Benchmark indices have been climbing all wall of worries in the month of January to hit their respective record highs but the momentum was fizzling out which most investors fail to take note off.

The mid & smallcap stocks which rose to fresh record highs in the year 2017 are witnessing some bit of profit booking. The rise in liquidity, both domestic, as well as global, led to a strong rally in the broader market which pushed valuations for most of these stocks beyond long-term averages.

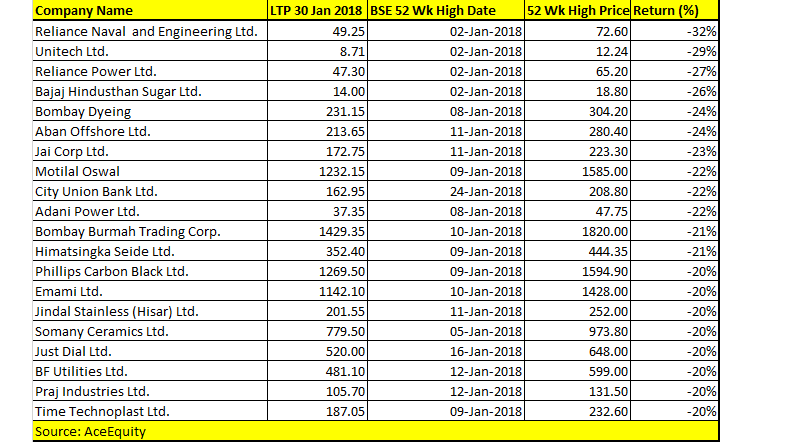

Data suggests that as many as 135 stocks have fallen over 10 percent from their respective 52-weeks high recorded in the month of January 2018, and 20 stocks have fallen between 20-30 percent in the same period.

Stocks which have fallen in the range of 20-30% include names like Reliance Naval and Engineering Ltd, Unitech, Reliance Power, Bajaj Hindustan, Aban Offshore, Jai Corp, Motilal Oswal, Adani Power, Jindal Stainless, JustDial, BF Utilities, Praj Industries, and Time Technoplast among others.

Investors prefer to go light in the Budget, suggest experts. There could be a possibility that traders are booking profits or squaring up their leverage bets to avoid getting caught up at the wrong end of the bargain.

“In case of no negative surprise in Budget, Nifty would continue to form base near 11,000 and this uptrend should continue. However, there has been some weakness seen in the midcap space which is not visible looking at the Nifty prices,” Amit Gupta, head of derivatives at ICICIdirect told Moneycontrol.

“The reason being the market participants were quite overboard on the midcaps instead of largecap stocks. This is where profit booking is quite visible in this space before the major Budget announcement,” he said.

Apart from midcaps, smallcap stocks have suffered the most in the run-up to the Budget. Some of the stocks in the S&P BSE Smallcap index which plunged up to 60 percent include names like Orient Paper, followed by Yamini Investments, Jaypee Infratech, Gujarat NRE Coke, Monnet Ispat, Jaiprakash Power Ventures, and Electrosteel Steels Ltd among others.

However, analysts’ are not too worried about the correction in the small and midcap space. They feel that it is routine profit taking but the tide should reverse soon because the way Economic Survey projects the growth path for the economy, small and midcap companies stand to gain the most.

“There is euphoria in some section of the market, but, by and large, we think it is in the normal course of the market. The cyclical or some high beta stocks did very well responding to improvement in underlying businesses with global growth picking up & Chinese curb on the production of certain commodities,” Atul Bhole, Vice President and Fund Manager, DSP BlackRock Investment Managers told Moneycontrol.

“Such stocks were also at oversold levels to start with, many of them were trading at below book values. Some of these companies also deleveraged their balance sheets at a decent pace with improvement in profitability, asset sale or fresh fund raise,” he said.

Bhole further added that this has resulted in big returns from such stocks with concern on existence going away. Most of these things actually are linked to starting of a fresh business cycle and hence is in course of the normal market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.