High-risk external debt

Invariably, part of the debt piled up by countries during the pandemic has been external. The World Bank ran a debt sustainability analysis on 66 out of 73 low-income countries eligible to participate in the G-20 Debt Service Suspension Initiative to ascertain the risk of debt distress among them. Unsurprisingly, the share of high-risk category is estimated to have increased in the last couple of years.

It is worth noting that the Debt Service Suspension Initiative expired in December 2021.

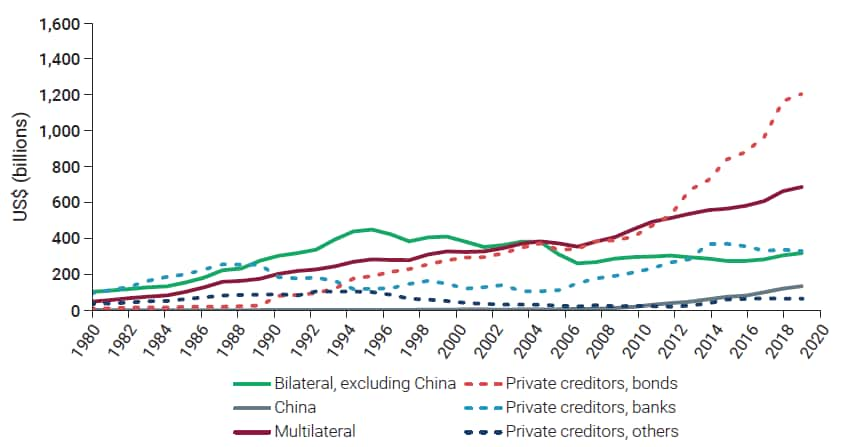

Sources of external debt

If high-risk external debt is rising for low-income countries, it is worth examining who these creditors are.

Using data for total public and publicly guaranteed external debt for 120 low- and middle-income countries - 73 of which fall in the low- and lower-middle-income category – the World Bank's report found a decrease in the transparency of sovereign debt due to the pandemic, which made it more difficult for governments to make their debt more sustainable by way of renegotiations and restructuring.

"One of the most significant developments is the increase in the type and number of creditors. As of 2020, countries eligible for the G-20 Debt Service Suspension Initiative had, on average, more than 20 distinct creditor entities (excluding bondholders). Some countries had many more. Creditors have increasingly included private and official lenders that are not part of the Paris Club, a standing committee of official creditor countries formed in 1956 that, since its creation, has been instrumental in the majority of sovereign debt restructurings," the report said.

This captures China's role as a global lender, too. In 2000, a mere 0.4 percent of the debt of low- and middle-income countries was owed to China. In 2019, this figure had risen to 4.8 percent. The situation is worse for low- and lower middle-income countries, with China accounting for 11 percent of total external public and publicly guaranteed debt.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.