The Indian gaming industry generated revenues of $3.8 billion for the financial year 2024, registering a 22.6 percent growth from 3.1 billion in FY23, according to a report by gaming and interactive media venture fund Lumikai.

The growth was driven by a 41 percent on-year surge in in-app purchases, particularly from mid-core games such as Battlegrounds Mobile India (BGMI), Free Fire Max, Clash of Clans, and EA FC Mobile, which saw a 53 percent year-over-year revenue increase.

This segment is expected to maintain this momentum, with a projected compound annual growth rate (CAGR) of 34 percent over the next five years.

"We expect in-app purchases and in-app advertising revenue to be the dominant form of revenue over the course of the next few years, especially culminating in FY29 because of the growth trajectory of the business," Salone Sehgal, founding general partner at Lumikai, told Moneycontrol.

According to the report, the country's gaming industry is estimated to cross $9.2 billion by FY29 at a 20 percent CAGR over the next five years.

Game spending on the rise

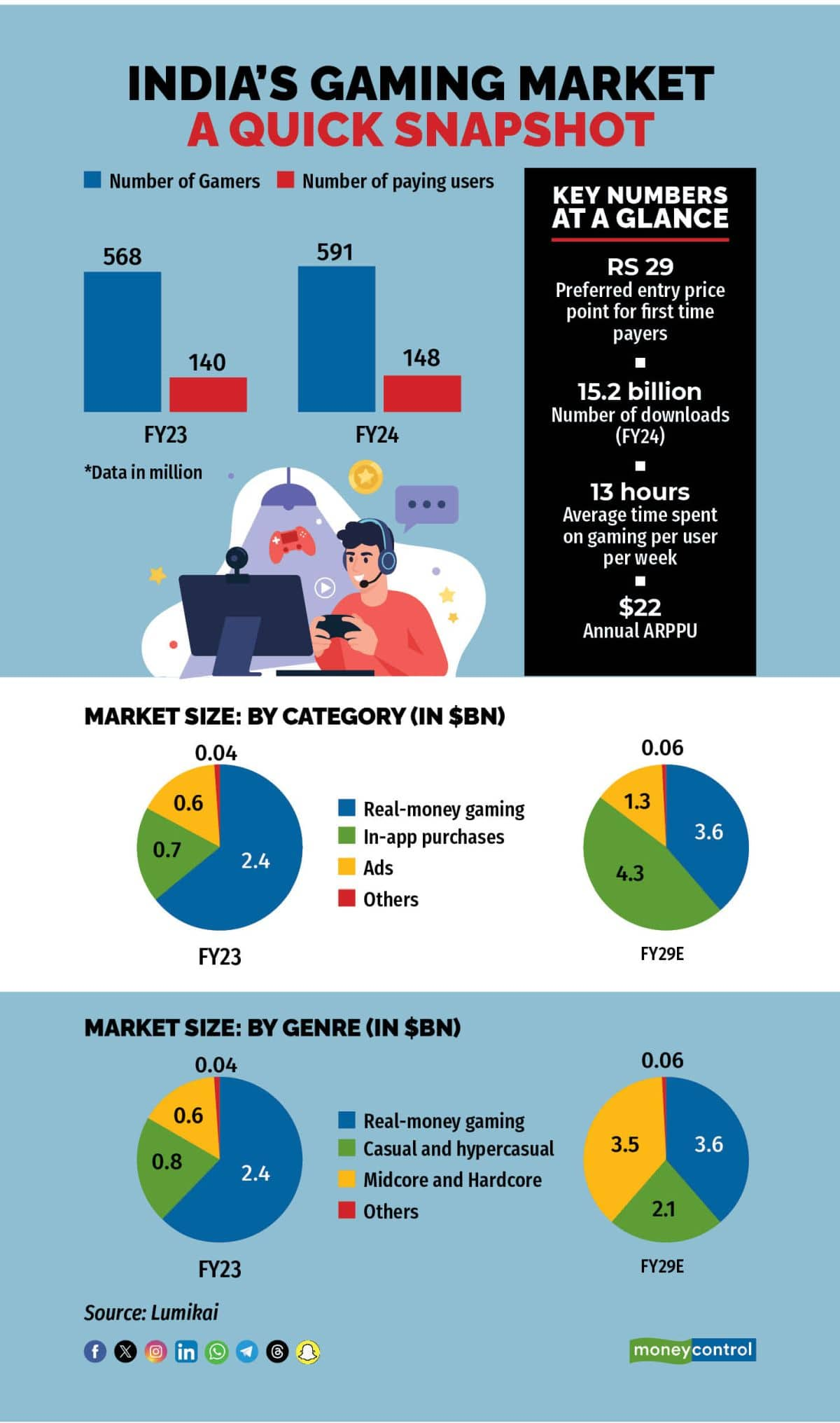

India, one of the largest gaming markets by user base, added 23 million users during the year, bringing the total gamer base to 590 million in FY24. The average weekly time spent on games increased by 30 percent, rising from 10 hours to 13 hours.

The number of paying gamers increased to 148 million in FY24, up 6 percent from 140 million in FY23.

People are also spending more money on games, with the average revenue per paying user (ARPPU) rising 15 percent year-over-year to $22 in FY24. Strategy games grossed the highest ARPPU at $28 annually, followed by action games at $18, casual games at $14, and sports games at $13.

The growth was helped by easier payment options such as Unified Payment Interface (UPI). "Around 83 percent of surveyed people use either UPI or digital wallets like Paytm to make in-app purchases," Sehgal said.

According to the report, Rs 29 is the sweet spot in terms of entry price point for first-time payers in terms of in-app purchases. Key drivers included unlocking new content, and upgrading in-game items.

Sehgal mentioned that there is a transition underway, with gamers who initially played real-money games are now starting to embrace and pay for mid-core games, indicating growing sophistication of gamers.

Some 64 percent of users who pay for real-money games are also paying for mid-core games, while 66 percent of players who used to pay for fantasy games have now started paying for mid-core games, the report said.

Category-wise revenue breakup

Real-money games, where the transfer of the money is involved, is the largest revenue source for the industry, accounting for about 63.2 percent of the overall industry revenues.

Of the $3.8 billion revenue, about $2.4 billion came from the real-money gaming segment. In-app purchases contributed about $0.7 billion, while advertising accounted for $0.6 billion.

The real-money money gaming segment is however undergoing a turbulent period due to challenges posed by the 28 percent GST regime, the lack of a regulatory framework in the country, and multiple legal challenges related to GST notices and the constitutional validity of state-level bans on real-money gaming formats.

"Contrary to predictions, the real-money gaming segment saw a revenue growth, adding about $400 million to the topline. However, that was primarily due to two reasons - platforms absorbing users' GST cost and a packed live sports season comprising two World Cups and an IPL (Indian Premier League)" Sehgal said.

"But if you look at margins and profitability, there was a compression between gross and net margins and there was a two-fold increase in payback periods over that same time. While larger players were able to absorb that hit, about 25 percent of the smaller players have been impacted with working capital constraints," she added.

About 66 percent of the gamers were from non-metro cities in FY24, while 43 percent of gamers are first-time earners in the age group of 18-30, thereby reflecting a high propensity to pay for gaming and interactive entertainment experiences, the report said.

Some 44 percent of gamers are women, up from 41 percent last year, playing casual mobile games. This is based on a survey with a sample size of 2,269 Indian smartphone users over a 12-month period from September 2023 to September 2024, the report said.

Funding scenario to improve

Sehgal also anticipates an improvement in the funding scenario in 2025, after a significant drop over the past year.

"The pace of deal-making is definitely slower than it was two years back. That was a function of global pullbacks in venture funding across various technology sectors. But in the last six months, we have seen a lot more funding announcements come through," she said. "I think a lot of people in the US were particularly waiting for the elections to know which way to plan their investment horizons. Now that the elections are over, I feel the markets will be a lot more open next year."

Additionally, more Indian tech companies are going public in the country, which is creating investor liquidity. "That cycle has just taken a lot of time and is happening now," Sehgal said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.