Infosys’ December quarter earnings performance will be marred by lower pass-through revenues, higher-than-usual furloughs, and weak discretionary spending, say analysts. The Street also expects the operating margin of India’s second-largest IT services company to decline due to salary hikes that the company rolled out in November last year.

Pass-through revenues are one-off revenues earned by IT companies.

The Bengaluru-based IT services exporter will declare its October-December earnings on January 11.

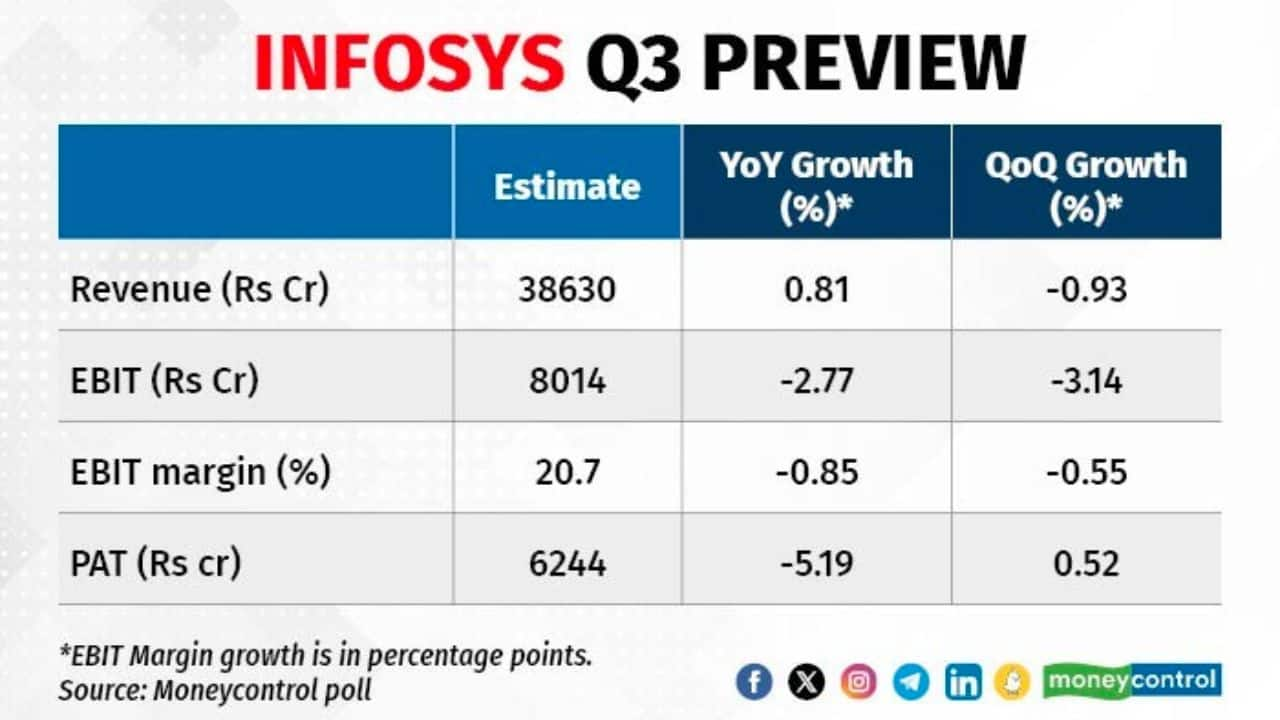

Infosys’ profit after tax (PAT) for the quarter is expected to rise 0.5 percent quarter-on-quarter (QoQ) to Rs 6,244 crore, according to an average of six brokerage estimates. Revenue is seen falling by 0.9 percent to Rs 38,630 crore for the quarter, according to average estimates by the same set of brokerages.

Kotak Institutional Equities expects the company to return to sequential revenue growth in the March quarter.

Most brokerages expect Infosys to maintain its revenue guidance for the financial year in the range of 1-2.5 percent. However, analysts at brokerage Kotak Institutional Equities are the only outliers who expect the company to trim its upper end of the guidance by 50 basis points (bps).

In a pre-earnings research note, Axis Capital analysts said, “We expect CC (constant currency) revenue decline of ~1 percent QoQ CC led by higher-than-normal impact of furloughs and likely lower pass-through revenues (which had increased sharply in the Sept ‘23 quarter).”

Analysts expect Infosys’ operating margin to be affected by furloughs and salary hikes.

Seasonal furloughs have been a pain point for Infosys in Q3, as has traditionally been for IT companies in the October–December quarter. Furloughs involve the situation where clients in areas like the US and Europe refrain from compensating outsourced employees from Indian IT firms for specific days when their operations are suspended, typically during Christmas and New Year.

This adversely impacts the profit margins of Indian IT companies, as they have to provide full salaries to their employees even when unable to invoice the client for the furloughed period.

The double whammy of furloughs and salary hikes will lead to Infosys’ operating margin declining by 0.5 percent to 20.7 percent for the quarter ended December, as per the average estimates.

“Margins are expected to be impacted (-110 bps) due to two months of salary hikes impacting the quarter and furloughs,” said Philip Capital analysts’ in a pre-earnings note.

Nonetheless, analysts expect Infosys to maintain its operating margin guidance for the financial year, calculated as earnings before interest and tax (EBIT) as a percentage of revenue.

The company had performed better than expected on the margins front in the July-September quarter, expanding 40 bps sequentially to 21.2 percent. The company has guided its operating margin for the full financial year in the range of 20-22 percent.

Moderating deal winsThe Street also expects Infosys’ deal wins to be muted this quarter. “We don’t expect recent large deal wins to contribute meaningfully as ramp-ups remain weak,” Philip Capital analysts said in a pre-earnings research note.

The conversion of revenues from large deals signed in earlier quarters into revenues will also continue to be in focus. This is because IT companies have been struggling to convert their deal pipeline into revenue in the past couple of quarters because of adverse macroeconomic issues.

When the company briefs the media and analysts on Thursday, investors will also be looking for commentary from the management on why the $1.5 billion mega-deal was cancelled.

The value of large deals grew by 58 percent in the last quarter to $7.7 billion in Q2, which was the highest ever recorded in a quarter.

Apart from the above, the Street would also focus on senior management attrition after multiple senior leadership departures. Infosys has seen at least nine senior-level exits in a year, with former chief financial officer Nilanjan Roy being the latest.

The management would be faced with questions on the possible adverse effects emanating from senior management resignations on the operational performance of the company.

Investor focus would also be on the deal pipeline, outcome of the annual client budgeting exercise and its implications for FY25, discretionary spending environment, vertical outlook such as on BFSI, margin levers, attrition, pricing, and ramp-up schedule of recently won large deals.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.