Top stocks that smart-beta funds rely on to max returns

With an aim to outsmart basic indices, smart-beta funds combine the prowess of active and passive funds into one. They select the stocks based on a variety of fundamental, technical and other filters. Here’s what smart-beta funds’ models pick, in order to stay ahead of the curve

1/13

Smart beta mutual funds are gaining popularity slowly among Indian investors. They are the passive funds that aim to beat the traditional market-capitalization-weighted index. These funds aren’t entirely passive. The choice of stocks is made by framing models that shortlist based on factors like low volatility, alpha, quality, value, equal weighing and momentum. Based on these factors, smart-beta indices are made. And the indices are churned once in a few months when the factors are run all over again, to update the basket. NSE India has launched 34 such strategy-based indices. Indian mutual funds offer 45 such smart beta index funds/ETFs (including seven equal-weight funds and two FoFs). Here are the top 10 stocks of the 12 smart beta indices that these schemes follow. The top 10 stocks mostly determine the outperformance of the schemes over their benchmarks. Data were as of July 31, 2023. Source: ACEMF, Niftyindices.com and Asiaindex.co.in

2/13

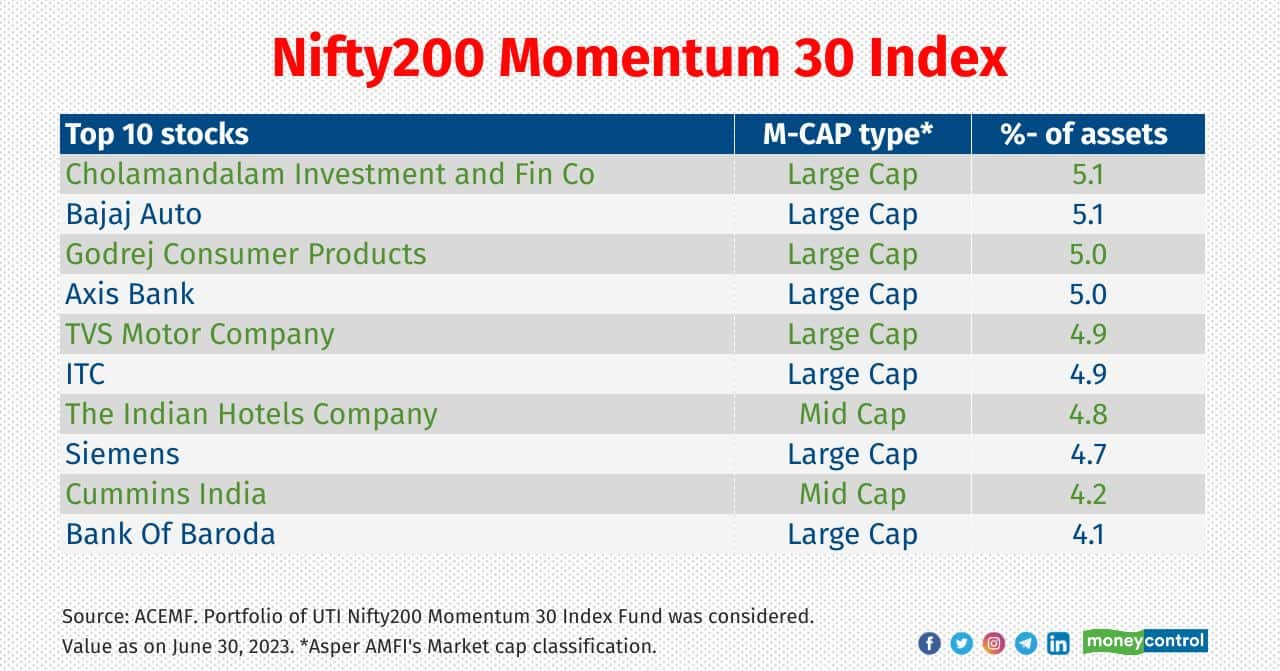

Nifty200 Momentum 30 Index

What does it do?: To pick stocks whose prices have been rising continuously.

Stock selection methodology: Nifty200 Momentum 30 Index which aims to track the performance of the top 30 companies within the Nifty 200 selected based on their Normalized Momentum Score. This is determined based on the stock’s 6-month and 12-month return in terms of stock price, adjusted for its volatility. The index considers the free-float market capitalisation as well.

Which schemes: UTI Nifty200 Momentum 30 Index Fund, Motilal Oswal Nifty 200 Momentum 30 Index Fund and ICICI Pru Nifty 200 Momentum 30 Index Fund.

What does it do?: To pick stocks whose prices have been rising continuously.

Stock selection methodology: Nifty200 Momentum 30 Index which aims to track the performance of the top 30 companies within the Nifty 200 selected based on their Normalized Momentum Score. This is determined based on the stock’s 6-month and 12-month return in terms of stock price, adjusted for its volatility. The index considers the free-float market capitalisation as well.

Which schemes: UTI Nifty200 Momentum 30 Index Fund, Motilal Oswal Nifty 200 Momentum 30 Index Fund and ICICI Pru Nifty 200 Momentum 30 Index Fund.

3/13

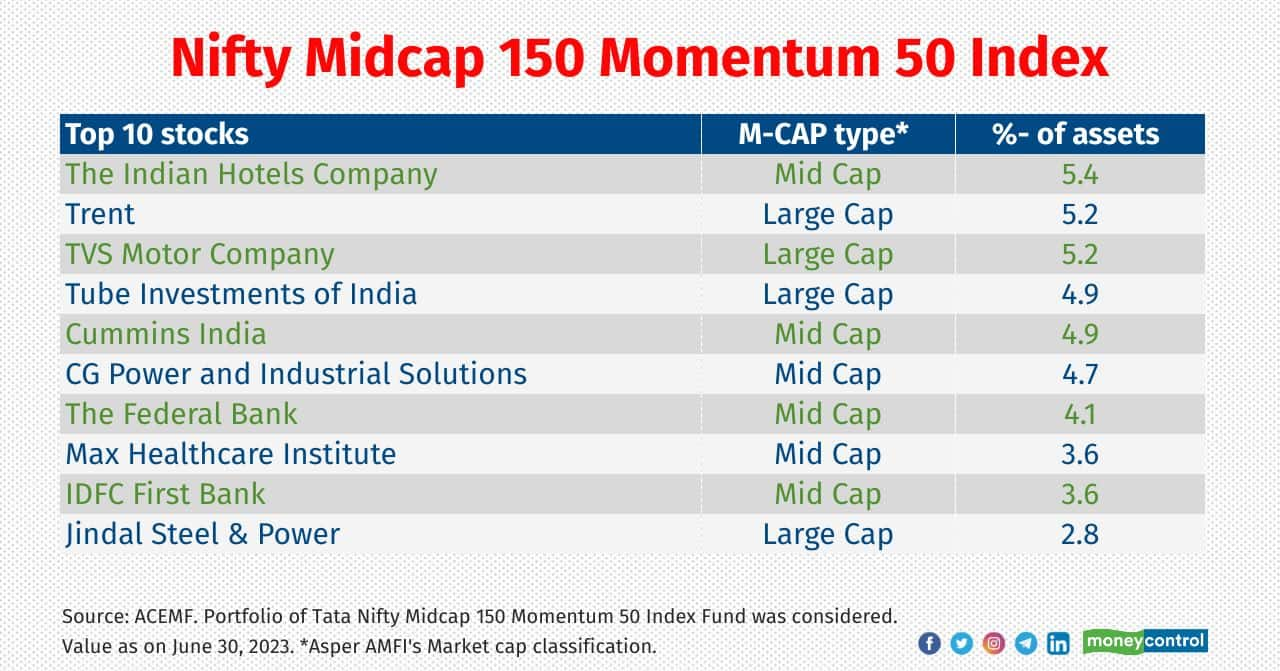

Nifty Midcap150 Momentum 50 Index

What does it do?: Just like Nifty200 Momentum 30 Index, this strategy pick stocks whose prices have been rising continuously. But unlike the former, Nifty Midcap150 Momentum 50 Index focusses on mid-cap stocks.

Stock selection methodology: The fund focuses on the Nifty Midcap 150. It picks stocks based on their 6-month and 12month return in terms of stock prices, adjusted for volatility. The index considers the free-float market capitalisation as well.

Which schemes: Tata Nifty Midcap 150 Momentum 50 Index Fund and Edelweiss Nifty Midcap150 Momentum 50 Index Fund

Read here: Buy high, sell higher: Does momentum strategy work for Indian investors?

What does it do?: Just like Nifty200 Momentum 30 Index, this strategy pick stocks whose prices have been rising continuously. But unlike the former, Nifty Midcap150 Momentum 50 Index focusses on mid-cap stocks.

Stock selection methodology: The fund focuses on the Nifty Midcap 150. It picks stocks based on their 6-month and 12month return in terms of stock prices, adjusted for volatility. The index considers the free-float market capitalisation as well.

Which schemes: Tata Nifty Midcap 150 Momentum 50 Index Fund and Edelweiss Nifty Midcap150 Momentum 50 Index Fund

Read here: Buy high, sell higher: Does momentum strategy work for Indian investors?

4/13

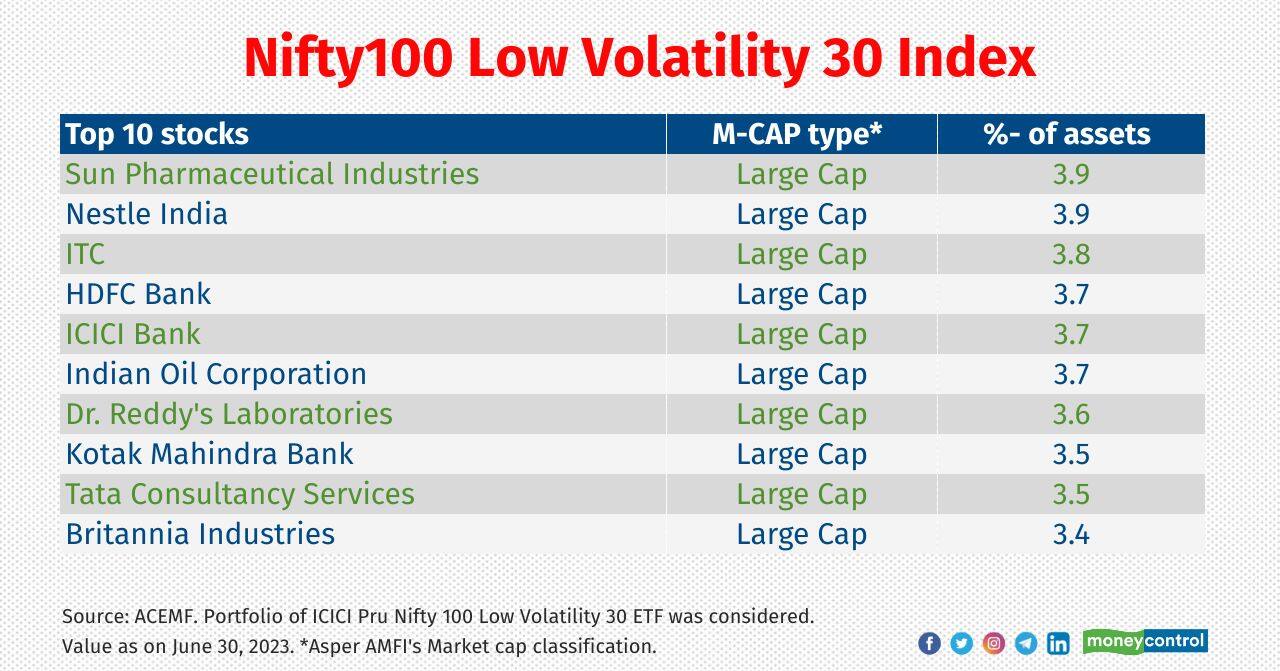

Nifty100 Low Volatility 30 Index

What does it do?: To pick low volatile stocks out of the 100 largest companies.

Stock selection methodology: The index looks at standard deviation of daily price returns (log normal) for last one year, to pick the lowest volatile stocks.

Which schemes: ICICI Pru Nifty 100 Low Volatility 30 ETF, Mirae Asset Nifty 100 Low Volatility 30 ETF and HDFC NIFTY100 Low Volatility 30 ETF.

What does it do?: To pick low volatile stocks out of the 100 largest companies.

Stock selection methodology: The index looks at standard deviation of daily price returns (log normal) for last one year, to pick the lowest volatile stocks.

Which schemes: ICICI Pru Nifty 100 Low Volatility 30 ETF, Mirae Asset Nifty 100 Low Volatility 30 ETF and HDFC NIFTY100 Low Volatility 30 ETF.

5/13

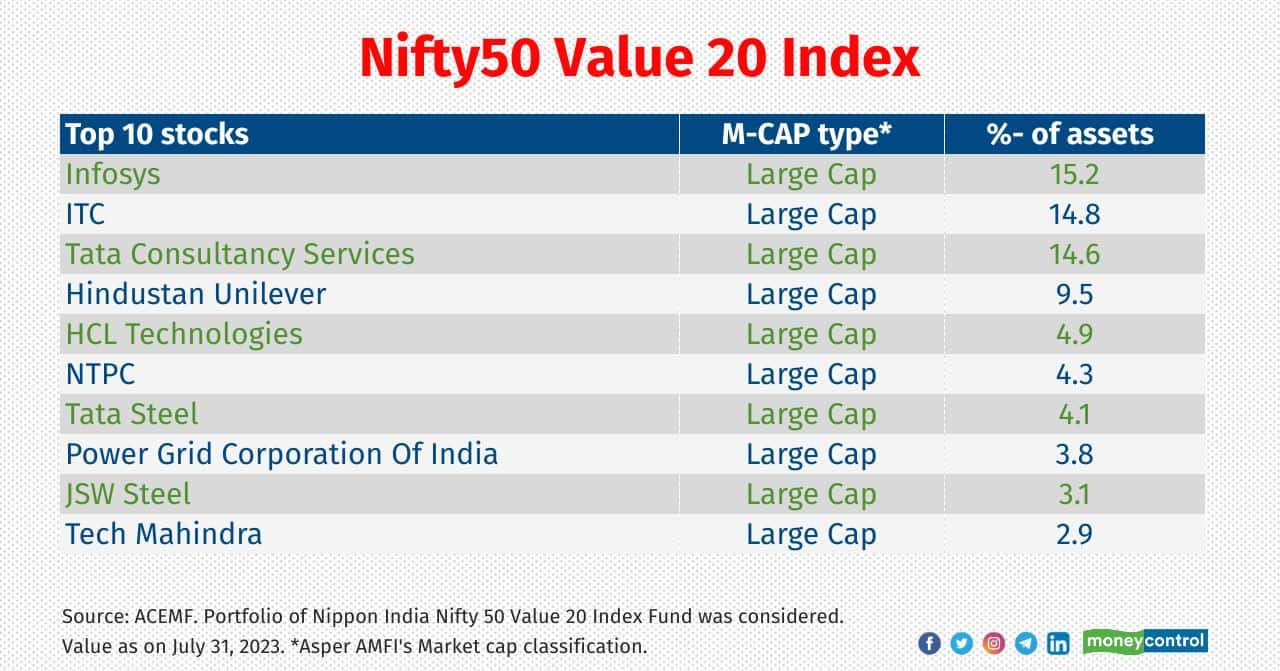

Nifty50 Value 20 Index

What does it do?: A value stock – picking strategy that draws stocks only from the Nifty 50 index; a large-cap index.

Stock selection methodology: Value companies are normally perceived as companies with low PE (Price to Earning), low PB (Price to Book) and high DY (Dividend Yield).

Which schemes: Nippon India Nifty 50 Value 20 Index Fund, ICICI Pru Nifty50 Value 20 ETF and Kotak Nifty 50 Value 20 ETF.

What does it do?: A value stock – picking strategy that draws stocks only from the Nifty 50 index; a large-cap index.

Stock selection methodology: Value companies are normally perceived as companies with low PE (Price to Earning), low PB (Price to Book) and high DY (Dividend Yield).

Which schemes: Nippon India Nifty 50 Value 20 Index Fund, ICICI Pru Nifty50 Value 20 ETF and Kotak Nifty 50 Value 20 ETF.

6/13

NIFTY Alpha Low-Volatility 30 Index

What does it do?: To pick stocks that have a track record in outperforming the benchmark index, with the least amount of volatility.

Stock selection methodology: It intends to counter the cyclicality of single factor index strategy and provides investors a choice to take exposure to multiple factors through a single index product. It consists of a well-diversified portfolio of 30 stocks selected from Nifty 100 index and Nifty Midcap 50 index.

Which schemes: ICICI Pru Nifty Alpha Low - Volatility 30 ETF and Nippon India Nifty Alpha Low Volatility 30 Index Fund.

Also read: Midcap darlings of conservative hybrid funds for long term growth

What does it do?: To pick stocks that have a track record in outperforming the benchmark index, with the least amount of volatility.

Stock selection methodology: It intends to counter the cyclicality of single factor index strategy and provides investors a choice to take exposure to multiple factors through a single index product. It consists of a well-diversified portfolio of 30 stocks selected from Nifty 100 index and Nifty Midcap 50 index.

Which schemes: ICICI Pru Nifty Alpha Low - Volatility 30 ETF and Nippon India Nifty Alpha Low Volatility 30 Index Fund.

Also read: Midcap darlings of conservative hybrid funds for long term growth

7/13

NIFTY Midcap150 Quality 50 Index

What does it do?: To pick stocks with healthier financials than peers, out of the mid-cap basket of 150 stocks.

Stock selection methodology: Stocks are selected based on ‘quality’ scores. This is determined based on return on equity, financial leverage (except for financial services companies) and earning per share (EPS) growth variability of each stock analysed during the previous 5 financial years.

Which schemes: DSP Nifty Midcap 150 Quality 50 Index Fund, UTI Nifty Midcap 150 Quality 50 Index Fund and DSP Nifty Midcap 150 Quality 50 ETF.

What does it do?: To pick stocks with healthier financials than peers, out of the mid-cap basket of 150 stocks.

Stock selection methodology: Stocks are selected based on ‘quality’ scores. This is determined based on return on equity, financial leverage (except for financial services companies) and earning per share (EPS) growth variability of each stock analysed during the previous 5 financial years.

Which schemes: DSP Nifty Midcap 150 Quality 50 Index Fund, UTI Nifty Midcap 150 Quality 50 Index Fund and DSP Nifty Midcap 150 Quality 50 ETF.

8/13

S&P BSE Low Volatility Index

What does it do?: To select the least volatile stocks based on a stock’s past track record.

Stock selection methodology: It picks stocks from the S&P BSE LargeMidCap. It measures volatility by means of standard deviation. The aim is to pick the stocks that have a fair representation of large-cap and mid-cap companies.

Which schemes: UTI S&P BSE Low Volatility Index Fund and Motilal Oswal S&P BSE Low Volatility ETF.

Also read: 15 smallcap gems with major MF stakeholding

What does it do?: To select the least volatile stocks based on a stock’s past track record.

Stock selection methodology: It picks stocks from the S&P BSE LargeMidCap. It measures volatility by means of standard deviation. The aim is to pick the stocks that have a fair representation of large-cap and mid-cap companies.

Which schemes: UTI S&P BSE Low Volatility Index Fund and Motilal Oswal S&P BSE Low Volatility ETF.

Also read: 15 smallcap gems with major MF stakeholding

9/13

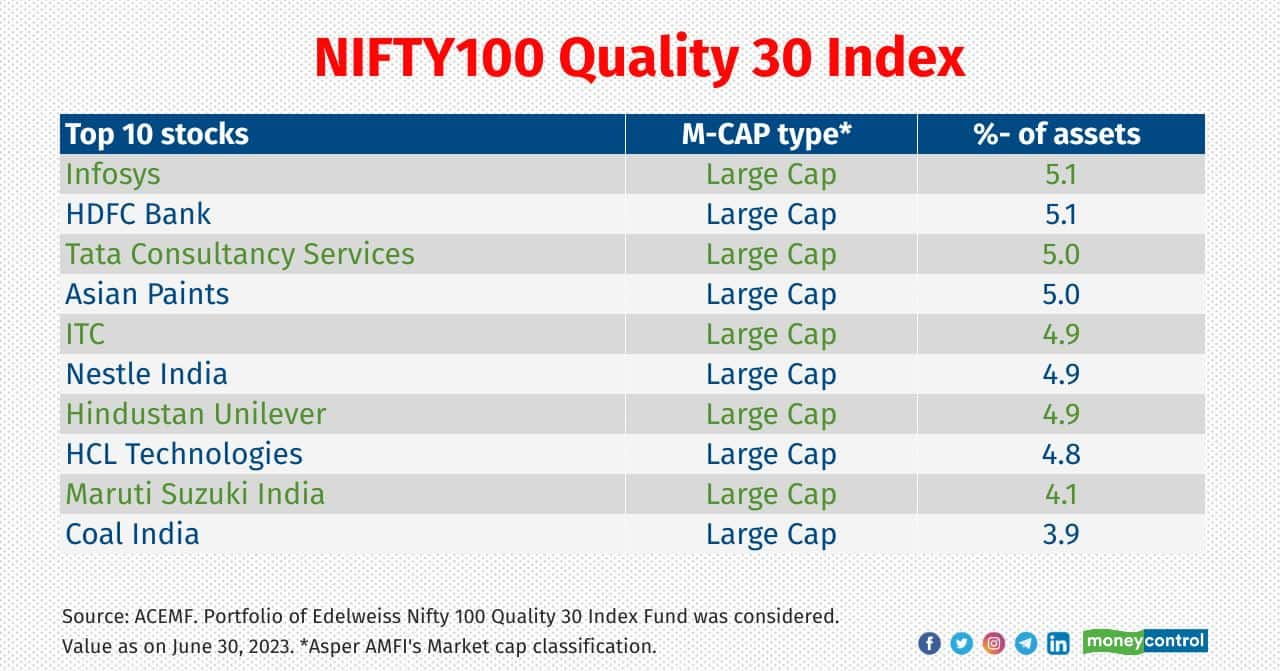

NIFTY100 Quality 30 Index

What does it do?: To pick stocks with healthier financials than peers, out of the large-cap basket of 100 stocks.

Stock selection methodology: Using a stock’s quality score, this strategy looks at return on equity (ROE), financial leverage (Debt/Equity Ratio) and earning (EPS) growth variability analysed during the previous 5 years.

Which schemes: Edelweiss Nifty 100 Quality 30 Index Fund and HDFC NIFTY100 Quality 30 ETF.

What does it do?: To pick stocks with healthier financials than peers, out of the large-cap basket of 100 stocks.

Stock selection methodology: Using a stock’s quality score, this strategy looks at return on equity (ROE), financial leverage (Debt/Equity Ratio) and earning (EPS) growth variability analysed during the previous 5 years.

Which schemes: Edelweiss Nifty 100 Quality 30 Index Fund and HDFC NIFTY100 Quality 30 ETF.

10/13

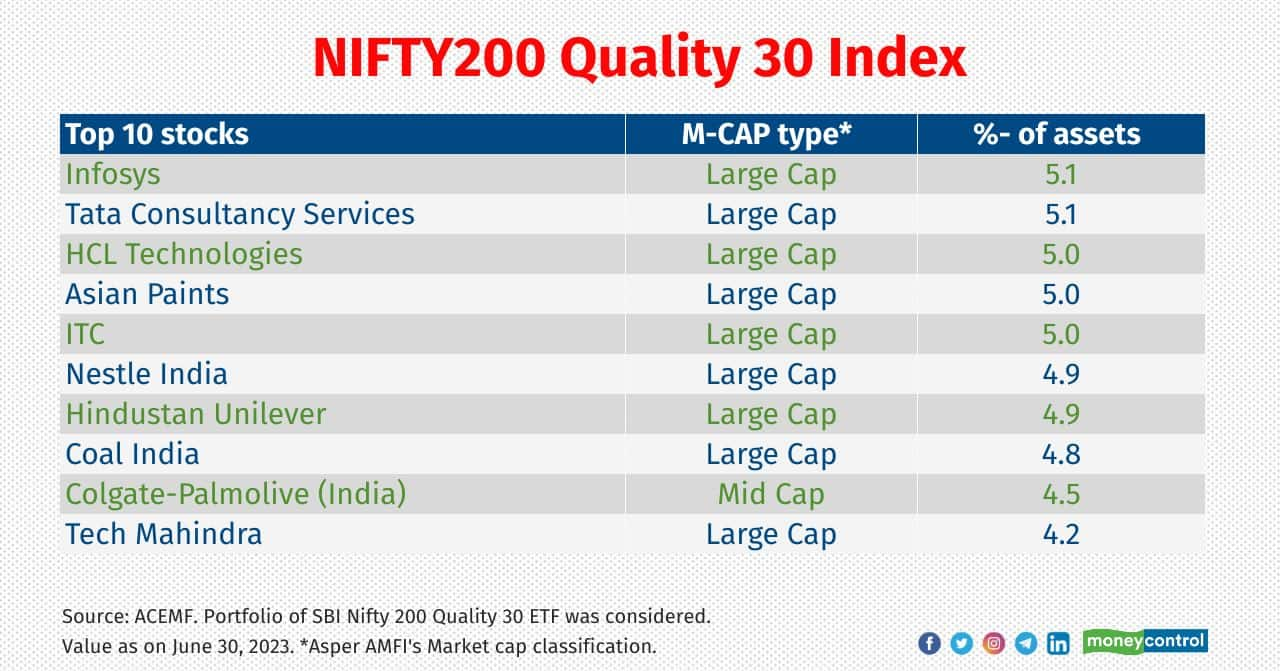

NIFTY200 Quality 30 Index

What does it do?: To pick 30 stocks with healthier financials than peers, out of the large- and mid-cap- basket of Nifty 200 index.

Stock selection methodology: It picks stocks based on return on equity (ROE), financial leverage (Debt/Equity Ratio) and earning (EPS) growth variability analysed during the previous 5 years.

Which schemes: Edelweiss Nifty 100 Quality 30 Index Fund and HDFC NIFTY100 Quality 30 ETF.

Also see: Here are 10 sectors on which mutual funds have gone big

What does it do?: To pick 30 stocks with healthier financials than peers, out of the large- and mid-cap- basket of Nifty 200 index.

Stock selection methodology: It picks stocks based on return on equity (ROE), financial leverage (Debt/Equity Ratio) and earning (EPS) growth variability analysed during the previous 5 years.

Which schemes: Edelweiss Nifty 100 Quality 30 Index Fund and HDFC NIFTY100 Quality 30 ETF.

Also see: Here are 10 sectors on which mutual funds have gone big

11/13

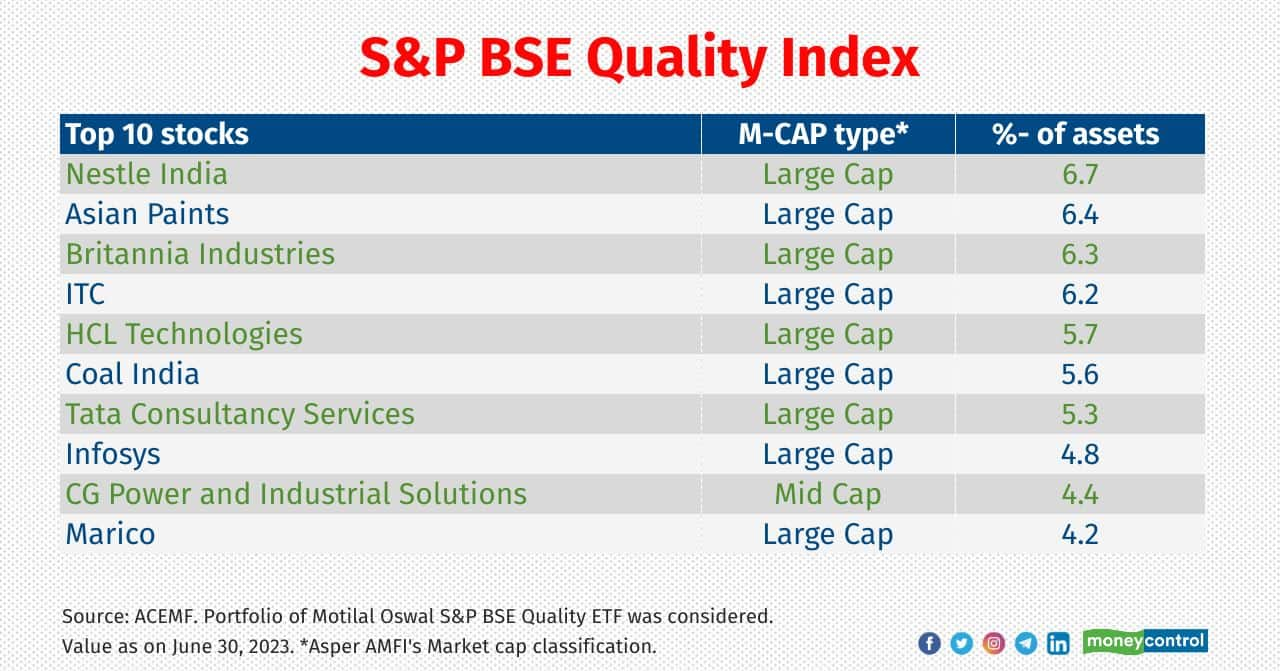

S&P BSE Quality Index

What does it do?: To pick 30 stocks with healthier financials than peers, out of the large- and mid-cap- basket of S&P BSE LargeMidCap index.

Stock selection methodology: It picks stocks based on return on equity, accruals ratio, and financial leverage ratio.

Which schemes: Motilal Oswal S&P BSE Quality ETF

What does it do?: To pick 30 stocks with healthier financials than peers, out of the large- and mid-cap- basket of S&P BSE LargeMidCap index.

Stock selection methodology: It picks stocks based on return on equity, accruals ratio, and financial leverage ratio.

Which schemes: Motilal Oswal S&P BSE Quality ETF

12/13

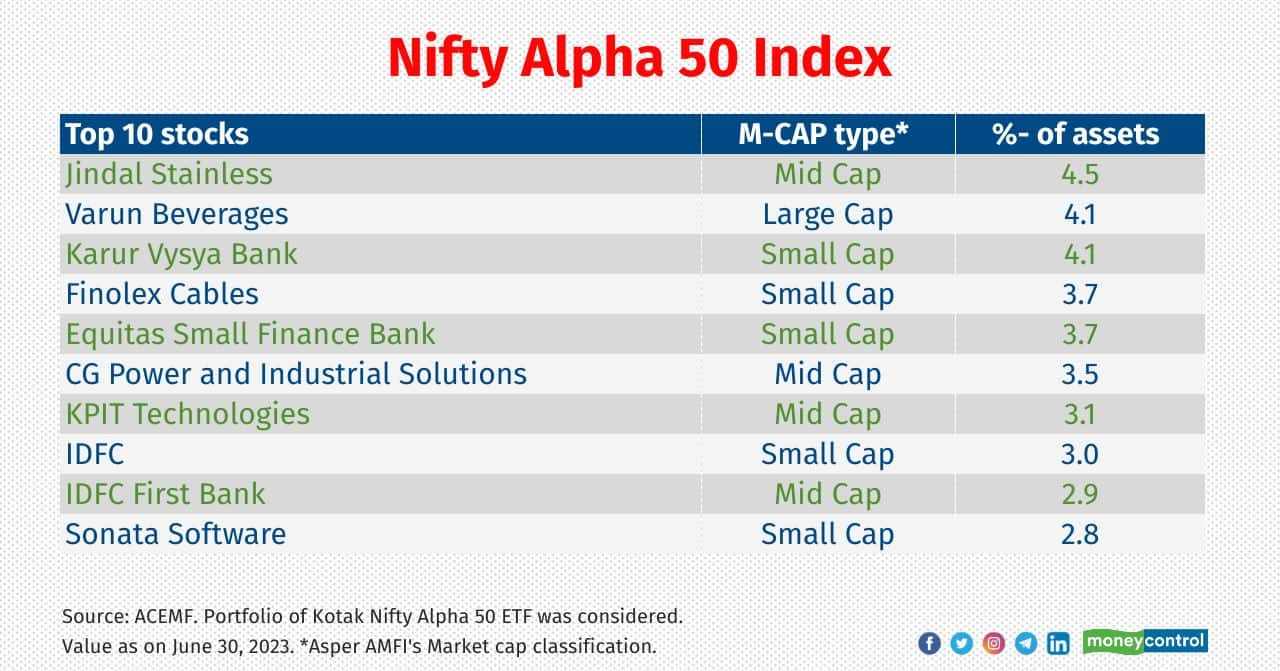

Nifty Alpha 50 Index

What does it do?: To pick 50 stocks that demonstrate an outperformance over other stocks within the 300 largest companies ranked in terms of market capitalisation.

Stock selection methodology: The index picks stocks based on their turnover and market capitalization. From this list, it then assigns scores based on their alpha values. Security with highest alpha in the index gets the highest weight.

Which schemes: Kotak Nifty Alpha 50 ETF

What does it do?: To pick 50 stocks that demonstrate an outperformance over other stocks within the 300 largest companies ranked in terms of market capitalisation.

Stock selection methodology: The index picks stocks based on their turnover and market capitalization. From this list, it then assigns scores based on their alpha values. Security with highest alpha in the index gets the highest weight.

Which schemes: Kotak Nifty Alpha 50 ETF

13/13

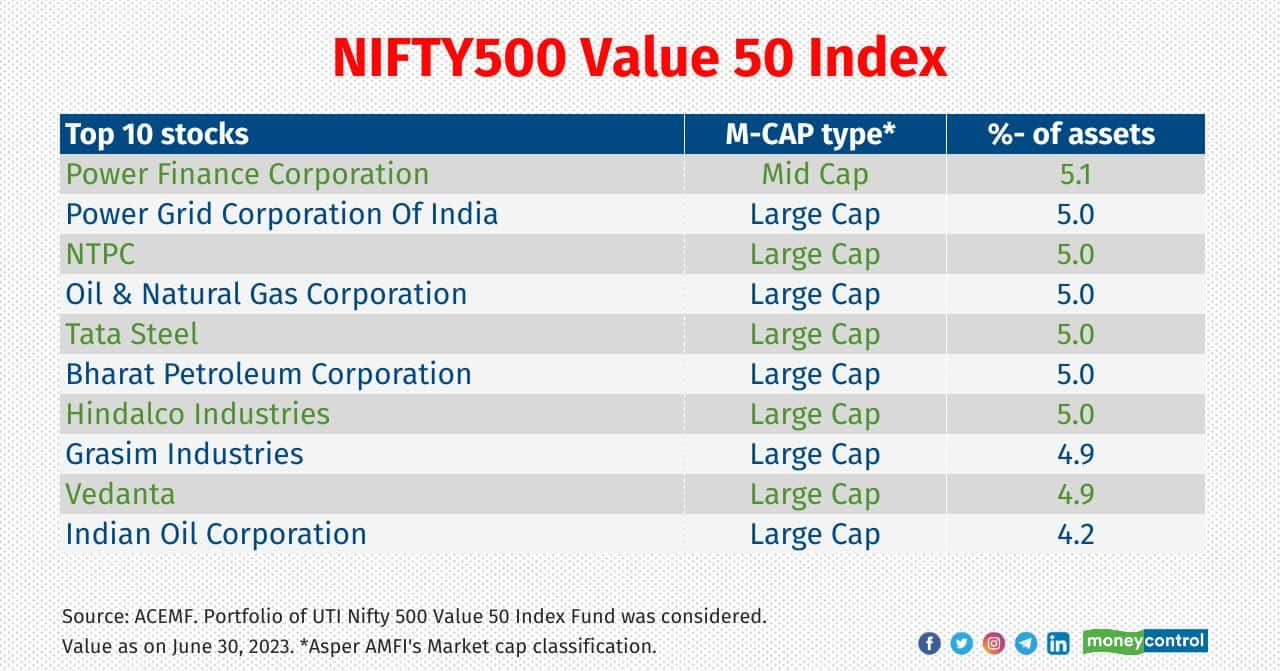

NIFTY500 Value 50 Index

What does it do?: A value stock–picking strategy that draws stocks only from the Nifty 500 index.

Stock selection methodology: The Nifty500 index consists of a good mix of large-cap, mid-cap and small-cap stocks. Companies are rated based on their ‘value’ scores, derived from the companies’ Earnings to Price ratio (E/P), Book Value to Price ratio (B/P), Sales to Price ratio (S/P) and Dividend Yield.

Which schemes: UTI Nifty 500 Value 50 Index Fund.

Also see: Smallcaps today, multibaggers tomorrow: Unique stocks that make it to MF hotlists

What does it do?: A value stock–picking strategy that draws stocks only from the Nifty 500 index.

Stock selection methodology: The Nifty500 index consists of a good mix of large-cap, mid-cap and small-cap stocks. Companies are rated based on their ‘value’ scores, derived from the companies’ Earnings to Price ratio (E/P), Book Value to Price ratio (B/P), Sales to Price ratio (S/P) and Dividend Yield.

Which schemes: UTI Nifty 500 Value 50 Index Fund.

Also see: Smallcaps today, multibaggers tomorrow: Unique stocks that make it to MF hotlists

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!