Passenger vehicle sales continued to remain on an upswing in May, thanks to sustained buying momentum for SUVs, excessive pending orders, marriage season, and continued recovery in rural markets. Furthermore, gradual easing of the chip shortage, reduced waiting period of certain models and production ramp up by OEMs are expected to sustain the growth momentum during June as well.

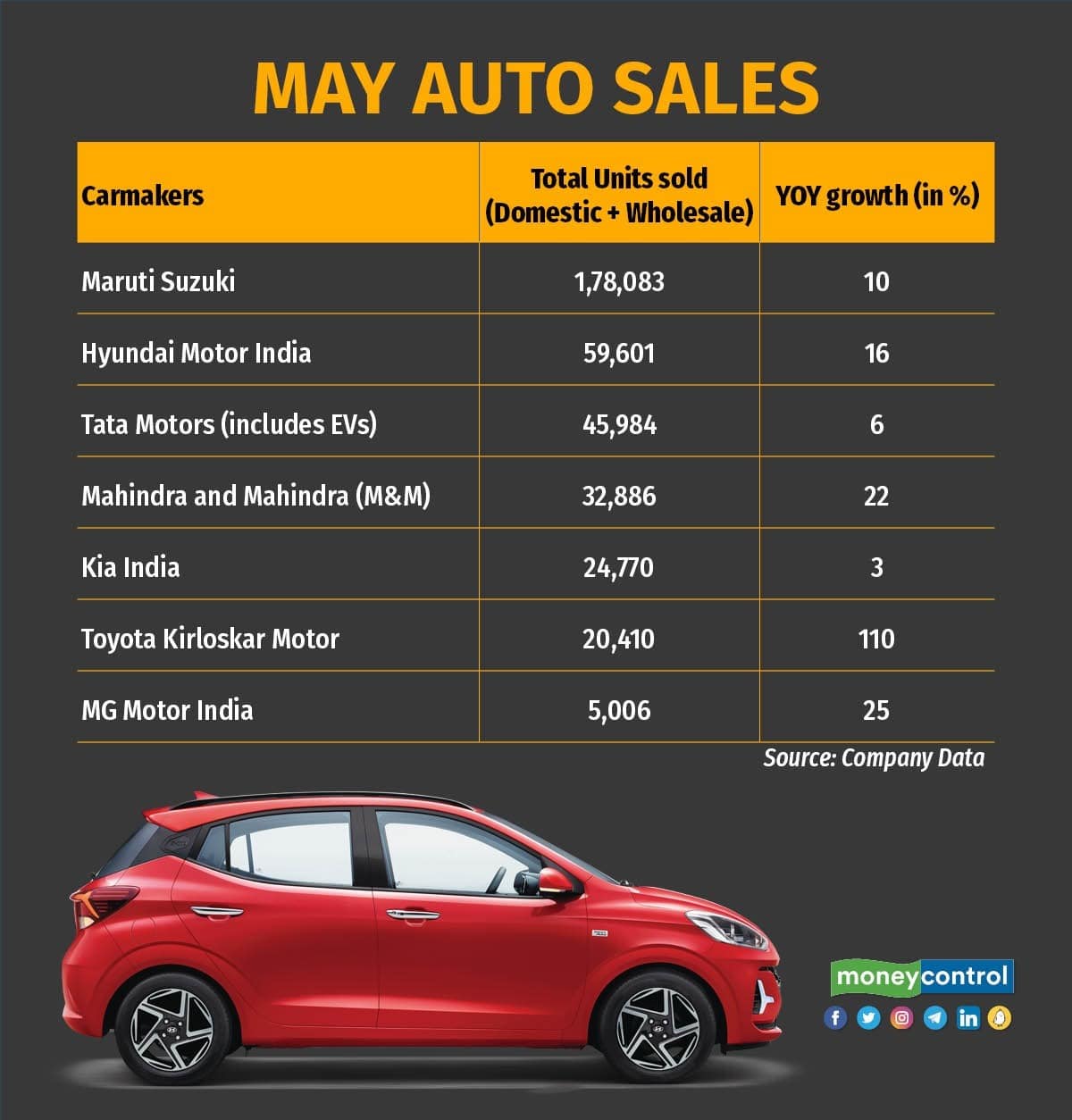

The top five auto majors such as Maruti, Hyundai, M&M, Tata Motors, Kia India, etc., have registered positive growth in numbers last month on a Year-on-Year (YoY) basis.

Maruti Suzuki India Limited (MSIL) reported a 10 percent increase in total wholesales at 1,78,083 units in May as compared to 1,61,413 units in the year-ago period. Its domestic sales went up by 13 percent to 1,51,606 units as against 1,34,222 units in May 2022. This also includes the 5,010 units it sold to Toyota Kirloskar Motor (TKM).

“The shortage of electronic components had a minor impact on the production of vehicles. The company took all possible measures to minimise the impact,” MSIL said in an official statement.

Hyundai Motor India’s sales for May rose 16 percent YoY to 59,601 units from 51, 263 units in the same month last year. Domestic sales increased 15 percent to 48,601 units (42,293 last year) while exports jumped 22.6 percent to 11,000 units (8,970 last year).

Mahindra and Mahindra (M&M) said that its domestic passenger vehicle sales were up by 22 percent at 32,886 units as compared to 26,904 units in May 2022. In the Utility Vehicles (UV) segment, Mahindra sold 32,883 vehicles in the domestic market and overall, up by 23% from year ago period. Last year, it sold 26632 units of EV in May.

According to Veejay Nakra, President, Automotive Division, M&M Ltd.: “The sales volume for both SUVs and Pik-Ups were restricted by a short-term disruption in engine-related parts at the supplier end. The semiconductor supply constraints on specific parts like Air Bag ECU, continued during the month too.”

Tata Motors’ total PV sales were up by 6 percent at 45,984 units vis-à-vis 43,392 units sold in the same month last year. The company’s domestic passenger vehicle sales were up 6 percent at 45,878 units as compared with 43,341 units in May last year. Its total sales of passenger electric vehicles, including international business, were at 5,805 units as against 3,505 units in the same month a year ago, a growth of 66 percent.

Kia India said its total wholesales increased 3 per cent to 24,770 units in May. While the overall domestic sales stood at 18,766 units, the exports accounted for 6,004 units in the month of May, 2023.

Hardeep Singh Brar, National Head, Sales & Marketing, Kia India said, "Although we faced some production limitations due to our plant annual maintenance shutdown for a week in May which impacted our numbers, we are confident of strong performance in coming months.”

Toyota Kirloskar Motor (TKM) claimed that it has registered the highest-ever monthly cumulative sales of 20,410 units for May 2023, thus reporting growth of 110% over 10,216 units in May 2022.

Atul Sood, Vice President of Sales and Strategic Marketing at Toyota Kirloskar Motor said, “As we look forward, given the sustained momentum, we continue to be optimistic for the rest of the year by prioritising the customers’ needs.”

MG Motor India sold 5,006 units in May 2023 and recorded a YoY growth of 25 percent. In the same month last year, its sales stood at 4,008 units.

Nissan Motor India’s (NMIPL) total auto sales for May 2023 came at 4,631 units, up by 23 percent on a YoY basis. Its domestic wholesales stood at 2,618 units, while export wholesales stood at 2,013 units.

As per the latest report by Motilal Oswal Financial Services (MOFS), May’23 PV retails are expected to decline 2-4 percent YoY as chip shortage continues to hurt volumes. Its interactions indicate up to a 10 percent hit on volumes due to chip shortages, resulting in lower inventory for high-end models/variants across OEMs. However, there is sufficient inventory for lower-end models, resulting in an average dealer inventory of 4-5 weeks (v/s 3-4 weeks until last month), as per MOFS.

“Urban consumption is driving the robust demand and urban market share is rising again India,” said Puneet Gupta from S&P Automotive. "Also the demand is rising on flurry of models been introduced by OEMs, especially in SUV segment."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.