Consumer staples firm Godrej Consumer Products Ltd. (GCPL) is set to post its earnings report for the January-March quarter on May 6, 2025. Revenue is likely to see single-digit growth, led by rural markets as urban consumption remains tepid.

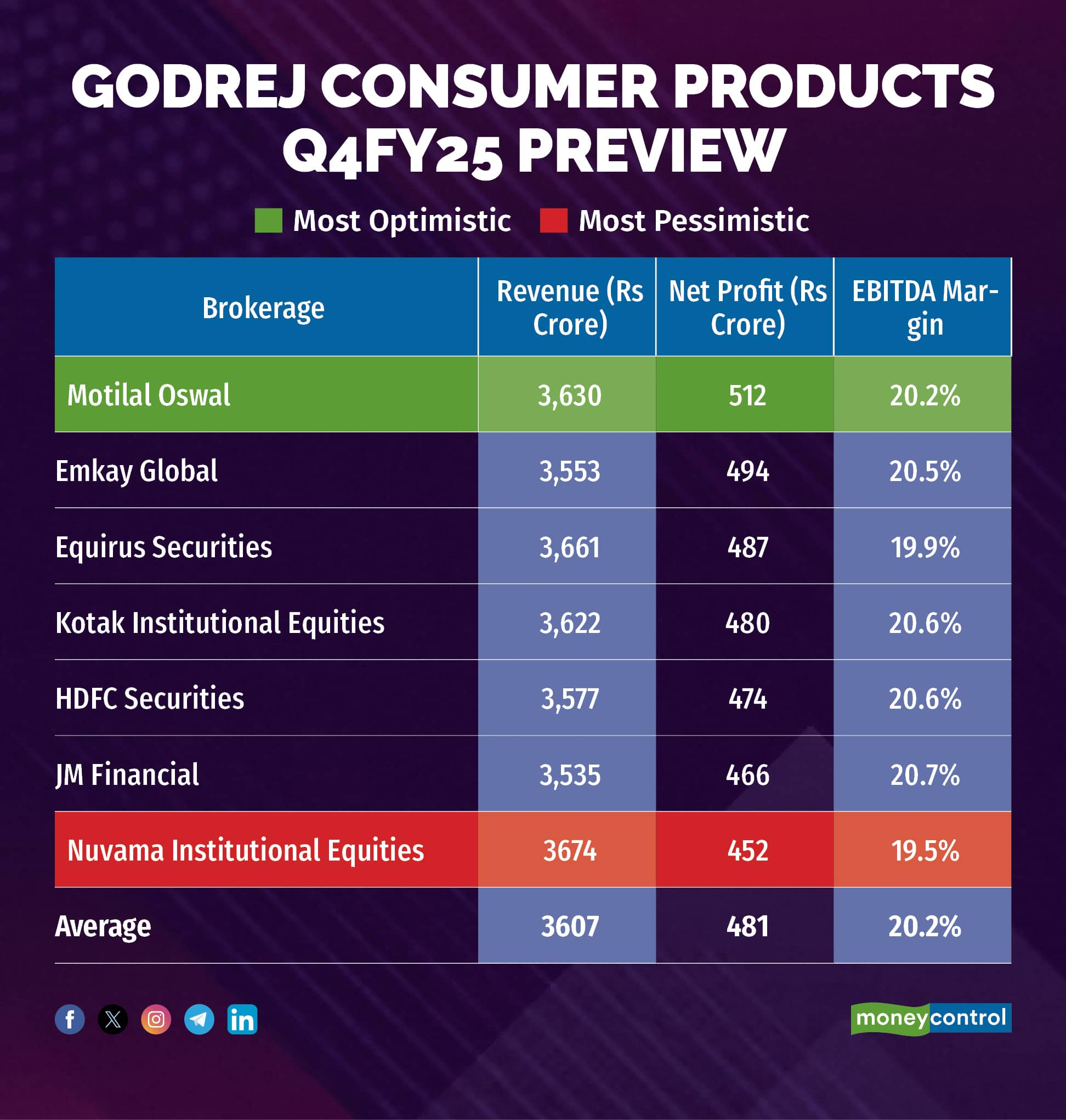

According to a Moneycontrol poll of seven brokerages, GCPL is likely to report a revenue growth of 6.6 percent year-on-year at Rs 3,607 crore, higher from Rs 3,386 crore reported during the same quarter last year.

Net profit is likely to come in at Rs 481 crore from a loss of Rs 1,893 crore in the corresponding quarter of the previous fiscal year, slipping 47 percent on-year. However, the March 2024 loss was a result of an exceptional one-time item. Without the exceptional item included in the bottom-line, the profit is likely to slip 16.3 percent from Rs 574 crore, the adjusted profit reported in March 2024.

While the earnings estimates of analysts polled by Moneycontrol are not in a narrow range, they all predict a sharp fall in net profit, while estimating a single-digit expansion in revenue for Trent. The most optimistic estimate sees Trent’s profit falling 11 percent on-year, while the most pessimistic projection sees a fall of around 21 percent YoY.

What factors are impacting the earnings?

Margins: Brokerages believe that high commodity inflation will continue to put pressure on margins. Motilal Oswal modeled 230 bps YoY decline in EBITDA margins due to negative operating leverage. Further, inflation in palm oil will hurt soap margins.

India business: Domestic business volumes shall grow ~5 percent YoY on a high base of 15 percent (flat volume growth in Q3FY25, on a base of 12 percent) while value growth to be 8-9 percent

YoY, said Nuvama. Home care revenue growth is likely to remain in mid-single digits, while personal care sales growth is likely to increase to 4-5 percent with price hikes in the soap portfolio.

International business: Godrej Consumer Products' international business is likely to see high single-digit sales growth from its international business, led by Indonesia, while GAUM continues to recover. Equirus expects seven percent Indonesia business growth, while Africa to growth at two percent, impacted by the East Africa business operating model change to franchise and inventory correction.

What to look out for in the quarterly show?

Analysts will closely monitor demand and the commentary on demand trends in urban areas and tier-3 towns.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!