New Delhi-headquartered Hero MotoCorp Limited is set to release its earnings report for the fourth fiscal quarter of FY25 on May 13. Analysts expect a marginal pickup in revenue as domestic sales remain subdued. However, margins are expected to be flat due to a richer product mix and cost control efforts

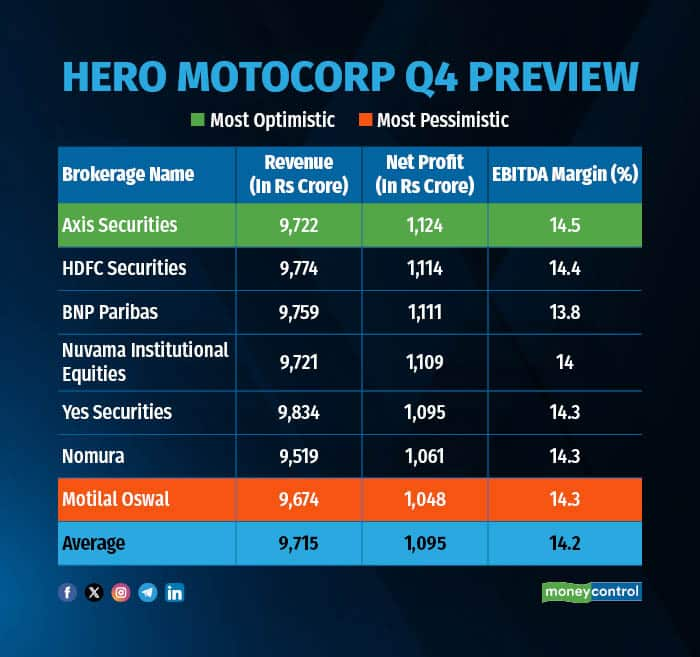

According to a Moneycontrol poll of seven brokerage firms, the Xtreme maker is anticipated to record a 2 percent year-on-year increase in revenue, reaching Rs 9,715 crore. Net profit is projected to surge 7.7 percent to Rs 1,095 crore from Rs 1,016 crore in the same quarter of the previous fiscal year.

Earnings estimates from analysts polled by Moneycontrol are in a narrow range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price.

What factors are driving Hero MotoCorp's earnings?

Domestic volumes dip: Revenue is expected to rise by just 2 percent year-on-year, largely due to a 0.8 percent decline in domestic volumes. The growth is likely to be driven by higher average selling prices, supported by price hikes during the year, an ongoing premiumisation trend, and stronger export volumes.

Margins under pressure: EBITDA margin is expected to come in at 14.2 percent, down 10 basis points year-on-year and 66 basis points sequentially. The decline is likely driven by lower volumes, a higher share of lower-margin electric vehicles and scooters, and deinventorisation during the quarter.

EV breakeven may take longer than peers: The company's guidance of an approximately 100 basis point annual margin impact from its electric vehicle business suggests that it may take longer than peers to achieve breakeven in this segment.

What to look out for in the quarterly show?

Investors will look for guidance on FY26 two-wheeler volume growth across sub-segments, along with insights into financing availability from NBFCs and Hero FinCorp. Commentary on replacement demand and the divergence between urban and rural demand trends will also be closely tracked. Updates on current inventory levels, discounting trends in the market, and the EV orderbook and ramp-up plans will be of interest. Additionally, the market will watch for details on upcoming model launches, orderbook and sales performance of high-end (HD) models.

Shares of the company closed at Rs 3,998, higher by 3.74 percent from the last close on the NSE. Hero MotoCorp shares have risen over 5 percent in the last one month.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.