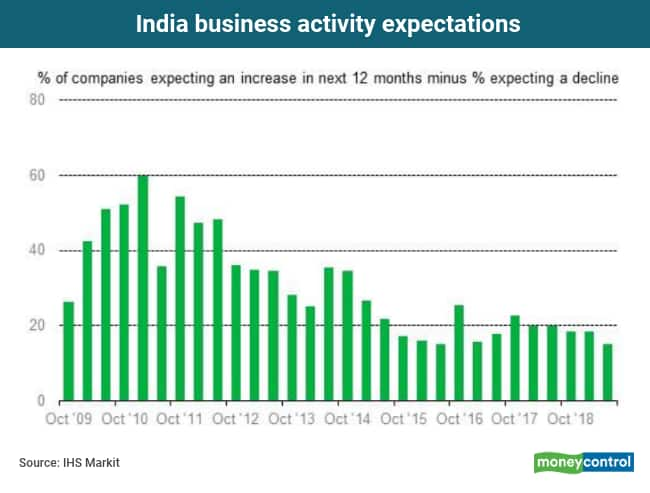

Not that we needed confirmation, but business sentiment has dramatically come down. According to IHS Markit, business activity expectations in India fell to its joint-lowest reading since the survey started in 2009. Only a net 15 percent of private sector companies surveyed in June see output growth in the year ahead. That’s the same as the June 2016 reading. The optimism is also lower than what it was during the policy paralysis years of the United Progressive Alliance –II government or during the steep rupee depreciation of 2013.

The reasons for plummeting optimism are all too familiar. Companies are worried about a slowing economy, public policies, weak sales, rupee depreciation, lack of skilled labour and even water shortages.

Although “firms plan to expand capacities by taking on additional workers…sentiment for all measures of expenditure are anaemic. Indeed, for capital investment confidence in India is among the weakest of all countries for which comparable data are available, ahead of only China and the UK,” wrote Pollyanna De Lima, Principal Economist at IHS Markit.

Note that this survey was carried out in June, before the Union Budget. If firms had any hopes from the budget, that too has been dashed to the grounds in the absence of a fiscal stimulus and explicit policies to boost near term consumption growth. Even the palliatives for the NBFC sector – which were expected to boost credit -- would now prove inadequate after DHFL’s results. In any case, given the abysmal level of confidence, the government's effort to lower the cost of capital is not enough to boost private investment. In the absence of a near term, quick recovery, expect business confidence to fall further before things look up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.