UPI merchant transactions have grown almost five-fold in less than three years, indicating the importance of the real-time mobile payments system in the country's commercial payments, according to data available from the National Payments Corporation of India.

NPCI operates the Unique Payments Interface (UPI) platform for digital payments.

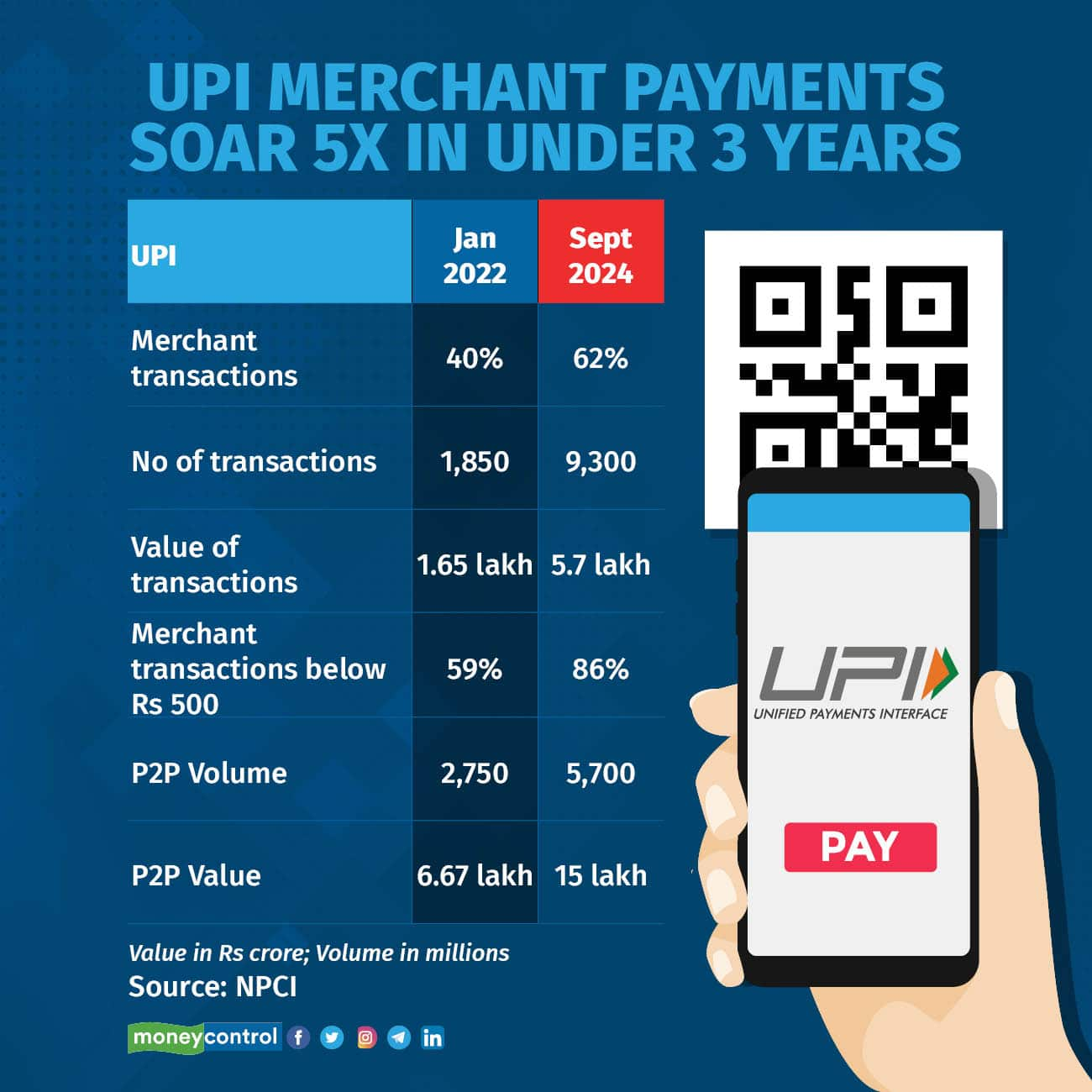

In September, UPI merchant payment volume stood at 9,300 million, compared to 1,850 million the platform had registered in January 2022, clocking a five-fold growth.

The value of UPI payments too reached Rs 5.7 lakh crore in September from Rs 1.65 lakh crore in January 2022, a growth of almost 3.5 times.

NPCI website does not have data for the period before January 2022.

Merchant payments constituted around 62 percent of the overall UPI payments, it was only 40 percent in January 2022, indicating the shift in UPI usage among customers from person-to-person to merchants.

UPI’s October numbers for merchant payments are not published on the NPCI website yet, but the platform has seen a huge growth over the September figures, likely spurred by the festive sales by online and offline retailers.

In October, UPI registered 16.6 billion transactions, compared to 15 billion in September, a growth of 10 percent month-on-month at a high base. The value also has grown to Rs 23.5 lakh crore during the month compared with Rs 20.6 lakh crore, a 15 percent monthly growth.

To put these numbers in context, UPI merchant payments are more than thrice that of credit card spending in the country. During September, the value of credit card payments stood at around Rs 1.75 lakh crore.

Rising importance of merchant payments

During September, UPI did around 5.7 billion p2p (person-to-person) transactions worth around Rs 15 billion. In terms of value, p2p payments are still more than twice as large as merchant payments.

This is because of the large proportion of small-value payments at merchant establishments. For instance, 86 percent of the merchant payments were below Rs 500. Another 10 percent of merchant transactions were between Rs 500 and Rs 2,000.

In contrast, 44 percent of p2p transactions were above Rs 500. In fact, 22 percent of all p2p transactions were above Rs 2,000, making the overall value of UPI payments 2.7 times that of merchant payments.

This is largely owing to the large number of small merchants, roadside hawkers and other service providers started adopting UPI payments across the country, including in smaller towns and rural areas.

For instance, only 59 percent of the merchant transactions were below Rs 500 in January 2022.

The shift is set to accelerate as more banks are launching Rupay credit cards that can be linked to UPI. Multiple banks are also launching credit line on UPI and is now being rolled out to customers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.