Bajaj Auto, one of India’s largest automobile manufacturers, is expected to report a muted performance for the quarter ended June due to supply-side challenges, high costs and muted demand in certain segments.

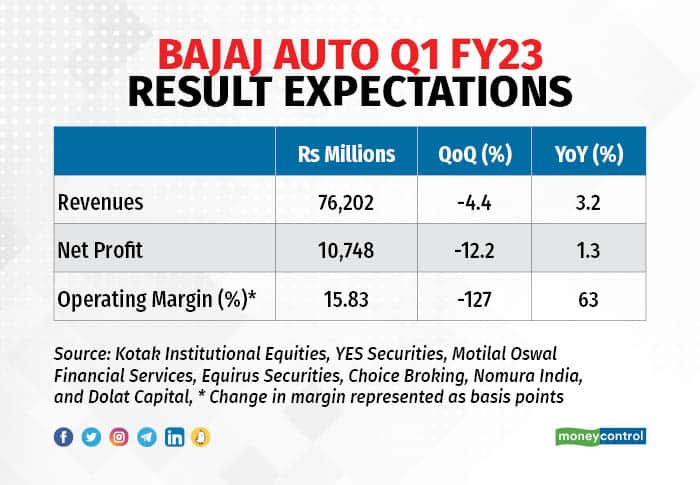

Bajaj Auto, which will share its June quarter numbers on July 26, is likely to report a modest 1.3 percent year-on-year growth in net profit at Rs 1,074.8 crore, according to an average of estimates from seven brokerages polled by Moneycontrol.

The Bajaj Pulsar-maker's muted bottomline performance is largely down to a weak topline performance in the quarter, as revenues are expected to grow merely 3.2 percent on-year to Rs 7,620.2 crore, according to the Moneycontrol poll.

On a sequential basis, Bajaj Auto’s revenues are likely to shrink 4.4 percent, while net profit is expected to tumble 12.2 percent. “Domestic two-wheeler market continues to remain weak and export markets are also showing some signs of weakness,” brokerage firm Motilal Oswal Financial Services said in a preview note.

The volumes in the quarter likely fell 4 percent on a sequential basis due to a sharp decline in three-wheeler exports and domestic three-wheeler sales. The two-wheeler portfolio faced challenges with respect to a shortage of semiconductors during the reporting quarter.

Follow our live blog for the latest market updates

That said, price hikes undertaken by the company would likely help the topline to grow on a year-on-year basis even as volumes may see a drop of 7 percent on-year. Automobile companies have continuously hiked prices to pass on some portion of the higher raw material costs to the end consumer.

On the operating side, the performance is expected to be muted given the high cost of steel and other inputs for the industry. Analysts expect operating profit to rise 7.8 percent on-year to Rs 1,207.4 crore in the June quarter helped by price hikes.

Also read: Tata Steel Q1 Preview | Macro factors may lead to a double-digit dent in profit, revenue

On a sequential basis, operating profit is likely to decline 11.6 percent as average selling price of Bajaj Auto’s products rose merely 1 percent from the previous quarter, analysts said.

“We believe Bajaj Auto is relatively better placed to face margin headwinds due to higher exports mix and lean cost structure,” brokerage firm Yes Securities said in a preview note.

At 11.30 am, shares of Bajaj Auto were down 0.7 percent at Rs 4,013.4 on the National Stock Exchange.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.