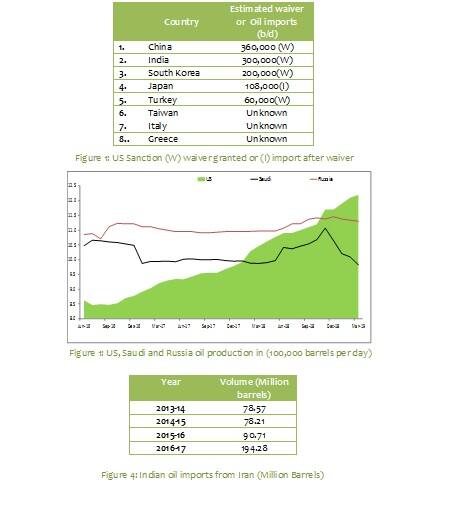

Oil prices rose sharply as the Donald Trump administration would no longer grant exemptions to some countries to import Iran oil, with the conditional waivers set to expire on May 2.

The US has advised Iranian crude oil buyers to stop purchases which were granted under the sanction waivers. Asian nations such as India, South Korea, China and Japan are likely to be the hardest hit.

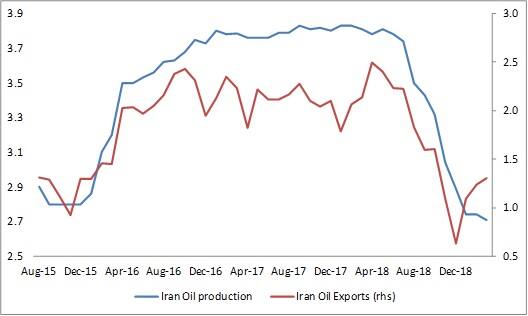

US sanctions have impacted Iran’s oil production and exports heavily since January 2019. Iranian oil production, which was 3.5 million barrels per day during 2018, has been reduced to 2.73 million barrels per day, which is a nearly 23 percent drop on an average. Iranian oil exports have reduced by 39 percent in Q12019 to 1.21 million barrels per day YoY.

Figure 1: Iran crude oil (mbd)

Image Source: Bloomberg, OPEC

Image Source: Bloomberg, OPEC

India's overall crude imports grew by nearly 2.7 percent YoY in FY19 and this growth rate is expected to continue in FY19 as well, as per the Petroleum Planning and Analysis Cell (PPAC) data. Before US sanctions on Iranian crude exports, Iran was the third largest oil supplier to India, fulfilling almost 12 percent of India’s oil requirements. Another largest oil supplier Venezuela is also reeling from sanctions; as a result, India may face a stiff challenge fulfilling its crude oil requirements.

The major advantages of buying Iranian crude is the additional credit period of 90 days that the country gives to India, compared to 30 days by other countries along with cheaper freight due to proximity. Third party ship tracking data suggests that India reduced its oil imports from Iran in the last quarter of FY19. India imported 350-400 kbd in December 2018, which currently stands below 300 kbd levels.

Restrictions over relatively cheap Iranian oil could also weaken the rupee further as a higher current account deficit (CAD) is expected for the first two quarters of FY19-20 (especially if crude continues to rally further). Other oil producers such as Saudi Arabia and United Arab Emirates could offset the loss of Iranian oil.

Brazil and Mexico have also expressed their desire to strengthen energy co-operation and India is evaluating these options. Brazil is the tenth largest oil producer globally with a production of about 150 million tons (mt) of crude and Mexico is placed at eleventh position and produces 110 mt.

India has little choice to import oil from Iran under mounting pressure from the US, therefore India is exploring the crude oil market to replace its Iranian crude loss. Further, to cater to its growing crude oil demand, India is leveraging its robust Middle-East ties for oil imports.

A less likely alternative for India is to continue to import some quantity of oil from Iran using the Rupee Payment mechanism, similar to a 2015 strategy, in the near term.

The drawbacks of importing crude oil from US, Mexico or other western oil producers are huge transportation costs and non-lucrative payment terms. India needs to re-evaluate its relations with all oil production countries to meet its future oil demand.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.