Madhuchanda DeyMoneycontrol Research

Two much-loved private sector banks, both growing way ahead of the system, valued at significant premium to peers, declaring quarterly numbers on the same day and finally afflicted by the same troubled group – strange coincidence indeed. That’s what came to light when the Street’s favourite IndusInd Bank and Yes Bank declared their numbers yesterday.

Amid the otherwise picture perfect results the performance on the asset quality front came as a shocker and beckons attention.

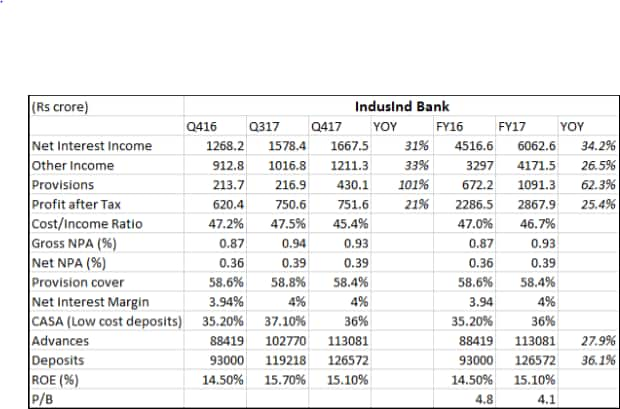

IndusInd Bank, despite a very strong core performance marked by 31 percent growth in net interest income (difference between interest income and interest expenses) and 33 percent surge in non-interest income reported a rather muted 21 percent growth in profit. The result was clearly marred by 101 percent rise in provision.

The management mentioned that they provided Rs 122 crore on a bridge loan for a large M&A transaction in the cement space pursuant to specific RBI advice in this regard. The provision is expected to get reversed on closure of the deal. While this could have easily been ignored as a one-off, the RBI’s recent circular makes us a lot more cautious.

From FY17 onwards, banks will need to provide new disclosures where the shortfall in provisions as per RBI norms exceeds 15 percent of the reported net income and/or there is 15 percent difference between the reported gross NPAs and RBI-assessed gross NPAs.

While IndusInd Bank's provisioning wasn't due to this new regulation, the first victim of the same was Yes Bank. Its pristine asset quality amid the turmoil in Indian corporate lending space was always suspect. However, having managed to come clean so far, the stock has had a stellar run with significant re-rating in valuation.

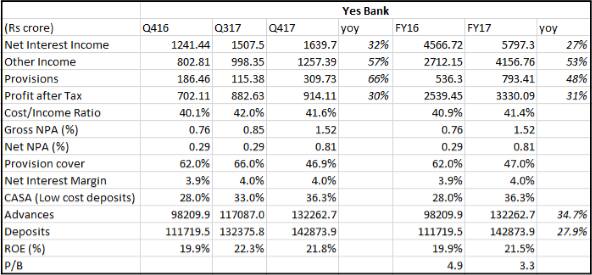

The headline profitability number from Yes Bank left little room for complaint. Earnings grew by 30 percent in the final quarter of FY17 backed by 32 percent growth in interest earnings and 57 percent in non-interest earnings. A decline in the provision coverage ratio shielded the headline profitability number.

The stark revelation from the earnings was classification of one account of Rs 911.5 crore as non-performing in accordance with the divergence observed by RBI. Interestingly, this divergence will now have to be highlighted for FY15 and FY16 as well, thereby raising the possibility of more skeletons in the closet.

Consequently, the reported gross and net NPL surged sequentially by 79 percent and 179 percent, respectively.

Now, the moot question that investors would like an answer to is what to do with the stocks?

Undoubtedly, the rise in provision on account of this cement asset for a consistent retail-focused player like IndusInd was a surprise – but not a shocker yet, if this truly turns out to be one-off. The bank has built a solid franchise with balanced asset mix (52 percent corporate, 48 percent retail), healthy interest margin of 4 percent that has the possibility to improve as the asset mix moves in favour of high yielding retail and a decent low cost deposit share of 36 percent.

IndusInd is all set to execute its "Planning Cycle 4" over the coming three years with a focus on rural lending, micro finance, digital thrust to curtail costs, balanced mix of corporate and retail and explore aggressive cross selling. The clarity on a profitable micro finance acquisition is also reassuring. So, while the 43 percent rally in the stock in the past one year and valuation at 3.8X FY18 adjusted book leaves little room for error; the above-peer earnings trajectory makes it a candidate worth accumulating on decline. For existing shareholders a correction could give an opportunity to add more at more reasonable valuation.

For the flamboyant Yes Bank, investors got to exercise more caution. The profitability numbers are exciting, the bank has recently raised capital (Rs 4906 crore by way of Qualified Institutional Placement) and looks set to deploy the same in earnings assets, likely to improve its share of low cost deposits further (from the current 36 percent) and improve margins on the back of recent liquidity infusion and moving more assets to retail (minuscule share of 9.5 percent now).

However, despite being a predominantly corporate lender, asset quality so far had been remarkably resilient. But the slippage in the latest quarter on account of divergence from RBI's evaluation opens many more questions on whether this is truly a one-off or there could be several such divergences that will now have to be mandatorily disclosed.

IndusInd and Yes both sounded confident about their telecom exposure which is 4.7 percent for IndusInd (less than 2.5 percent funded) and 4.9 percent for Yes. They do not feel the need to step up provision yet.

However, with RBI sharpening its focus on recognition and provisioning thereby completely closing doors for any kind of window dressing, for an entity like Yes Bank, sustaining valuation at 3X FY18 adjusted book might not be easy in the short to medium term. Incidentally, the stock has risen by 80% in the last one year.

While we acknowledge that savvy private sector entities like IndusInd and Yes stands to gain market share on account of the weak position of public sector banks, the stock of Yes Bank can be looked at on a meaningful correction. Or else, investors got to wait out for a quarter to be reassured that there is no more skeleton in the closet.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.