The Unified Payments Interface (UPI) crossed the 20 billion monthly transaction milestone in August but its annual growth has slowed dramatically, data available on the National Payments Corporation of India's website, which operates the mobile payments platform, shows.

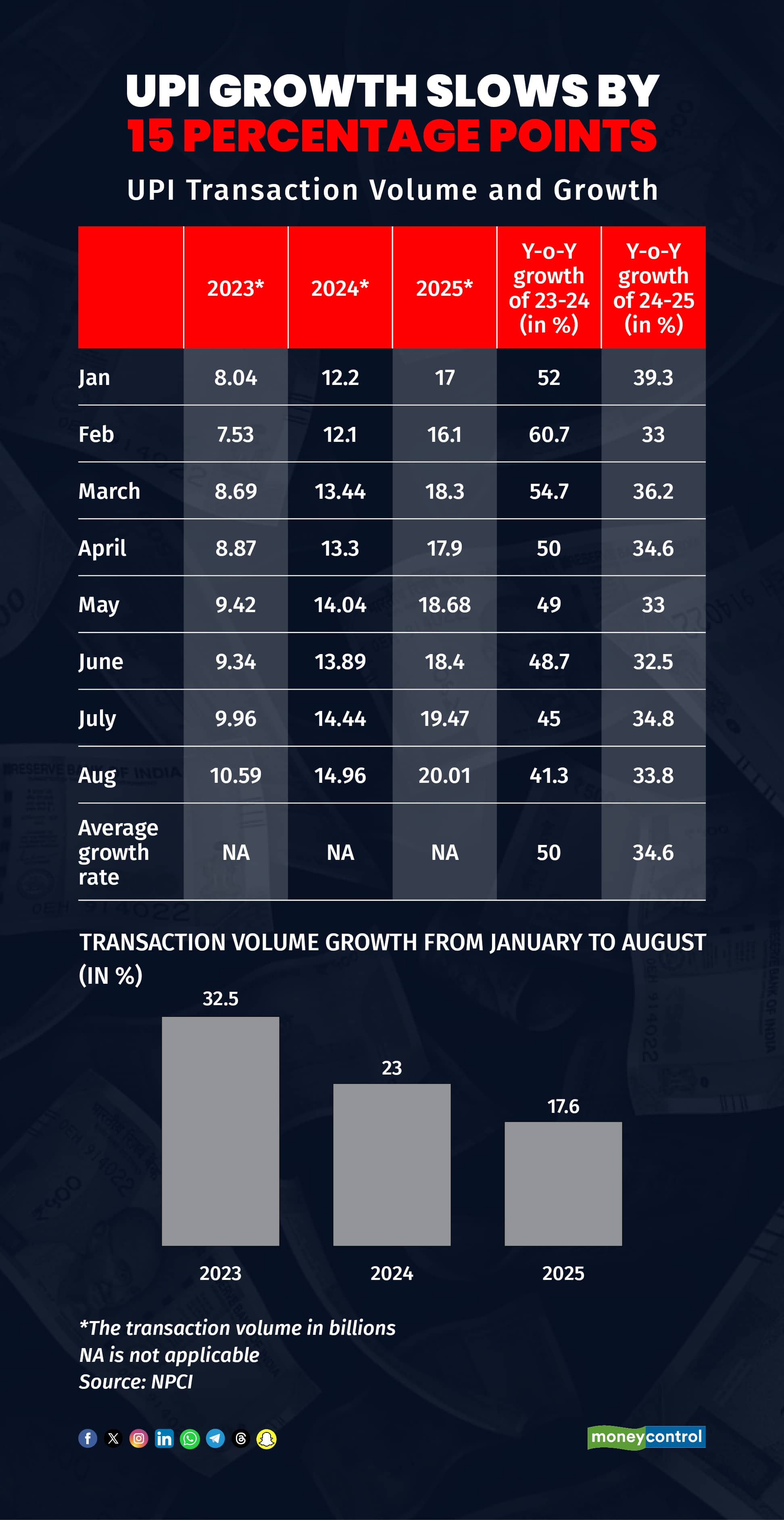

In the first eight months of this year, UPI's year-on-year growth rate was around 35 percent against 50 percent in the year-ago period, a drop of 15 percentage points.

To be sure, 35 percent growth is four times that of the GDP, an indication of growing acceptance and deepening reach of UPI.

Given the size of UPI, at around 20 billion transactions worth Rs 25 lakh crore – almost 12 times the size of credit card spending in a month – the base effect was expected to show up.

“There is a saturation effect. While there is no public data to compare trends yet, the number of new users seems to be coming down. This is not a case for worry. For a country with limited digital literacy and low per capita income and economic velocity, the current growth at such a large base is really good,” said Srinath Sridharan, author, policy researcher and corporate adviser.

UPI growth slows

UPI growth slows

With close to 400 million unique UPI users, the room to grow is limited, as a large segment of the population is either too old or too young to use the platform.

To address this accessibility issue, NPCI last year launched the delegated payment model under the UPI Circle.

“The current growth and the growth so far have been great considering the scale. We are looking at the past growth of the platform and want to target the same, which only shows our ambition,” said Mohit Bedi, co-founder of Kiwi, a fintech startup that offers virtual UPI-linked Rupay credit cards.

To be sure, UPI transactions have doubled from around 10 billion transactions in August 2023 to 20 billion this month.

The MDR argument

The growth momentum has also been slowing in the January-August period. The platform reported a 32 percent growth through the first eight months of 2023 compared to less than 18 percent in 2025.

“This year, we will likely see the UPI growth below 35 percent. While all big platforms see a slowdown in growth as they scale, UPI has the potential to continue growing at 50 percent if the right investments are made by the ecosystem players,” said a senior banker who works on the platform.

The banker, who spoke on condition of anonymity, was referring to the discussions around the Merchant Discount Rate (MDR), the payment commission merchants pay to companies facilitating digital payments. The revenue generated from MDR will be ploughed back into expanding the UPI network, says the senior banker quoted above.

Merchant transactions account for 64 percent of all UPI transactions.

There is an MDR on card payments but not on UPI. Payment companies and banks have urged the government to charge a small MDR fee for large merchants and for high-value payments.

A second senior banker cautioned that the case for MDR is not well articulated. “It is like the tax argument. The governments will say that higher taxes are needed to get better infrastructure. But do you really get better facilities with higher taxes is the question,” the banker added

Sridharan said India’s larger structural constraints are probably catching up. “India has a large informal sector, and a low female work participation could mean that the room to add new users will be limited for UPI. Even the new users’ propensity to spend will be considerably lower than that of the existing power users. MDR alone is not the solution for higher growth,” he added.

Moderation in UPI growth and lower transaction sizes also reflect broader consumption trends, with consumers exercising caution amid inflationary pressures and a slowing economy, he said. This slowdown in spending activity naturally affects digital payments. These trends can reverse once economic momentum strengthens and consumer confidence improves, he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!