Kotak Mahindra Bank is slated to release its April-June quarter (Q1FY25) results on July 20, wherein analysts anticipate the private lender to clock healthy profit and net interest income (NII) growth, led by strong growth in loans.

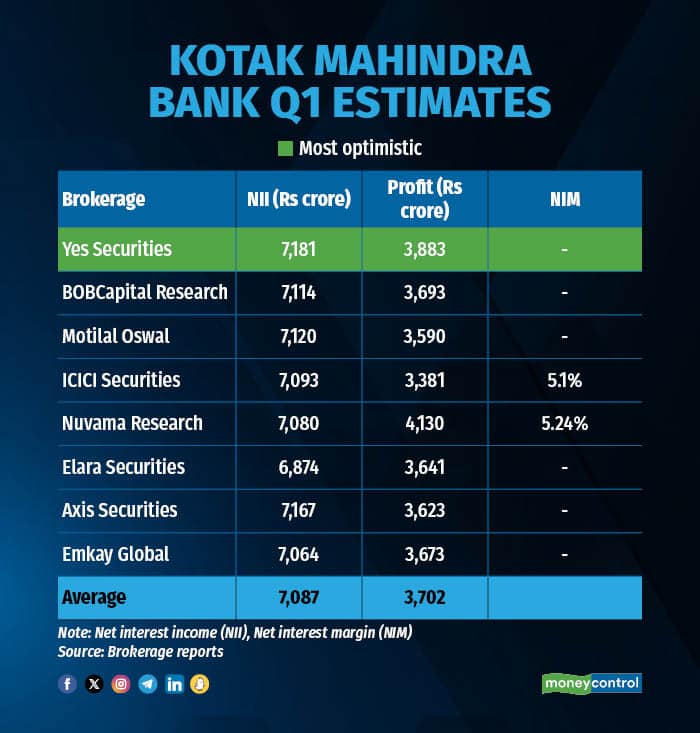

According to an average estimate of 8 brokerages, Kotak Bank is expected to clock up to 13 percent year-on-year (YoY) growth in NII to Rs 7,087 crore in Q1FY25 from Rs 6,234 crore in Q1FY24. Its net profit is also pegged to grow by 7.2 percent YoY to Rs 3,702 crore in Q1FY24, up from Rs 3,452 crore in the year-ago period.

What factors are driving the earnings?

What factors are driving the earnings?

Strong loan, deposit growth: According to Motilal Oswal analysts, the lender's deposits are likely to grow 19 percent YoY to Rs 4.6 lakh crore in Q1FY25 from Rs 3.8 lakh crore in the year-ago period. Loans, too, will see an uptick of 18 percent YoY to Rs 3.8 lakh crore in the June-ended quarter.

Stable asset quality: Kotak Bank's gross non-performing assets (GNPAs) is likely to stand at 1.37 percent in Q1FY25, down from 1.7 percent in Q1FY24, estimated Motilal Oswal analysts. Net NPA is also modeled to drop to 0.34 percent in Q1FY25 from 0.4 percent in the year-ago period.

Margin compression: Margins are likely to take a hit amid rising funding costs. Analysts estimate net interest margins (NIMs) to contract up to 40 basis points (bps) to 5.2 percent in Q1FY25 from 5.6 percent in Q1FY24.

ALSO READ: Axis Bank, Kotak Mahindra Bank see lower attrition in FY24

What to look out for in the quarterly show?

Market participants will keenly watch out management's commentary on margin trajectory, trends in cost of funds, unsecured loan book portfolio, and growth outlook for the rest of fiscal year.

During the April-June period, the stock of Kotak Mahindra Bank rose 1 percent, underperforming benchmark Nifty 50's 7 percent rise.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.