The National Payments Corporation of India (NPCI) run real real-time payment platform IMPS transaction volume has dropped to a four-year low as the Unified Payments Interface (UPI) surges in popularity.

Launched in late 2010, the Immediate Payment Service was NPCI’s flagship product until the launch of UPI. The latter has been developed on top of the IMPS platform by mapping the customer’s phone number to their bank account.

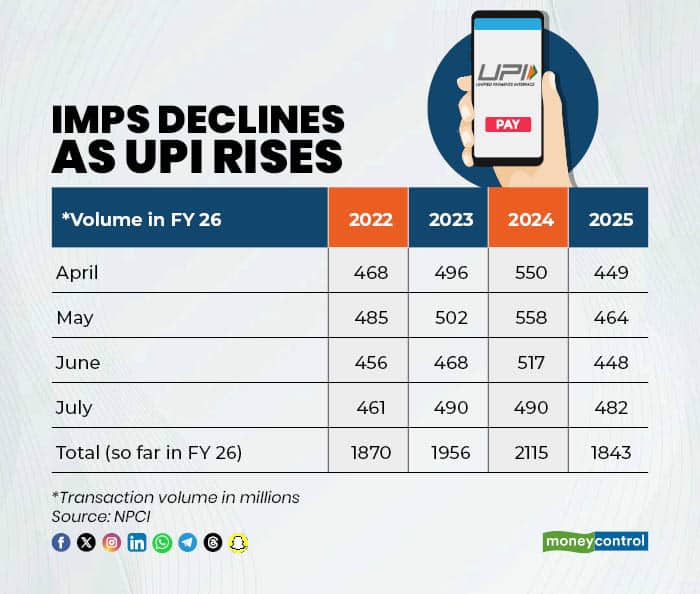

IMPS average monthly transaction volume during the current financial year stood at around 460 million compared with 529 million during the last fiscal. During the first four months of FY 23, IMPS reported 467 million transactions.

Meanwhile, UPI transactions have grown more than three times during the same period, from around six billion transactions a month in early FY 23 to more than 18 billion transactions this fiscal.

IMPS is a much safer money transfer platform, as customers need to add beneficiary bank account details and bank branch IFSC code before entering OTP to approve the beneficiary. However, the same safety aspects made it more cumbersome for customers, who ditched the payments platform for UPI.

“UPI offers a far superior user experience, an open app ecosystem, QR code ubiquity, and continuous innovation from NPCI and its partners, creating a network effect that has entrenched it as the natural starting point,” said Srinath Sridharan, a policy researcher and corporate advisor.

However, IMPS is often used by customers for high-value transactions, with the average value of transactions being higher than Rs 13,000 in July this year. The IMPS transactions also have to happen through the bank website or app.

Meanwhile, for UPI, the average transaction value was around Rs 1,300 last month. UPI transactions happen on any third-party payment app.

In July, IMPS processed 482 million transactions worth Rs 6.3 lakh crore.

Corporations continue to rely on other business-to-business (B2B) digital transaction platforms like NEFT and RTGS for bulk, high-value and scheduled flows, leaving little space for IMPS in their treasury workflows.

“What we are witnessing is more a product-portfolio evolution, where UPI has absorbed many of IMPS’s original use cases, while IMPS remains relevant for niche, legacy, and fallback scenarios,” Sridharan added.

However, bankers point out that multiple payment rails in operation allow for user convenience, innovation, and systemic resilience. For instance, when UPI is down, customers can opt for IMPS, which is also a real-time payment system. During this year, UPI has seen a few outages owing to bank and NPCI issues.

“The way forward could be in repositioning IMPS for specialised segments such as high-value instant retail, cross-border payments, developer-friendly bank APIs, and as a resilient secondary rail in the event of outages,” Sridharan said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.