Kotak Mahindra Bank’s loss translated into gains for Federal Bank in the stock market today, as the exit of Joint Managing Director KVS Manian dragged Kotak Bank's stock down by 3 percent, while Federal Bank's stock gained as much on speculation that he might be headed to Federal Bank next.

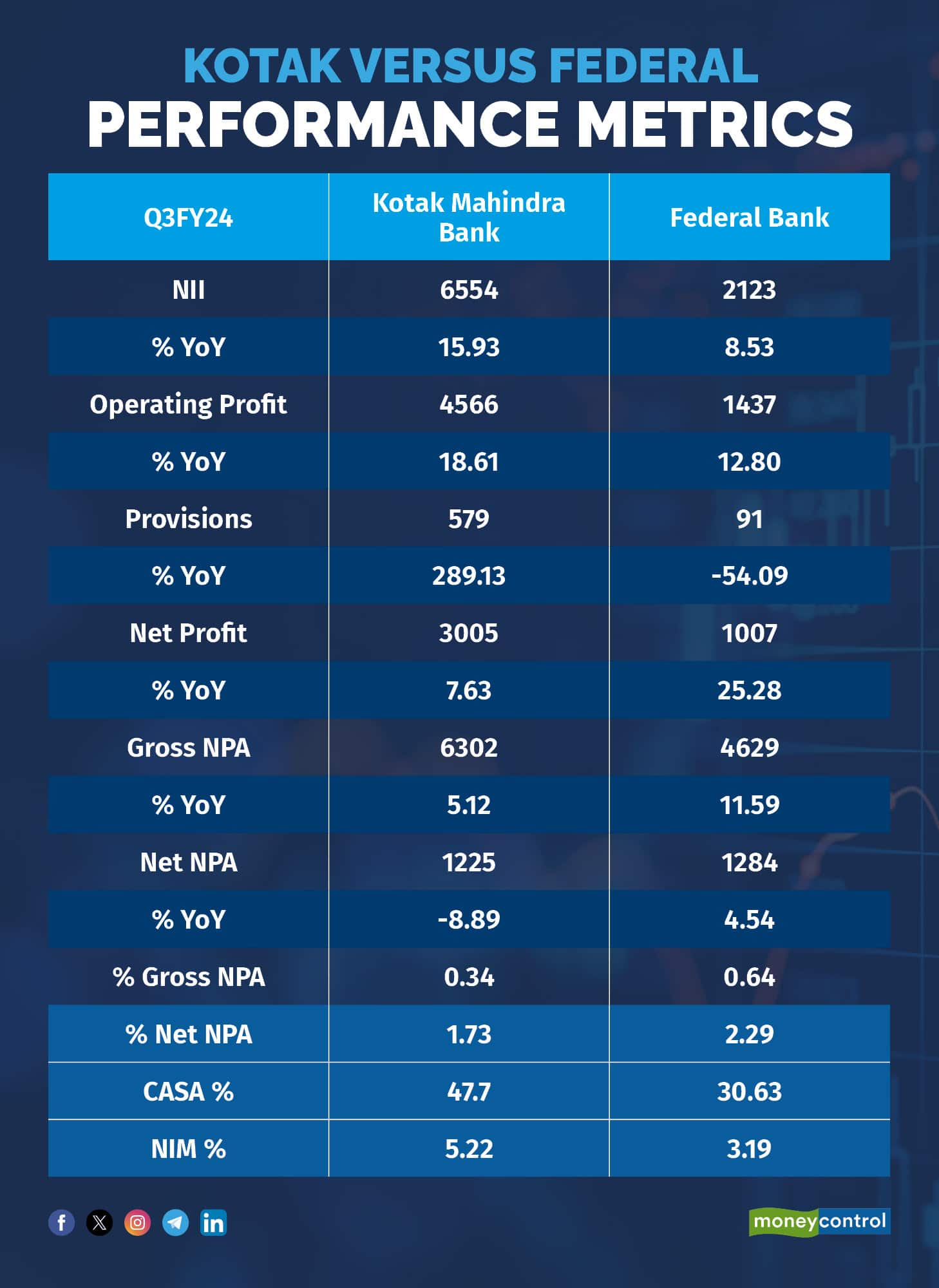

How do the two banks compare in terms of key financial metrics and stock performance. Here is a snapshot:

The Earnings Story

In Q3FY24, Federal Bank performed much better than Kotak Bank in terms of earnings, despite the latter showing better topline growth, due to significantly higher provisions. On key metrics like asset quality, low-cost deposits, and net interest margin, Kotak Bank stood tall compared to Federal Bank.

Growth Metrics

Over the years, both Kotak Mahindra Bank and Federal Bank have demonstrated varying trends in deposit and advances growth. Federal Bank has showcased more consistent growth in both deposits and advances, while Kotak Mahindra Bank's performance has been more fluctuating, with periods of both strong and weak growth.

The Stock Story

Over the past three years, Federal Bank seems to have considerably outpaced Kotak Bank in terms of stock performance. This year has been particularly bad for Kotak Bank, as it has lost 14 percent, while Federal Bank has managed to clock a 4 percent return.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!