The recent rebound in Indian equities to two-month highs has not seen a wide investor participation, with the average daily turnover in the cash segment for March showing only a marginal uptick compared to the previous month, indicating a cautious sentiment despite the market rally, as experts look to RBI policy and quarterly earnings for the next big cue.

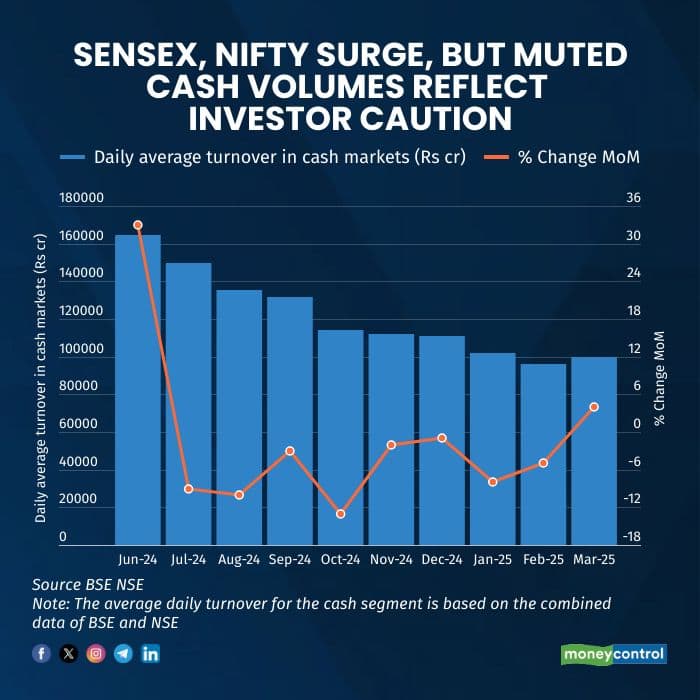

The combined average daily cash turnover of BSE and NSE in March so far stood at around Rs 1 lakh crore, reflecting only a modest 3% rise compared to the previous month. The cash market turnover is still down 40 percent from the June 2024 peak, even as markets attempt a rebound.

The Sensex had surged over 4,000 points and the Nifty 50 has gained nearly 1,300 points since the beginning of March, helping Sensex cross the 78,000 level, with the Nifty index turning positive for 2025. The upmove had led to a six-day rally in March, a first since September 2024, turning Nifty 50 positive for 2025.

The benchmark indices Sensex and Nifty 50 are up 6.5 percent and 7 percent respectively since the start of March, with the broader markets BSE Mid and Smallcap indices outperforming by rising 9.8 percent and 11.1 percent respectively.

Experts attribute the cautious approach to concerns that valuations may still be expensive, potentially creating space for another leg of downturn. This caution has kept several investors on the sidelines, making them hesitant to deploy fresh capital at current levels. Many investors are still nursing portfolio losses from the recent correction, leading to hesitation as to whether it is time to average out, take fresh long positions, or stay on the sidelines.

Mayank Mundhra, FRM - VP Risk & Head Research at Abans Financial Services said global uncertainties have contributed to the cautious sentiment. Concerns over potential US tariff hikes and their inflationary impact have raised fears of economic instability, thus leading to increased volatility across global markets.

Investors are now awaiting the Reserve Bank of India’s bi-monthly policy announcement, expected in April, with hopes pinned on a potential rate cut. The upcoming Q4FY26 earnings season too is expected to be a major catalyst for market direction, as corporate performance playing a crucial role in shaping sentiment.

Few market experts said that the marginal rise in volumes is on account of easing of selling pressure from foreign institutional investors (FIIs), however, a sharp increase in volumes is unlikely, they added.

With the financial year nearing its end, many participants typically reduce activity in the final weeks, to close their books, which could further explain the flat volume trend in March compared to the previous month.

"The broader market continues to consolidate, and the next decisive move will depend on a confluence of factors including corporate earnings, FII activity, and technical confirmation," said KKunal V Parar, Vice President – Technical Research and Algo, Choice Broking.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.