BUSINESS

How have India’s oldest MF schemes rewarded investors?

A Moneycontrol analysis of India’s oldest equity-oriented mutual fund schemes have shown that they have returned 9-19% of compounded annualised returns since inception. They are either equity scheme or hybrid schemes having rich track record of paying dividend. These schemes rewarded the long term investors well and helped them to reach their financial goals

BUSINESS

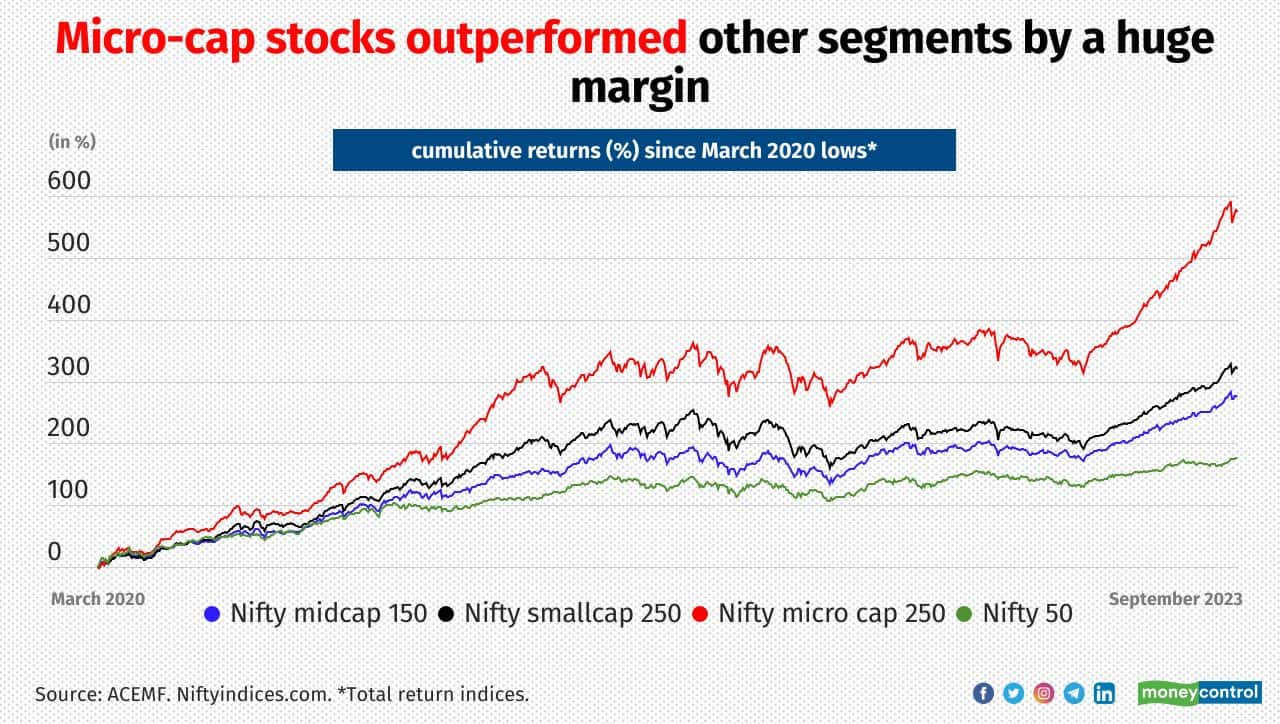

Microcaps that are fund house favourites but yet to unlock their potential

Many microcap stocks held by mutual funds have not yet performed well. Fund managers continue holding these stocks in their portfolio believing that these businesses may play out well in the future

BUSINESS

Risk mitigation strategy: low volatile largecap stocks held by smallcap funds

Although smallcap mutual fund schemes must invest at least 65 percent of the corpus in smallcap stocks, they can invest the balance in large or midcap stocks. Large-cap investments help mitigate risk and provide cushion if markets were to fall sharply

BUSINESS

Nifty at 20K: These stocks had low weight on index - Active funds got the bet right

Stocks with relatively lower weight in the Nifty 50 index such as Tata Motors, Apollo Hospitals Enterprise and JSW Steel gained significantly. Though their contribution to the index was miniscule due to their lower weight, many active fund managers bought them early and benefitted by holding significant exposure into them

BUSINESS

13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

Exposure to smallcap stocks by infrastructure funds was increased significantly to 33% from 29% in the last three years

BUSINESS

Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

A Moneycontrol personal finance study shows that different smart-beta funds can have common stocks. It implies that these stocks possess the characteristics of different factors

BUSINESS

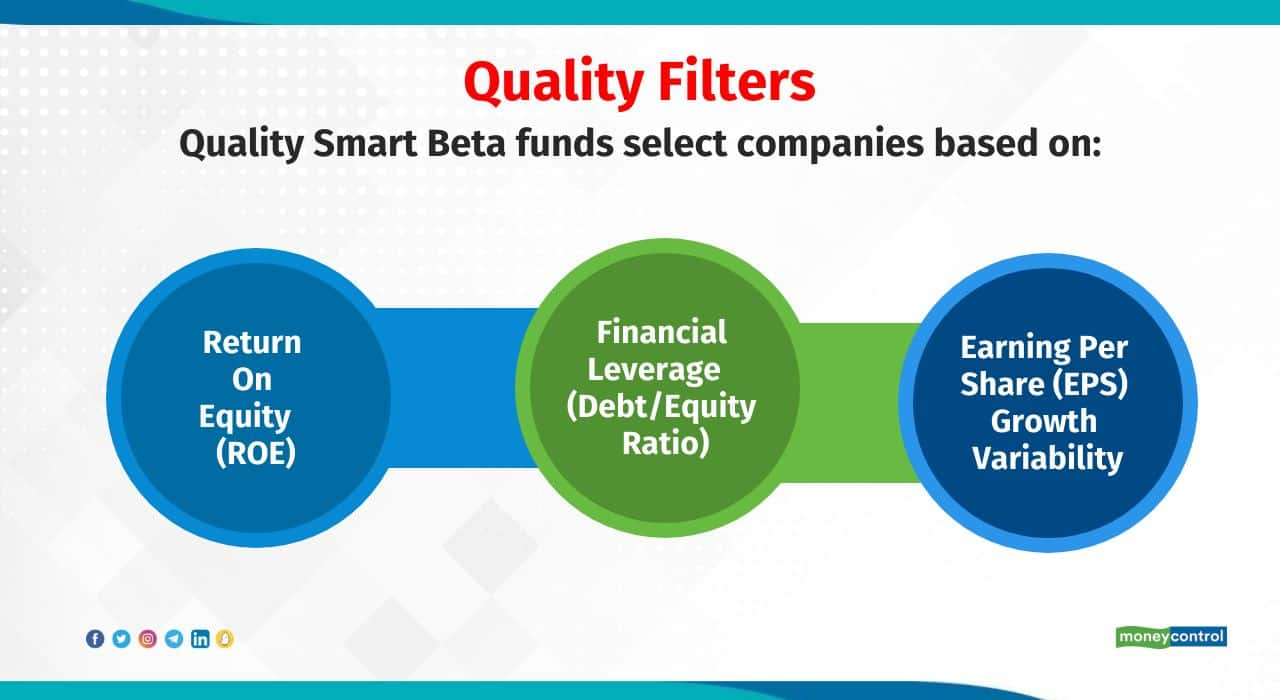

The quality test: Should you invest in smart beta funds focusing on quality?

Smart beta funds focusing on quality prefer to invest in quality companies with high valuation and strong cash flows. These funds are likely to offer good downside protection and tend to outperform in bear markets

BUSINESS

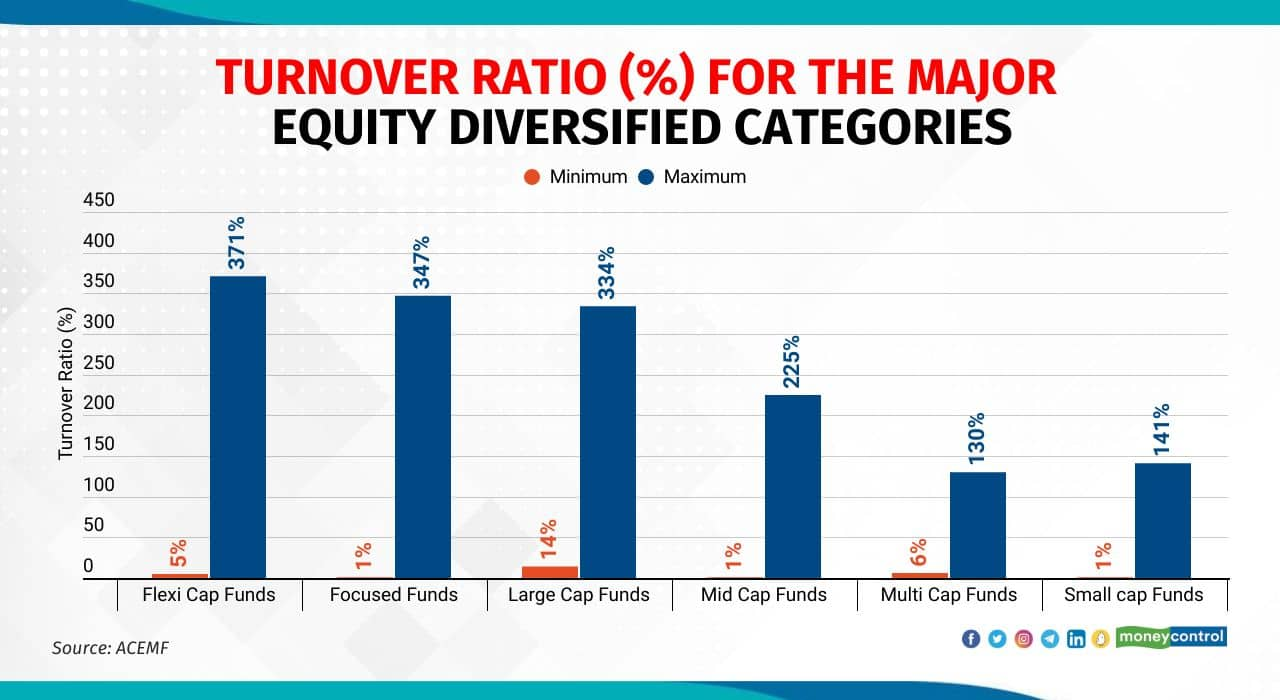

Buy-and-hold: Mutual Fund schemes that churn the least

A Moneycontrol Personal Finance analysis of diversified equity schemes shows that small-cap funds typically have the least turnover ratios. To get the best out of small-cap stock picks, it is widely held that these stocks must be held through their life cycles

BUSINESS

MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

PGIM India Midcap Opportunities Fund has delivered below-average returns in the short term. However, its long-term performance has been noteworthy

BUSINESS

10 most popular large-cap stocks among PMS to withstand volatility

Portfolio managers prefer to hold stocks that could provide stability and cushion volatility

BUSINESS

Hot small-cap pharma and healthcare stocks that MFs hold currently

Active fund managers are particularly interested in the small- and mid- cap segment of pharmaceutical and healthcare businesses

BUSINESS

Top sectors that PMS managers bet for higher returns

From banking to capital goods and healthcare, here are 10 sectors that PMS fund managers believe, have promising prospects

BUSINESS

MF investment in these 12 midcaps, smallcaps surges 3-fold and more in 6 months

Although equity markets hitting all-time highs, Mutual funds continue adding midcap and smallcap stocks with quality businesses and healthy growth prospects

BUSINESS

Cautious of market highs: Here are the most sold small-cap stocks by MFs

Experts are cautions that markets are trading near all-time high levels, currently. Aggressive fund flows and positive sentiments have pushed the valuation above their fair value. Many small cap stocks look expensive and way ahead of their fundamentals

BUSINESS

Manufacturing: The new hot stock picking ground for MFs. Here are their top midcap picks

Companies that belong to the ‘manufacturing’ sector are likely to benefit from the Indian government’s ‘Make in India’ drive. Small wonder then that of the six schemes that invest predominantly in manufacturing sectors, four were launched in the last one year or so ago

BUSINESS

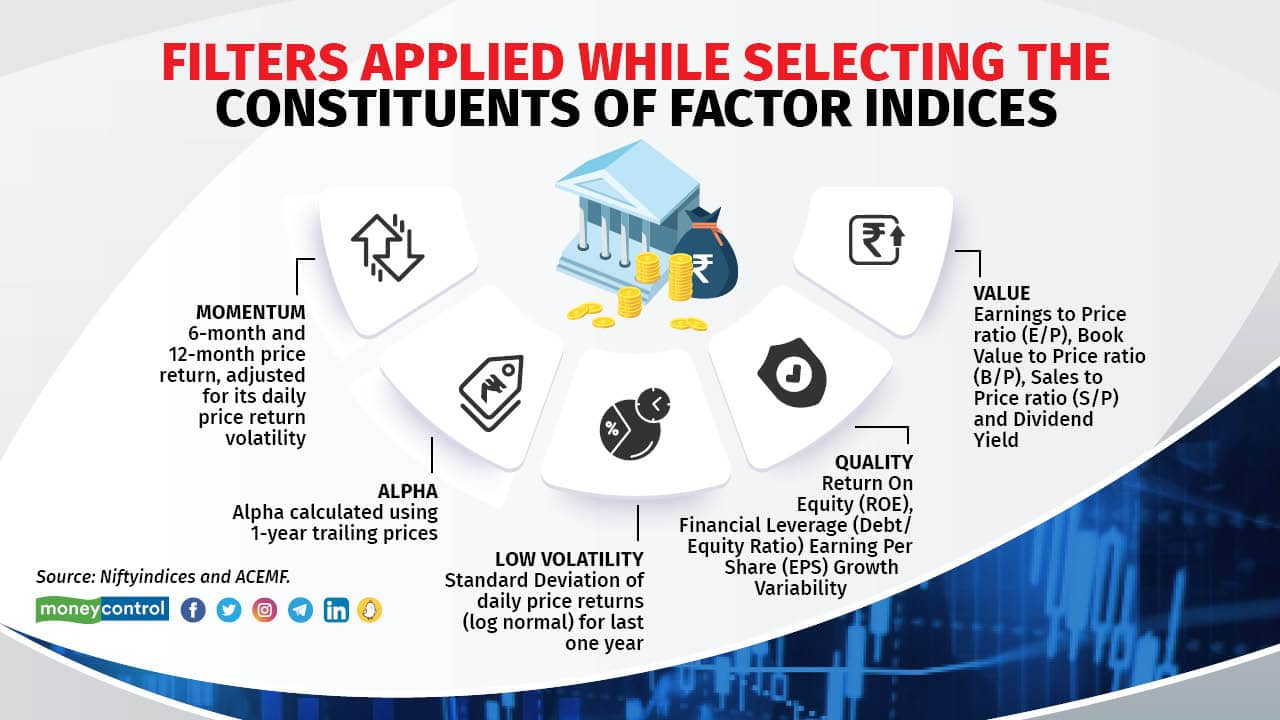

Top stocks that smart-beta funds rely on to max returns

With an aim to outsmart basic indices, smart-beta funds combine the prowess of active and passive funds into one. They select the stocks based on a variety of fundamental, technical and other filters. Here’s what smart-beta funds’ models pick, in order to stay ahead of the curve

BUSINESS

Here are 10 sectors on which mutual funds have gone big

Active mutual fund managers have either made fresh positions or increased exposure significantly in these sectors over the last year

BUSINESS

Midcap darlings of conservative hybrid funds for long term growth

The nature of the conservative hybrid schemes nudges their fund managers to pick low-volatile stocks. However, adding midcap and smallcap stocks in the portfolio spices up the overall returns of the schemes.

BUSINESS

Here's where funds cut exposure in 2023: Check your portfolio

Active fund managers sense these changes early and reposition their portfolios accordingly.

BUSINESS

15 smallcap gems with major MF stakeholding

As per the latest shareholding pattern data, mutual funds hold a significant portion in the total shares of these smallcap companies. This indicates fund managers’ optimism over the future growth prospects of these companies.

BUSINESS

Buy high, sell higher: Does momentum strategy work for Indian investors?

Momentum strategy follows a ‘buy high and sell higher’ approach of investing and exhibits high volatility in the short term. Investors with a high risk profile and long-term view can allocate 10-15 percent of their portfolio to momentum strategy. About 12 mutual fund schemes offer this play

BUSINESS

Why systematic withdrawal plans in MF work best for retirees

Systematic withdrawal plan allows unitholders to withdraw money at regular intervals. A Moneycontrol analysis of MC30 debt and equity funds show that 6-8% can be ideally withdrawn every month without depleting the corpus, if you stay invested for 10 years

BUSINESS

Nifty 200 Momentum 30 Index rebalancing: 11 new mid-cap stocks that entered the index

These midcap stocks scored relatively high momentum score as they have outperformed the peers in Nifty 200 basket over the last one year. To reduce the risk levels that come with momentum strategy, some fund houses have launched momentum index funds

BUSINESS

Smallcaps today, multibaggers tomorrow: Unique stocks that make it to MF hotlists

Due to a wide range of small-cap stocks in the market, fund houses go bottom-fishing to pick multibaggers of tomorrow. In this pursuit, many schemes end up having unique or exclusive stocks