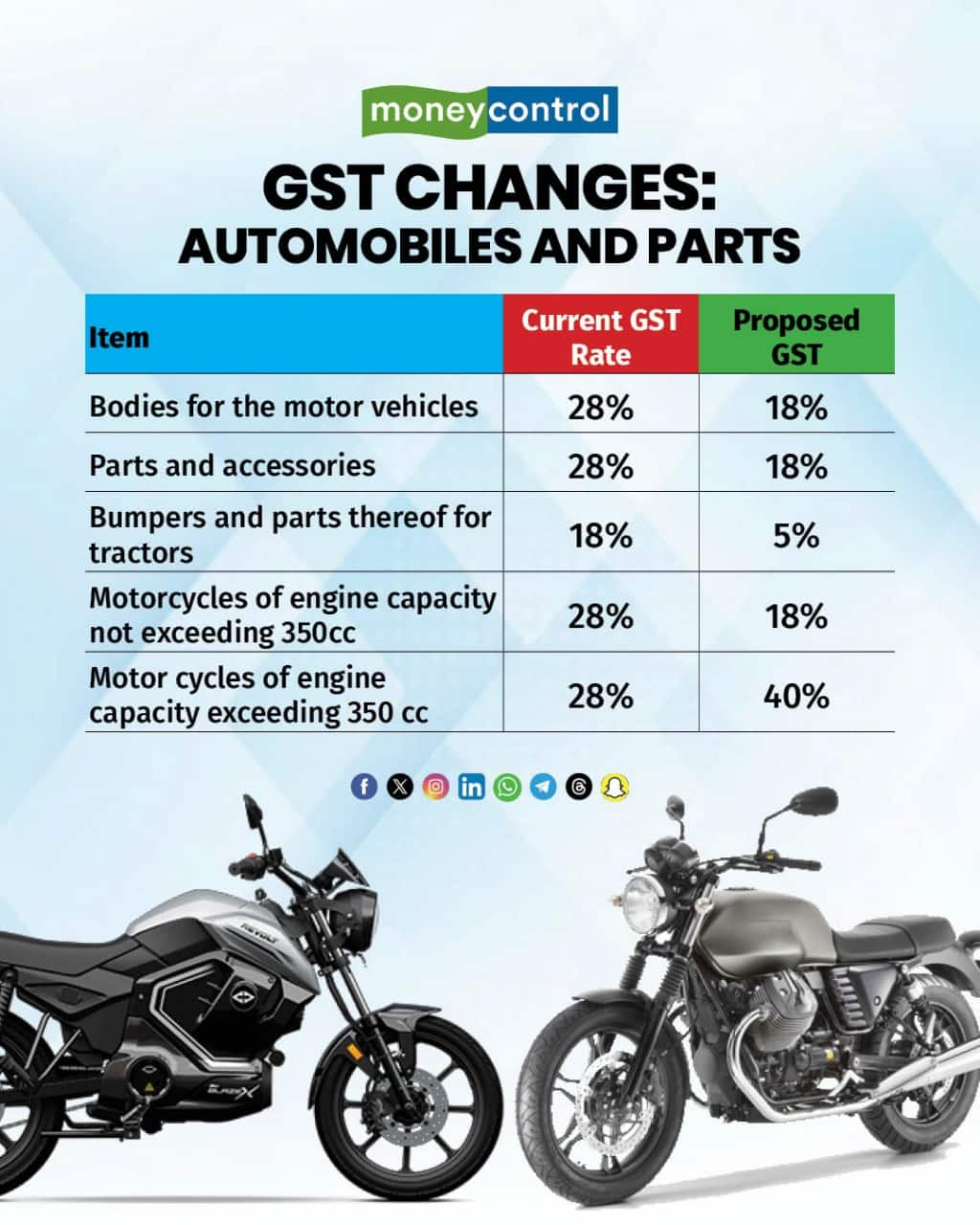

In a move aimed at spurring demand in the automobile sector, the Goods and Services Tax (GST) Council today slashed the tax on small cars, up to 350cc two-wheelers, three-wheelers and commercial vehicles (CVs), all powered by an internal combustion engine (ICE), from the earlier 28% to 18%.

As part of the GST restructuring, the 12% and 28% slabs have been removed, while the 5% and 18% slabs have been retained. Also, a new 40% slab has been added for sin and luxury goods.

Moreover, the government has withdrawn the compensation cess, making the vehicles more affordable in the country.

During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST.The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and…

— Narendra Modi (@narendramodi) September 3, 2025

At the 56th GST Council Meeting, Union Finance Minister Nirmala Sitharaman said that the new rates will be applicable from September 22.

"Some items have moved to 40%. There is nothing more to be added. The maximum rate you can levy on any item is 40%," she added.

Hon’ble Prime Minister Shri @narendramodi announced the Next-Generation GST Reforms in his Independence Day address from the ramparts of Red Fort.Working on the same principle, the GST Council has approved significant reforms today.

These reforms have a multi-sectoral and… pic.twitter.com/NzvvVScKCF

— Nirmala Sitharaman Office (@nsitharamanoffc) September 3, 2025

The small cars earlier attracted a GST of 28% along with a compensation cess of 1-3%. They will now be charged with only 18% GST. This move will benefit carmakers like Maruti Suzuki India, Hyundai Motor India and Tata Motors, which offer such models.

The relatively larger cars, including SUVs, sedans and luxury models, have been moved to the 40% bracket with no compensation cess. Even this move is beneficial for such models, as earlier the total tax (GST + compensation cess) would be from 45-50%.

While the move to bring two-wheelers with an engine capacity of up to 350cc will benefit entry-level models as they will become cheaper, those with an engine capacity of more than 350cc will witness a significant rise in price, as they will now attract a 40% GST. These larger two-wheelers earlier attracted a total tax of 31%, including 28% GST and 3% compensation cess.

In the two-wheeler segment, the major beneficiaries will be Hero MotoCorp, Honda Motorcycle & Scooter India, TVS Motor Company and Bajaj Auto. Royal Enfield, which sells several models with an engine capacity of over 350cc, will feel the pinch due to the government's GST rationalisation.

The GST rate on electric vehicles (EVs) has not been changed as they still remain in the 5% slab, irrespective of their body size or price. However, the hydrogen fuel cell vehicles (FCEVs) have moved from the 12% slab to the 5% slab.

The GST rate rationalisation aims to benefit hybrid vehicles as well. While the smaller hybrid models have been moved to the 18% slab now from the 28% slab earlier, the larger models have been shifted to the 40% slab. Still, the total tax is lower on the larger models now as they earlier attracted 43% levy, including 28% GST and 15% cess.

While three-wheelers and commercial vehicles earlier attracted a 28% GST with no compensation cess, they are now in the 18% slab.

"The next-generation GST reforms announced today mark a defining moment in India's journey towards building a simpler, fairer, and more inclusive tax system. By moving to a streamlined two-rate structure and focusing on essentials that touch the lives of every citizen - from food, health, and insurance to agriculture and small businesses - the government has reaffirmed its commitment to ease of living and ease of doing business. The rationalisation measures will not only provide immediate relief to households but also strengthen key sectors such as automobiles, agriculture, healthcare, renewable energy, and MSMEs - all of which are vital to job creation and sustainable growth," said Dr Anish Shah, Group CEO and MD, Mahindra Group.

"The correction of long-pending inverted duty structures in critical industries is welcome. At Mahindra, we view these reforms as transformative. They simplify compliance, expand affordability, and energise consumption, while enabling industry to invest with greater confidence. This bold step is in line with the vision articulated by the Hon'ble Prime Minister of building a citizen-centric, future-ready Bharat. It strengthens India's economic foundations and will help drive the next phase of equitable and inclusive growth - journey towards Viksit Bharat @2047," he added.

S&P Global Mobility Light Vehicle Production Forecasting Associate Director Gaurav Vangaal said: "The GST cut on small cars to 18% is a timely catalyst for India's auto sector. With festive demand building from Navratri through Diwali, entry-level segments are set for a strong rebound. Lower acquisition costs will boost consumer sentiment, especially for compact crossovers like Fronx and Punch. We also expect new hybrid offerings in the sub-4 metre category to gain traction, making sustainable mobility more accessible. It seems we’re heading toward a bumper Diwali this year."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.