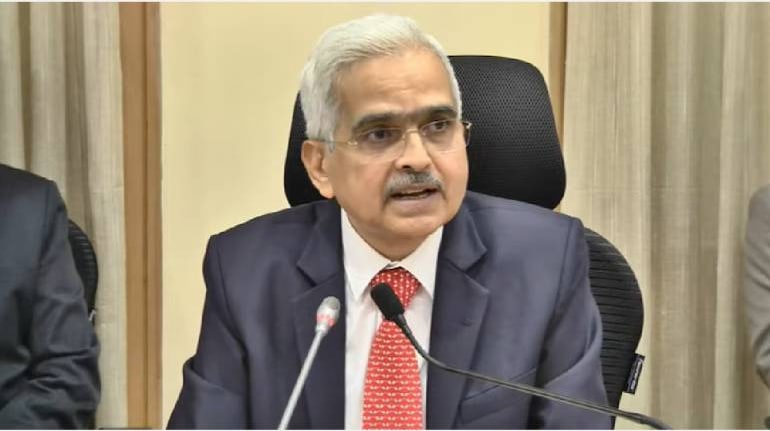

The guidelines to govern lending through digital platforms will be out in a few weeks, according to Reserve Bank of India (RBI) Governor Shaktikanta Das. The regulator expects licensed entities to operate within the permitted territory.

"It has taken more time than we had initially presumed, but the situation is so complex. you know, we are being very careful and very cautious. On one hand, we have to support innovation, on the other we have to maintain financial stability," Das said on July 22.

“Our responsibility is to ensure financial stability. If we have given a licence to a particular entity, we expect them to operate within that domain. If they want to do something over and above that, they need to seek permission from us (RBI). If they are building anything beyond what their licence permits, then it is not acceptable. We cannot allow a scenario where risk is building up."

The working committee, which is responsible for setting the norms, is looking into matters of unregulated entities lending, as well as licensed entities entering into activities they are prohibited from undertaking, he mentioned.

The fintech industry is awaiting the guidelines on digital lending which will impact all companies lending through online platforms like apps and websites. The Governor had earlier said on June 17 that the guidelines should be out ‘shortly’.

While the Governor has previously expressed concerns over lending activities of unlicensed and unregulated digital lenders, this is the first time he has spoken about issues regarding licensed entities breaching their domain.

This comes after a clarification issued by RBI to fintechs on June 20, stating that loading of credit lines on to prepaid payment instruments (PPIs) such as wallets and prepaid cards is prohibited.

The clarification caused widespread panic and impacted the core lending offering of players like Slice Uni, PostPe, KreditBee, PayU’s LazyPay, Ola Postpaid etc that were lending through prepaid cards and wallets. While some of these players hold non banking finance company (NBFC) licenses, others have PPI licenses. However, loading of credit lines onto PPI instruments was seen as an activity not permissible under PPI guidelines.

RBI's clarification had said, "The PPI-MD does not permit loading of PPIs from credit lines. Such practice, if followed, should be stopped immediately. Any non-compliance in this regard may attract penal action under provisions contained in the Payment and Settlement Systems Act, 2007."

Following the clarification, many fintechs started looking for alternatives to their business models. Tiger Global-backed Slice told customers on July 19 that it is moving from extending free-to-use credit lines through its card to offering short-term loans that will be underwritten and sanctioned in real-time. Uni and KreditBee are said to have paused card issuance and are in the process of figuring out alternatives.

PayU’s LazyPay too is mulling moving from prepaid cards to pure credit cards, Moneycontrol had reported citing sources on July 1.

The RBI had set up a working group in January 2021 to study issues surrounding digital lending apps and suggest regulations. Besides earlier mentioned players, these norms will also be applicable to other Buy now Pay Later (BNPL) players including ZestMoney, Axio (formerly Capital Float) etc.

In November 2021, the working group proposed stricter norms for digital lenders, including subjecting digital lending apps to a verification process by a nodal agency to be set up in consultation with stakeholders, and the setting up of a self-regulatory organisation covering the participants in the digital lending ecosystem.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.