July 25, 2022 / 16:29 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic equities recoiled after witnessing strong rally last week. Nifty traded in a range in the absence of any positive trigger and closed with loss of 88 points (-0.5%) at 16,631 levels. Broader market too ended in negative territory with Nifty Smallcap 100 down 0.6% while Nifty Midcap 100 ending flat. Except for Metals and IT, all others sectors ended in red. India VIX surged by 6.2% at 17.68 levels.

Global markets were mixed on the back of weak results given by Snap Inc. and cautiousness ahead of FED meet and US GDP data during the week.

Domestic equities saw a pause in rally after markets reacted to the mixed set of results by Index heavyweights that came over the weekend. ~18 more Nifty companies are scheduled to declare their 1QFY23 results during the week which would keep the market busy. On the global front, US Fed meeting and US Q2 GDP data would be key events to watch out for. Overall positive momentum would continue with bouts of volatility on the back of ongoing action packed earning season, fluctuation in FIIs flows and global events.

July 25, 2022 / 16:17 IST

Prashanth Tapse, Vice President (Research), Mehta Equities:

Key benchmark indices lost momentum after 6-days of winning streak on weakness in select Asian peers and caution ahead of the US Federal Reserve's rate meeting on Wednesday.

Nifty stumbled 0.65% and volatile currency can also be blamed for it with the USD/INR hovering around 79.73. The street suspects that the Federal Reserve will be hiking rates again on 27th July by another 75bps. Also, commanding attention will also be US Q2 GDP to be released on July 28th. Technically speaking, the bulls can do a victory lap only if Nifty closes above its 200-DMA at 17045. On the downside, the line in the sand is at Nifty’s support at 16551 mark.

July 25, 2022 / 16:13 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index ended on a flat note after a stupendous rally in the past week. The Bank Nifty index remains in a buy-on dip mode with immediate support at 36,200-36,000 levels.

The immediate resistance on the upside is placed at 37,000 and if breached will see a further rally towards 37,300-37,500 levels.

July 25, 2022 / 16:07 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Fears of global economic slowdown along with the reaction to a slew of major quarterly earnings dictated the trend in the domestic market. Recession fears are casting a shadow over the global markets as US and Euro business activity contracted unexpectedly owing to the downturn in manufacturing and service sectors.

The major market driver this week will be the Fed’s policy decision on Wednesday, where it is expected to hike rates by 75bps.

July 25, 2022 / 16:00 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

For the last three sessions, the Nifty was trading near upper end of a rising channel. The index was inching higher along with the upper channel line as it is an upward sloping channel. However, the Nifty is now parting from that upper channel line on the downside.

Consequently, it has posted a negative daily close after six consecutive positive sessions. Thus the index seems to have stepped into a short term consolidation.

The hourly momentum indicator developed a negative divergence, which is also suggesting the same. Structurally, the index can witness a brief consolidation in the range of 16480-16750 in the coming sessions.

July 25, 2022 / 15:57 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Nifty index after a 600 points rally witnessed profit booking at higher levels. The index will likely consolidate in the range of 16,400-16,800 ahead of the US FED meet. The trend remains on the upside and one should keep a buy-on-dip approach.

July 25, 2022 / 15:54 IST

S Ranganathan, Head of Research at LKP securities:

Markets opened lower on the back of weak global cues but recovered during the day in a volatile session as the street took stock of few big earnings over the weekend.

Financials was a pocket of interest with Corporate India de-leveraging and a buoyant year last fiscal for several Metal companies.

High provision coverage by several large state owned banks with sharp focus on written-off accounts seem to provide comfort to the street for the current fiscal.

July 25, 2022 / 15:49 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd

Bulls finally lost steam after surging ahead for the last six consecutive sessions as investors booked profit in automobile, oil & gas, and telecom stocks, even though gains in metals and select capital goods stocks capped losses.

Investors traded with caution ahead of the Federal Reserve meet on Wednesday, where it is expected a 75 bps rate hike could be in the offing.

Technically, on daily charts, the Nifty has formed a small Doji candle which indicates indecisiveness between the bulls and bears. For traders, 16600 would be the key level to watch out for and below the same, the index could slip till 16500-16475 levels. On the flip side, a fresh uptrend rally is possible only after the 16700 breakout and above the same, the index could rally up to 16780-16850.

July 25, 2022 / 15:34 IST

Market Close

Benchmark indices ended lower in the volatile session on July 25 with Nifty below 16,700.

At Close, the Sensex was down 306.01 points or 0.55% at 55,766.22, and the Nifty was down 88.50 points or 0.53% at 16,631. About 1465 shares have advanced, 1878 shares declined, and 168 shares are unchanged.

M&M, Reliance Industries, Maruti Suzuki, Eicher Motors and ONGC were among the top Nifty losers, while gainers included Tata Steel, IndusInd Bank, Coal India, Hindalco Industries and Apollo Hospitals.

A mixed trend was seen on the sectoral front with Metal index rose 1.5 percent, while Auto index slipped nearly 2 percent.

BSE midcap and smallcap index ended on flat note.

July 25, 2022 / 15:32 IST

Rupee Close:

Indian rupee ended 12 paise higher at 79.73 per dollar against Friday's close of 79.85.

July 25, 2022 / 15:26 IST

CRISIL Q1 Results:

The company has reported 35.8 percent jumped in its Q1 net profit at Rs 136.9 crore versus Rs 100.8 crore and revenue was up 26.5% at Rs 668.5 crore versus Rs 528.5 crore, YoY.

CRISIL was quoting at Rs 3,270.90, down Rs 25.75, or 0.78 percent on the BSE.

July 25, 2022 / 15:22 IST

Geojit View on Havells India

Havells India's revenue growth remained healthy supported by pick-up in construction activities, revival in consumer sentiments, and market share gains. Though the sharp fall in raw materials is positive in the long term, but we may see some moderation in demand as well as decline in margins.

Considering the likely impact on margins and premium valuation, we value Havells at a P/E of 42x (10 year avg.) on FY24E and downgrade to SELL from BUY with a target price of Rs 1,104.

July 25, 2022 / 15:19 IST

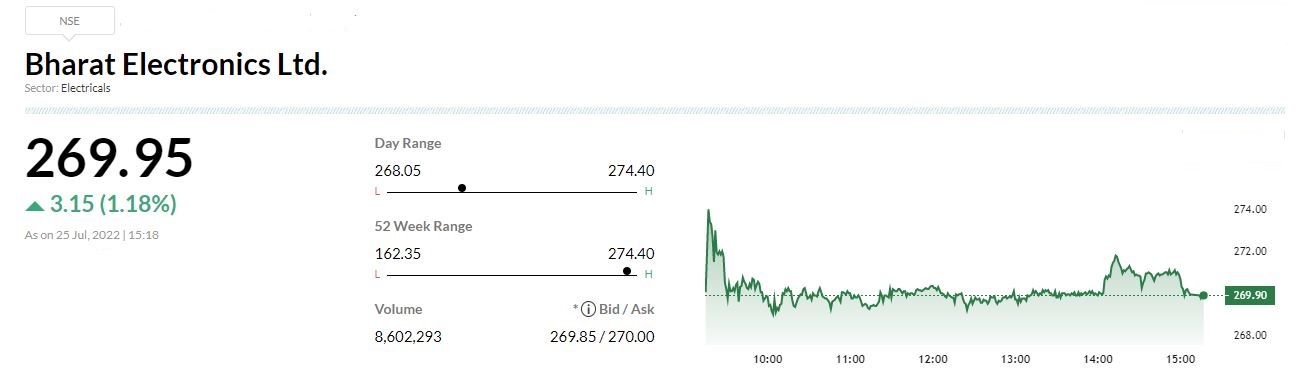

Buzzing

Bharat Electronics has signed a Rs 250 crore contract with Ministry of Defence. It will supply nine integrated ASW complex (IAC) MOD 'C' systems. IAC MOD 'C' is an integrated anti-submarine warfare (ASW) system for all surface ships of the Indian Navy.