In a major boost to the new income tax regime and to make it more appealing to the common man and woman, finance minister Nirmala Sitharaman has announced crucial changes to the new income tax regime.

Here is a look at the measures she spelt out in the budget for FY 24 she presented in Parliament on February 1.

Additional rebateBudget 2023 has provided a rebate on income earned up to Rs 7 lakh, up from Rs 5 lakh earlier. Those earning income of up to Rs 7 lakh will not have to pay any tax. To be sure, this will help only those whose income is up to Rs 7 lakh.

The basic exemption limit in the new tax regime has been raised to Rs 3 lakh, from Rs 2.5 lakh earlier. This move will help all taxpayers who opt for the new tax regime.

Rejigging tax slabs

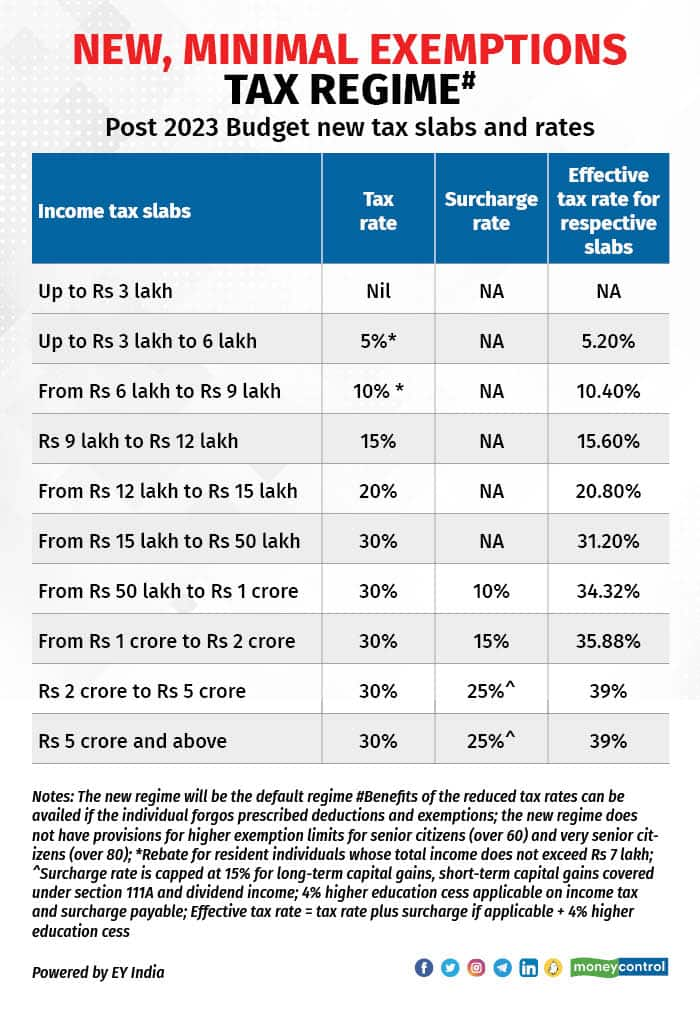

The number of slabs under the new income tax regime has now come down to five from six. Income of up to Rs 3 lakh carries no tax liability. On income of Rs 3-6 lakh, the tax rate is 5 percent. Income of between Rs. 6 lakh and Rs. 9 lakh will be taxed now at 10 percent. On income of Rs. 9-12 lakh, the tax rate is now 15 percent. Income of Rs. 12-15 lakh will be taxed at 20 percent. And for those whose income is above Rs 15 lakh, the tax rate is 30 percent.

What this means is that for an individual who earns Rs 9 lakh, his or her tax liability comes to Rs 45,000, down from Rs 60,000 earlier.

"This is just five percent of her income," said Sitharaman in her Budget speech.

Standard deduction

For salaried individuals and pensioners under the new income tax regime, a standard deduction has been introduced. Sitharaman said the benefit would be equivalent to Rs 52,500.

Peak rate surcharge comes down

To give relief to the highest taxpayers, and also those who switch to the new income tax regime, Sitharaman brought down the surcharge in the highest tax bracket (with the highest surcharge rate), down to 25 percent from 37 percent earlier.

So, the effective tax rate in the highest tax bracket is now 39 percent, from 42.74 percent earlier.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.