Rajeev Chandrasekhar, the Union Minister of State for Electronics and Information Technology, has on July 13 backed the GST Council's decision to levy 28 percent on the online real-money gaming sector, stating it as a "well-thought out preliminary measure."

On July 11, the GST Council had decided to impose the top GST slab of 28 percent on the full value of the money paid by users to play skill-based games, in a uniform manner with no distinction made between game of skill and chance. Gaming platforms currently pay an 18 percent GST on platform fees.

This decision, which came after nearly two years of deliberation, had shocked the country's burgeoning real-money gaming industry. Several industry executives and associations have warned that this move will "wipe out the entire industry and lead to job losses".

Also Read: 28% GST levy will make Indian real-money gaming sector an 'unviable business model': IAMAI

The real-money gaming segment accounted for 77 percent of India's gaming sector revenues in 2022 which stood at Rs 13,500 crore, as per a recent FICCI-EY report. These revenues are set to grow to Rs 16,700 crore in 2023 and Rs 23,100 crore in 2025, it said.

Revenue Secretary Sanjay Malhotra, however, played down these concerns in an interview with Moneycontrol on July 13. He said that when online games are based on wagers, irrespective of whether they’re wagers on skill or chance, they’ve always been taxed on the face value under GST.

It's worth noting that these tax rates do not apply to free-to-play and paid video games in the country, wherein the 18 percent GST rate is already included in the app sales on Google Play and Apple App Store.

Read: 28% GST levy will upend the economics of real-money gaming sector, says Nazara's Nitish Mittersain

The move comes a few months after the Ministry of Electronics and Information Technology (MeitY) notified new gaming-related amendments to the IT Act 2021, that will allow multiple self-regulatory organisations (SROs) to determine whether a real-money game, where the transfer of money is involved, is permitted to operate in India or not.

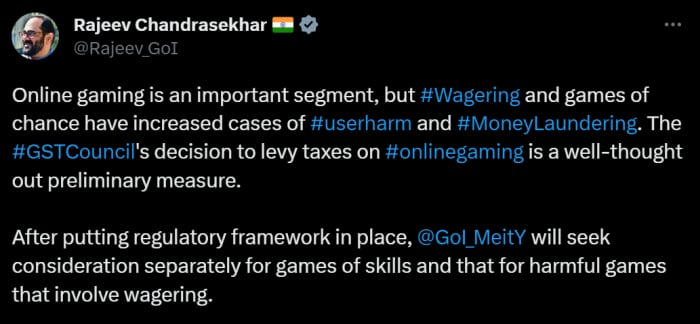

In a tweet on July 13, the minister said that after putting the regulatory framework in place, MeitY will seek consideration separately for "games of skill" and that for "harmful games that involve wagering".

"Online gaming is an important segment, but wagering and games of chance have increased cases of user harm and money laundering. The GST Council's decision to levy taxes on online gaming is a well-thought out preliminary measure" the union minister said in the tweet.

A screenshot of Rajeev Chandrasekhar's tweet on the recent GST Council decision

A screenshot of Rajeev Chandrasekhar's tweet on the recent GST Council decision

On July 11, Finance Minister Nirmala Sitharaman had mentioned that the GST Council "will ensure it is in touch with the IT ministry. We will align with the regulation the ministry brings in."

According to media reports, the government plans to bring in amendments to the GST law on "online gaming" during the Monsoon Session of Parliament, that is starting on July 20.

The revenue secretary told Moneycontrol that the government estimates to collect taxes of up to Rs 15,000-20,000 crore in FY23-24, marking a significant jump from Rs 1,700 crore collected in FY22-23.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.