Axis Bank is likely to clock a modest 7 percent on-year net profit growth at Rs 5,698 crore in the September quarter, led by net interest income (NII) growth and firm asset quality when it reports its second-quarter result on October 25.

Higher costs of funds will continue to exert pressure on the margins of the private bank, just like for other lenders, analysts said.

Axis Bank’s net interest income (NII), the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, is expected to increase 15 percent on-year to Rs 11,908 crore, driven by a steady pick-up in loan growth, according to the average of five brokerages’ estimates.

Net profit is likely to fall 2 percent on-quarter, weighed down by elevated cost ratios due to Citi integration. NII is estimated to remain flat from Rs 11,959 crore in the previous quarter.

ALSO READ: Motilal Oswal reiterates ‘buy’ rating for Axis Bank; sees 19% upside

Cost of funds to limit net interest margins; provisions to jump

As the rising cost of funds continues to haunt the banking sector, Axis Bank would not be spared as well, analysts said.

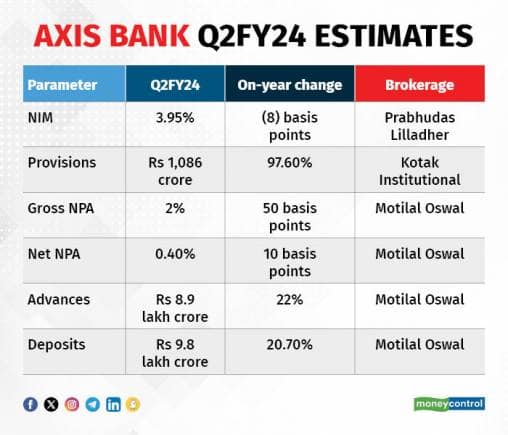

Its net interest margin (NIM) is expected to contract by 8 basis points (bps) in July-September from 4.03 percent in the same period of the previous year. Sequentially too, the margin is pegged to shrink about 10 bps, Prabhudas Lilladher said.

One basis point is one-hundredth of a percentage point.

Nimble asset quality is modelled to paint a happy picture for Axis Bank. Gross non-performing assets (GNPAs) are likely to improve to 2 percent from 2.5 percent in the year-ago period, Motilal Oswal said. Net NPA is expected to improve to 0.4 percent from 0.5 percent.

Both gross and net NPAs will remain unchanged from the previous quarter.

Provisions will likely more than double on-year to Rs 1,086 crore from Rs 549 crore a year ago, and will grow 5 percent from the previous quarter, Kotak Securities has said.

Provision refers to the amount banks must set aside to cover the losses from a loan account. When an account becomes an NPA, the required provisions will equal the full loan amount.

Also read: AXIS Bank | Valuation Discount To Other Private Peers To Narrow | Stock Of The Day

Healthy business growth

Deposits are likely to see an uptick of 20 percent YoY to Rs 10 lakh crore in Q2 FY24 from the year-ago period. Loan growth is estimated to rise 22 percent YoY to Rs 9 lakh crore, Motilal Oswal said.

Investors will closely watch the management’s commentary on Citi portfolio integration, growth outlook and the margin trajectory.

In the July-September period, the Axis Bank stock gained 5 percent against a 2 percent rise in the Sensex. Over the past year, Axis Bank stock CAGR was 9 percent against 6 percent for HDFC Bank and 3 percent for ICICI Bank, data showed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.