Nifty at 20K: These stocks had low weight on index - Active funds got the bet right

Stocks with relatively lower weight in the Nifty 50 index such as Tata Motors, Apollo Hospitals Enterprise and JSW Steel gained significantly. Though their contribution to the index was miniscule due to their lower weight, many active fund managers bought them early and benefitted by holding significant exposure into them

1/10

NSE’s benchmark index Nifty 50 hit the milestone of 20,000points on September 11. It took as much as 3 years to reach 20,000 up from 10,000 levels. Data compiled from ACEMF shows that half of the stocks in the Nifty 50 basket more than doubled over the last three years. Stocks with significant weight in the index including L&T, SBI and ICICI Bank grew notably and contributed remarkably. Meanwhile, stocks with relatively lower weight in the index such as Tata Motors, Apollo Hospitals Enterprise and JSW Steel too gained significantly. Though their contribution to the index was miniscule due to their lower weight, many active fund managers bought them early in large quantities and benefitted from subsequent upward movement in prices.

Here, we compiled the list of schemes that benefitted from the Nifty underweight stocks by going overboard. For this study, we shortlisted nine underweight stocks in the Nifty index that delivered relatively higher returns among the constituents in the last three years.

Definition of ‘underweight stocks’: Below 25 stocks in the index in terms of weightage. Source: ACEMF.

Here, we compiled the list of schemes that benefitted from the Nifty underweight stocks by going overboard. For this study, we shortlisted nine underweight stocks in the Nifty index that delivered relatively higher returns among the constituents in the last three years.

Definition of ‘underweight stocks’: Below 25 stocks in the index in terms of weightage. Source: ACEMF.

2/10

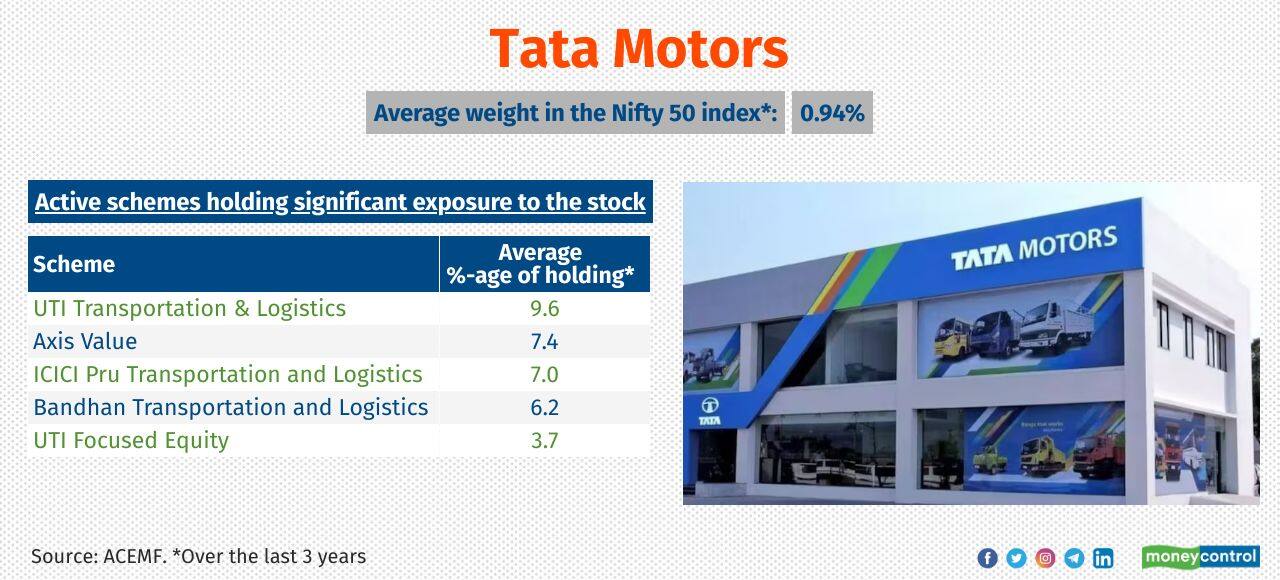

Tata Motors

3 years return (point-to-point): 340%

No. of active MF schemes held the stock as of Aug 31, 2023: 169

3 years return (point-to-point): 340%

No. of active MF schemes held the stock as of Aug 31, 2023: 169

3/10

Apollo Hospitals Enterprise

3 years return (point-to-point): 216%

No. of active MF schemes held the stock as of Aug 31, 2023: 99

Also see: 13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

3 years return (point-to-point): 216%

No. of active MF schemes held the stock as of Aug 31, 2023: 99

Also see: 13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

4/10

JSW Steel

3 years return (point-to-point): 186%

No. of active MF schemes held the stock as of Aug 31, 2023: 38

3 years return (point-to-point): 186%

No. of active MF schemes held the stock as of Aug 31, 2023: 38

5/10

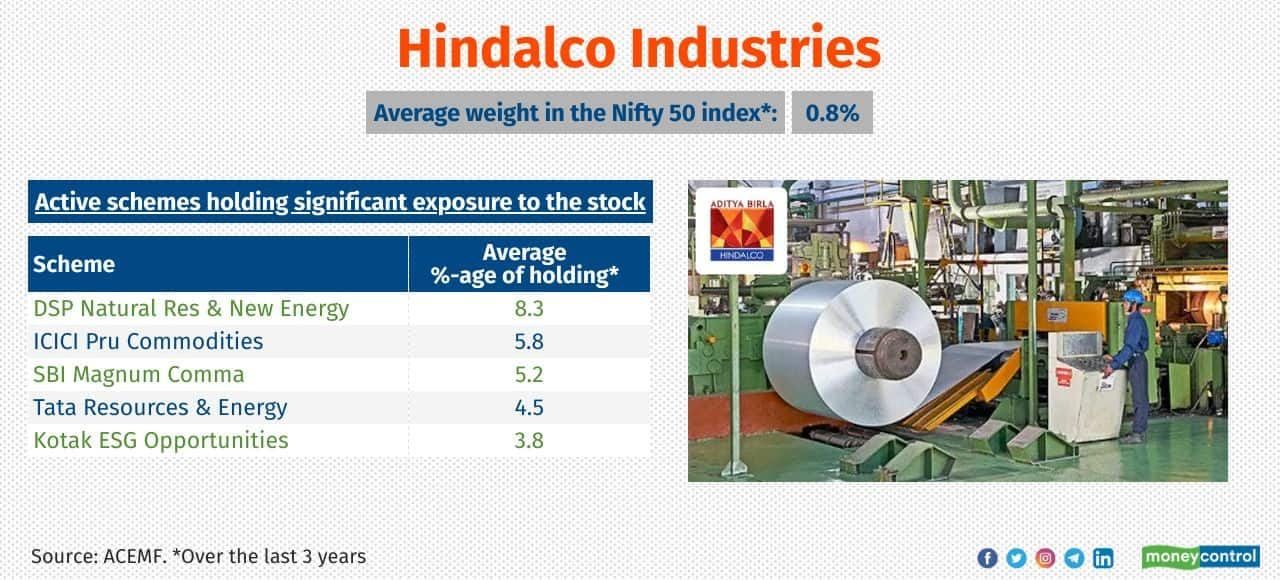

Hindalco Industries

3 years return (point-to-point): 171%

No. of active MF schemes held the stock as of Aug 31, 2023: 152

Also see: Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

3 years return (point-to-point): 171%

No. of active MF schemes held the stock as of Aug 31, 2023: 152

Also see: Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

6/10

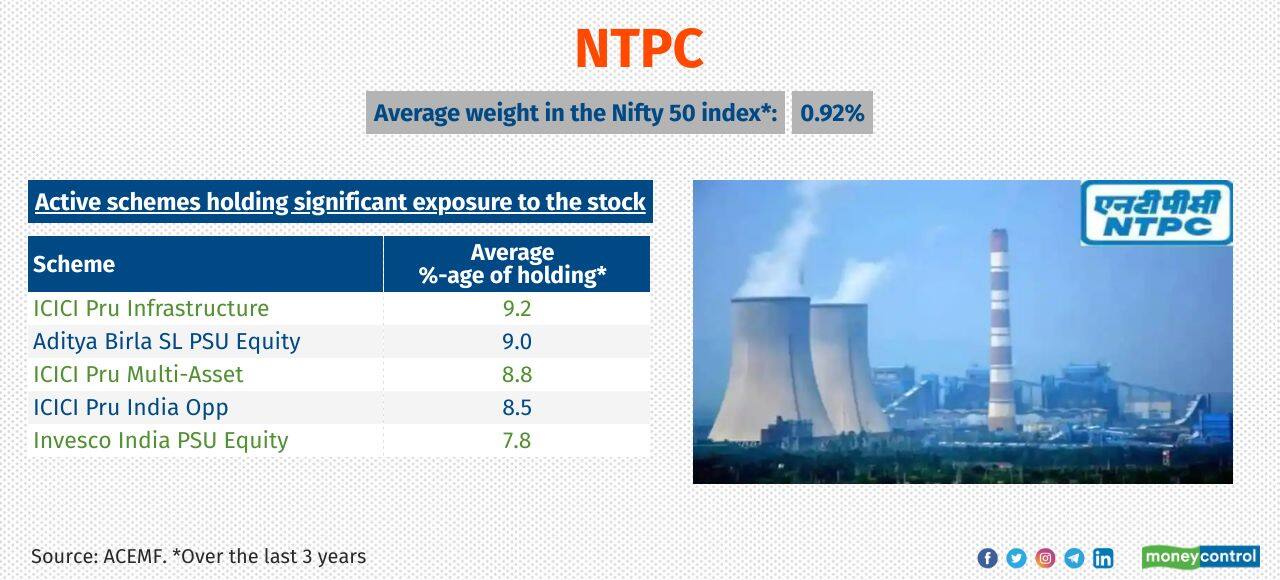

NTPC

3 years return (point-to-point): 170%

No. of active MF schemes held the stock as of Aug 31, 2023: 233

3 years return (point-to-point): 170%

No. of active MF schemes held the stock as of Aug 31, 2023: 233

7/10

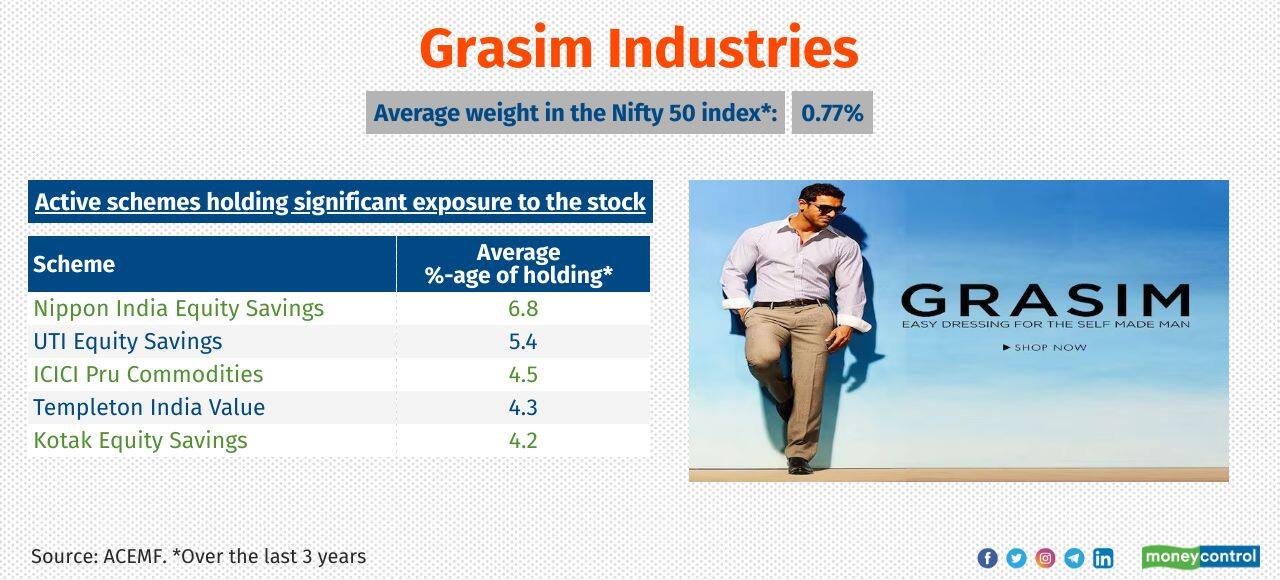

Grasim Industries

3 years return (point-to-point): 158%

No. of active MF schemes held the stock as of Aug 31, 2023: 65

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

3 years return (point-to-point): 158%

No. of active MF schemes held the stock as of Aug 31, 2023: 65

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

8/10

Adani Ports and Special Economic Zone

3 years return (point-to-point): 157%

No. of active MF schemes held the stock as of Aug 31, 2023: 36

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

3 years return (point-to-point): 157%

No. of active MF schemes held the stock as of Aug 31, 2023: 36

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

9/10

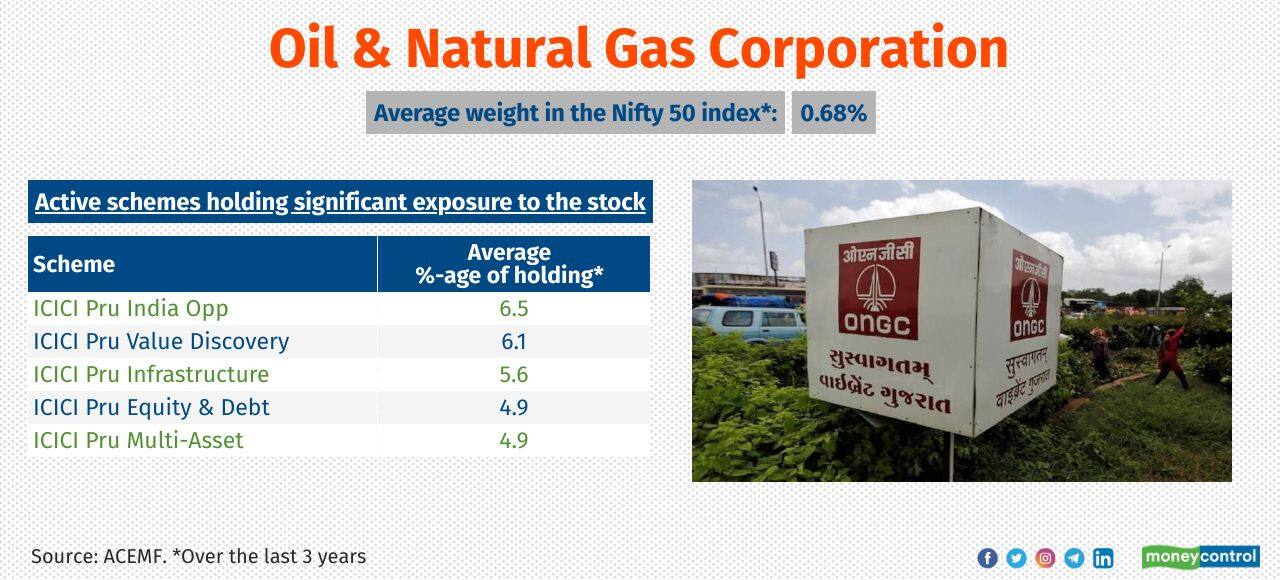

Oil & Natural Gas Corporation

3 years return (point-to-point): 150%

No. of active MF schemes held the stock as of Aug 31, 2023: 77

3 years return (point-to-point): 150%

No. of active MF schemes held the stock as of Aug 31, 2023: 77

10/10

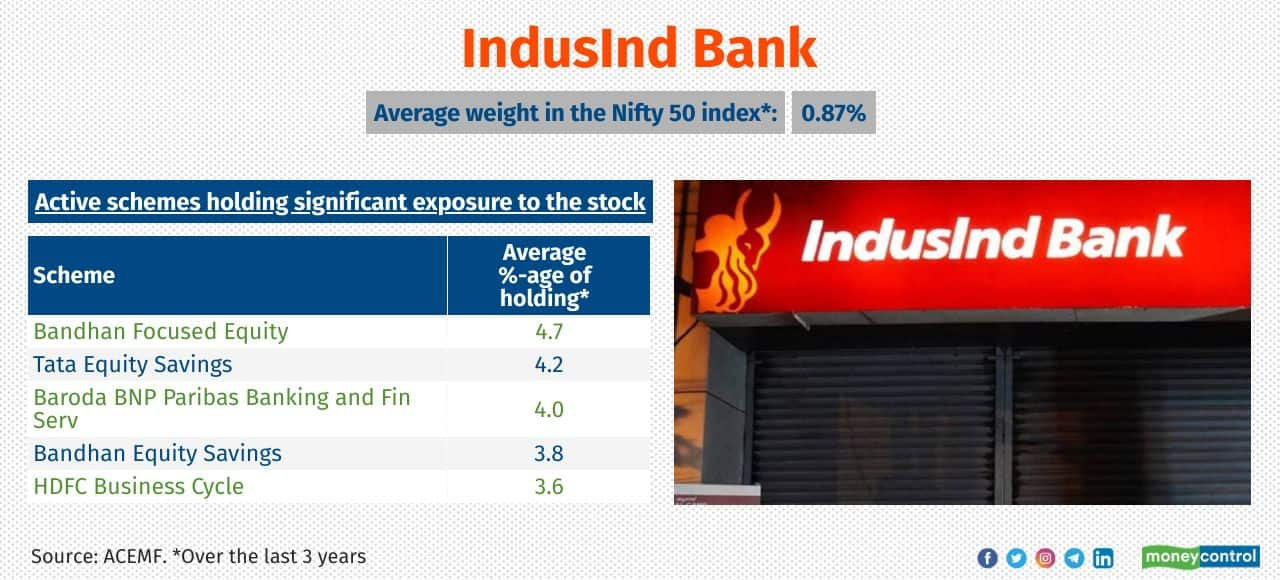

IndusInd Bank

3 years return (point-to-point): 138%

No. of active MF schemes held the stock as of Aug 31, 2023: 186.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

3 years return (point-to-point): 138%

No. of active MF schemes held the stock as of Aug 31, 2023: 186.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!