On July 5, 2019, the government hiked the import duty on gold to 12.5 percent from 10 percent. The move took the market by surprise, as everyone was demanding a duty cut to support the domestic gems and jewellery industry.

At present, the consumer has to pay a 3 percent goods and services tax (GST) on gold value and a 5 percent GST on making charges, in addition to a 12.5 percent import duty. This has hit the jewellery industry hard, which has already been dealt a blow by the coronavirus outbreak.

Source: WGC and Abans Research (Gold imports in tons, net import includes import of Gold Dore)

Source: WGC and Abans Research (Gold imports in tons, net import includes import of Gold Dore)

The impact of the hike in import duty and coronavirus pandemic are clearly seen on India’s gold imports. India’s gold imports in 2020 slumped to their lowest in more than a decade. The duty and the coronavirus pandemic have battered demand and logistics.

As the Indian economy is still recovering from the COVID-19 shock, all eyes will now be on Finance Minister Nirmala Sitharaman, who will present the Union Budget on February 1.

It is observed from the trading sentiments that the market is anticipating a hike in the import duty on gold, as MCX prices were trading at a premium of 0.50 percent to 1 percent during the week in anticipation. We do not believe that the government will hike import duty, here are the reasons why:

1) Current account under control

While increasing import duty on non-essential items, the government typically wants to control a rise in the current account deficit (CAD). India's current account recorded a surplus of $15.5 billion in September 2020, compared with a surplus of $19.2 billion in the previous quarter. The data reached an all-time high of $19.2 billion in June 2020, from a record low of $-31.9 billion in December 2012. The current account situation is in a much better position and there is no need to hike the duty on gold.

Source: RBI and Abans Research (India Current Account Balance in Billion US Dollar)

Source: RBI and Abans Research (India Current Account Balance in Billion US Dollar)

2) The rupee factor

The rupee, which has rallied to its weakest level above 77, against the dollar in April 2020, just after the lockdown in the country, has now appreciated sustainably to higher levels at 73.02 against the dollar. Record inflows into the country and a drop in imports were a few reasons behind it. Rupee appreciation and current account surplus, driven by a sharp drop in domestic demand for imports, is not good. Any increase in the duty is likely to put additional pressure on imports, which will result in further appreciation in the rupee against the dollar.

Source: RBI and Abans Research, (Spot rate of USD/INR)

Source: RBI and Abans Research, (Spot rate of USD/INR)

3) Record holding in SGB

As per the latest data, the government has issued nearly 58.9 tonnes of gold through the sale of sovereign gold bonds. This is valued at nearly Rs 29,037 crore and an increase in import duty by 2.5 percent would result in the appreciation of gold prices and a loss of Rs 725 crore to the exchequre, not a good idea in the current situation.

Source: RBI and Abans Research (Total SGB holding in tons)

4) Investors are moving from physical to paper gold

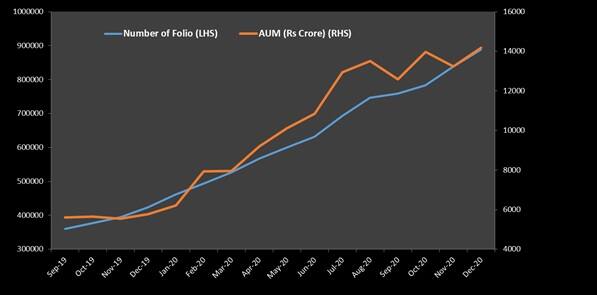

As the government increased import duty to 12.5 percent, it resulted in huge inflows into gold ETFs. Paper gold offers several advantages such as liquidity, transparency in pricing, tax efficiency, affordability, assurance of purity and safety over the physical metal. The number of folios (or the total investor base) in gold ETFs rose from 4.23 lakh in December 2019 to 8.87 lakh in December 2020. During the same period, assets under management (AUM) rose by Rs 8,406 crore, or 145 percent, from Rs 5,767 crore, to Rs 14,173 crore. As a desirable result is clearly visible from an import duty hike, we do not see any further reason to increase the duty from current levels.

Source: AMFI & Abans Research (Gold ETF, AUM in Rs. Crore)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.