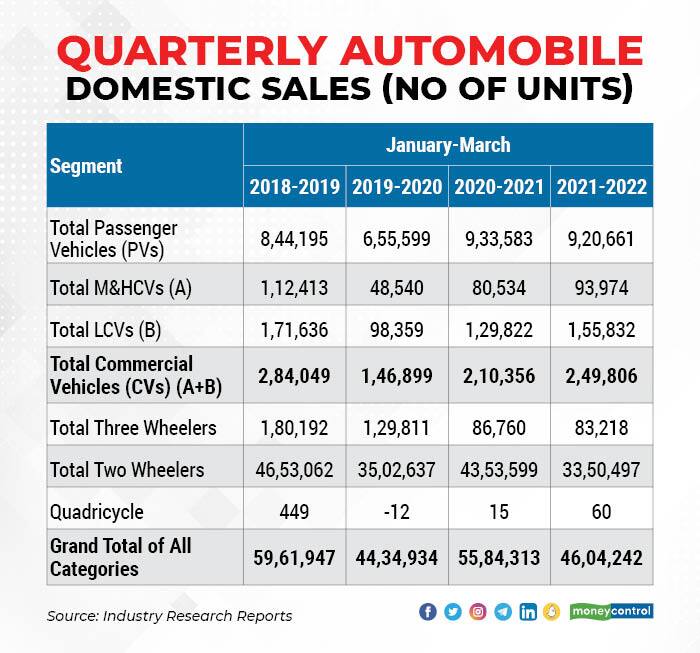

The quarter ended March 2022 was a mixed bag for the domestic automobile sector. While commercial vehicles recorded reasonable growth over the same period last year, a revival of demand was visible in passenger vehicles. In two wheelers, a downtrend in sales continued.

The domestic sales volume for the automobile sector fell 18 percent on-year during the quarter ended March 2022. The industry continued to face adverse impacts of the Ukraine crisis, the resultant surge in oil prices and the COVID-led lockdown in China which further aggravated the supply chain disruptions for semi-conductors.

The fuel prices in India have also increased by Rs 10 a litre over the past few weeks for both petrol and diesel. The sales were also impacted by the long waiting periods and delayed deliveries to consumers.

For the full year of FY22, the industry recorded a 6 percent on-year reduction in sales volumes. Supply chain disruptions continued to create headwinds for the sector throughout the year.

“The impact caused by the successive waves of the pandemic and the consequent lockdown restrictions by various states across the country adversely affected the rural as well as the urban markets,” said a report from CARE Edge Research.

The Ukraine crisis further aggravated the semi-conductor shortage because Russia is one of the largest producers of palladium, which is essentially used for semi-conductors, and Ukraine is one of the biggest producers and exporters of neon gas, which is also used in the manufacturing semiconductors.

Demand trends across segmentsPassenger vehicle sales declined by 4 percent on-year in March and were down marginally during the quarter. For the full year FY22, however, the segment posted a 13 percent on-year growth.

Sales improved on a month-on-month basis with a growth of 6.3 percent, led by some new products and a slight reduction in the waiting periods with an improvement in supply-side issues.

“The average inventory days for this segment stood at 15-20 days versus 12-15 days during February 2022,” the CARE Edge report said.

Volumes in the two-wheeler segment fell 21 percent on-year in March 2022 because of subdued demand, both in rural as well as in urban areas, impacted by rising fuel prices, while higher commodity prices and insurance costs increased the cost of acquisition of a vehicle.

On a month-on-month basis, however, the volumes increased by 14.1 percent due to the pent-up demand with the opening up of offices and educational institutions, festivals and marriage season.

“The average inventory days for the segment stood in the range of 25-27 days for this segment similar to the February 2022 levels,” CARE Edge said.

The commercial vehicle domestic sales improved by 19 percent on-year during the quarter ended March 2022. The MHCV segment saw an improvement of 17 percent on-year primarily due to increased construction and infrastructure activities across the country.

The LCV segment sales also improved by 20 percent on-year during the quarter benefitting from the rise in e-commerce and the increasing need for last-mile delivery.

Financial performanceExperts hope to see 11 percent on-year revenue growth during the quarter for the sector. The growth is led by 13 percent growth for OEMs (original equipment manufacturers) as compared to 5 percent growth for auto ancillaries. They expect the impact of raw material headwinds will be negated by price hikes taken by the players and also due to a better product mix which will result in a 50-100 bps increase in gross margins for the OEMs. Tata Motors and Mahindra & Mahindra are expected to lead with 28 percent on-year growth in revenues for the quarter.

"The profitability of ancillaries will be impacted by cost pressures which can continue to face margin headwinds in H1FY23 due to surge in commodity prices,” Axis Securities said in a report.

Management commentary around future price hikes and potential demand outlook will be key to watch out for.

“OEM revenues are likely to increase by 11 percent QoQ mainly on account of recovery in PV and premium motorcycle segments, aided by improvement in the supply chain situation and strong recovery in CV segment demand, aided by improving fleet operators’ profitability and higher fleet utilisation levels,” said Kotak Institutional Equities.

Kotak expects the EBITDA (earnings before interest, tax, depreciation and amortization) margin to increase by 160 bps on-quarter due to operating leverage benefits and price hikes even though raw material headwinds are expected to impact profitability from first quarter of FY23 onwards.

“Aggregate EBITDA for (ex-Jaguar Land Rover) is likely to decline by 10 percent YoY (up 15 percent QoQ),” Axis Securities said. For OEMs (ex-JLR), it expects EBITDA is likely to decline by 4 percent YoY (+23 percent QoQ) aided by higher volumes and gross margins.

For ancillaries however, EBITDA is likely to drop by 21 percent YoY (higher margin pressure due to lead/ lag impact of commodity costs and pricing pressure in replacement segment).

Top PicksExperts prefer companies with higher visibility in terms of a demand recovery; a strong competitive positioning; margin drivers, and balance sheet strength.

Axis Securities prefer OEMs over ancillaries. Mahindra & Mahindra and Tata Motors are its top picks, followed by Ashok Leyland and Bajaj Auto.

It maintains a ‘sell’ on Maruti Suzuki and Eicher Motors. Within ancillaries, it prefers Bharat Forge, Craftsman, Endurance, Motherson Sumi from a 2–3-year perspective.

Maruti Suzuki and Ashok Leyland are the top OEM picks for the brokerage firm Motilal Oswal Financial Services Ltd and it prefers Tata Motors as a play on global passenger vehicles.

Among auto component stocks, Motilal Oswal prefers Bharat Forge and Apollo Tyres.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.