The Indian car market, jostling with uncertainty and speculation till a few days back, is in a cheerful mood now. The reason? With the Goods and Services Tax (GST) restructuring done, cars across different segments are set to get cheaper.

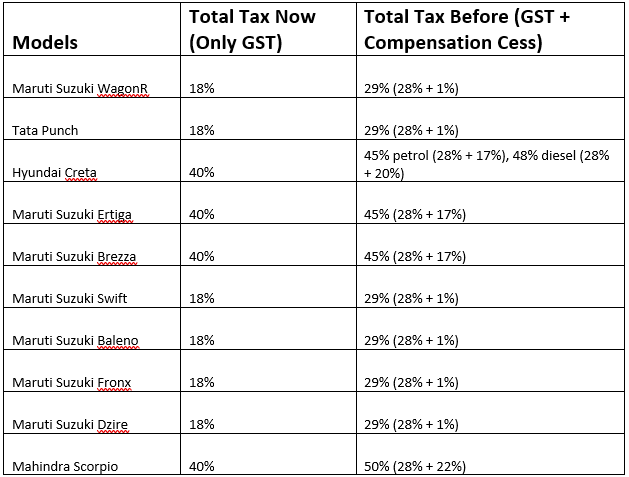

If we talk about internal combustion engine (ICE) cars, they earlier attracted a GST of 28%. Over and above that, there was a compensation cess, ranging from 1-22%, depending on the length, body style and engine capacity. This would result in a total tax of 29-50%.

With the GST Council revamping the tax structure, the 28% and 12% slabs have been removed, while the 18% and 5% slabs have been retained. Also, a new 40% slab has been introduced for sin and luxury goods. The compensation cess has been done away with, except for a few tobacco-related items.

The changes in the GST rates will be implemented from September 22, the first day of the nine-day Navaratri festival.

How does this restructuring help the car market? The entry-level and relatively smaller cars, which earlier attracted a total tax of 29-31%, will be charged only 18% GST now. For the mid-size, large and luxury cars, buyers will have to pay only 40% GST now, as against 45-50% total tax earlier. There is no additional compensation cess on cars anymore.

Hence, lower taxes are expected to lead to a decrease in car prices.

Let us look at how the revised GST rates will impact the 10 largest-selling cars in India in terms of taxation. Just for reference, the ex-showroom price of any vehicle in India is inclusive of GST and compensation cess.

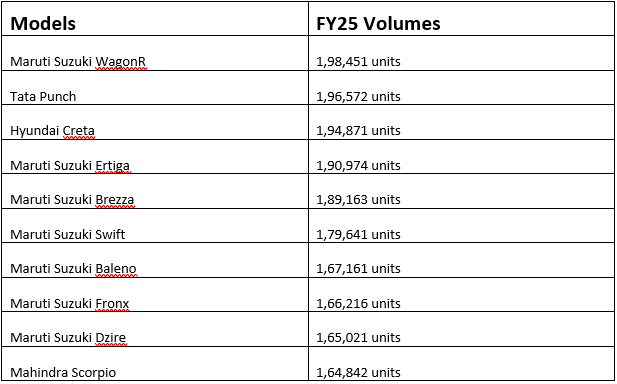

In FY25, the Maruti Suzuki WagonR was the largest-selling car in India. It was followed by the Tata Punch, Hyundai Creta, Maruti Suzuki Ertiga, Maruti Suzuki Brezza, Maruti Suzuki Swift, Maruti Suzuki Baleno, Maruti Suzuki Fronx, Maruti Suzuki Dzire and Mahindra Scorpio.

Source - Industry

Source - Industry

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.