Krishna KarwaMoneycontrol Research

GST had quite an impact on the performance of corporate India, as seen in the earnings season. Most of the consumer-centric businesses — staples, durables, electricals — attributed their underperformance to GST transition.

However, from a broader perspective, numbers from the retail sector were much better. How did they weather the storm so well?

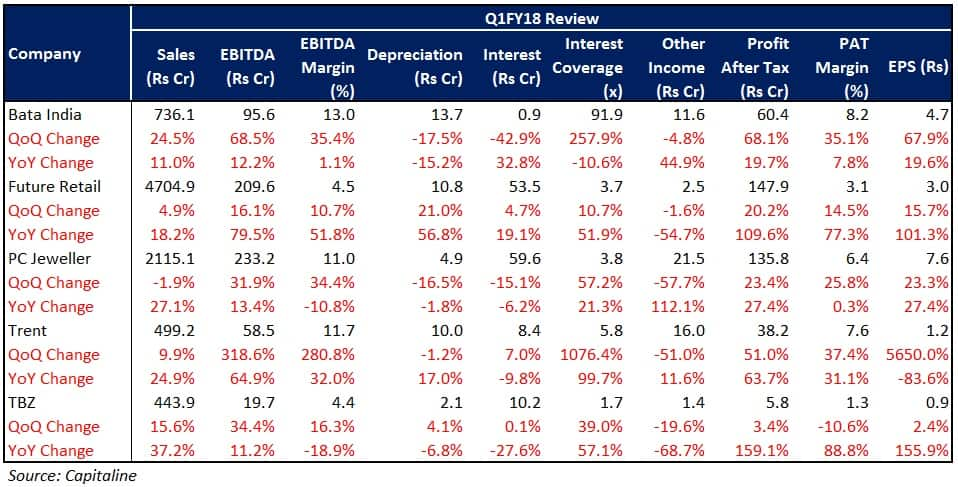

The exhibit points to some discerning trends that are interesting to take note of. Some of India's most renowned retail companies witnessed double-digit growth in top-line, largely attributable to higher member spends, effective inventory management, and high pre-GST footfalls (owing to numerous discount schemes offered).

Retailers that stood out — Bata, Future Retail, Trent

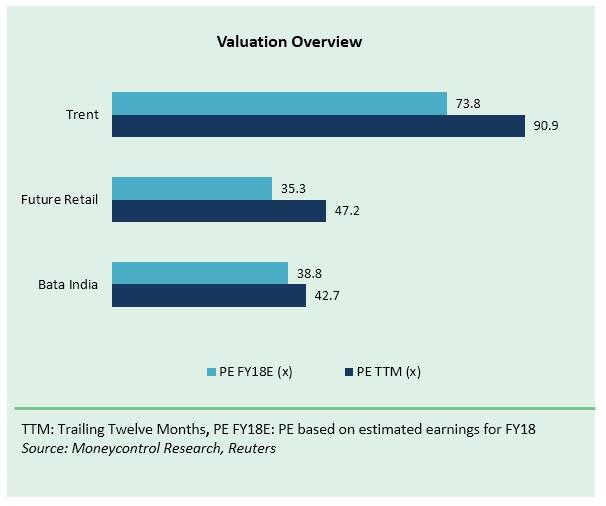

Retail majors saw decent traction in operating profit as well. They appear to be doing something fundamentally right that has already captured the attention of the market, thus reflecting in their stretched valuations. Nonetheless, as long as these businesses continue to carve a niche for themselves, they deserve one's attention, notwithstanding the valuation.

In the footwear segment, for instance, focus on visual merchandising, branding, and value added products gave Bata a distinct edge over its peers in the first quarter of this fiscal. In the upcoming quarters, the company is reasonably well-positioned to capitalise on the growing market for women/children products and fashion-consciousness amongst Indian masses. Store additions and online channels will chart the course for the company's future performance too.

Future Retail’s quarterly numbers reflect the effectiveness with which the company leveraged on its ‘Big Bazaar’ flagship brand and expanded its member base. Success of the reputed household essentials store brand will be of prime importance in the years to come because of its diversified pan-India presence (spanning 127 Indian cities across 26 states) and consumer convenience format (all items under one roof). Measures undertaken to enhance visibility for the comparatively less popular store brands (FBB, EasyDay, Foodhall, E-Zone, HomeTown) could take the company one step closer to unlocking its true potential.

For Trent, cost optimisation in its ‘Westside’ outlets enabled it to post a good result. Factors such as Westside’s brand recall in the women’s wear category, efforts to incentivize average transaction size, exclusive private label brand promotion programmes, revival of the ‘Zara’ brand, store renovation, and revamping of distribution channels (mainly through medium size stores of 5000-10000 sq. feet) will be crucial in driving the company's engine forward.

Jewellery sector — strong tailwinds from GST

GST promises to be a shot in the arm for organised jewellers, that currently comprise only 30-35 percent of the market. According to industry sources, unorganised units and small jewellery makers may join hands with the relatively better-positioned brands through franchises, thereby leading to consolidation and market share gains for the organised entities. Though Q2FY18 may turn out to be a soft quarter in comparison to Q1, the outlook is likely to be promising for the second half of the ongoing fiscal.

PC Jewellers and TBZ registered good sales growth in the recently concluded quarter on account of a spike in pre-GST sales, especially in the last fortnight of June 2017. However, their bottom-line bore the brunt on account of pricing cuts, additional promotional costs, and a rise in overheads. In TBZ’s case, the optically high year-on-year PAT margin change was on a low base of 0.7 percent in Q1FY17.

Going forward, the focus of these companies will be on premium-end branded jewellery (studded diamond varieties) that fetch better realisations and margins as compared to the relatively basic wedding variants. In a bid to augment brand appeal across regions, the two companies look forward to laying more emphasis on company-owned and franchise store launches, apart from omni-channels.

Evidently, the retail sector seems like an oasis of comfort, and investors should keep the same under consideration.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.