The benchmark indices fell nearly 0.7 percent on September 25, continuing weakness for the fifth straight day, with market breadth favouring bears. About 1,987 shares declined against 785 shares that gained on the NSE. The bearish sentiment may sustain in the short term, given the weakening momentum. Below are some short-term trading ideas to consider:

Jay Mehta, Technical Research at JM Financial Services

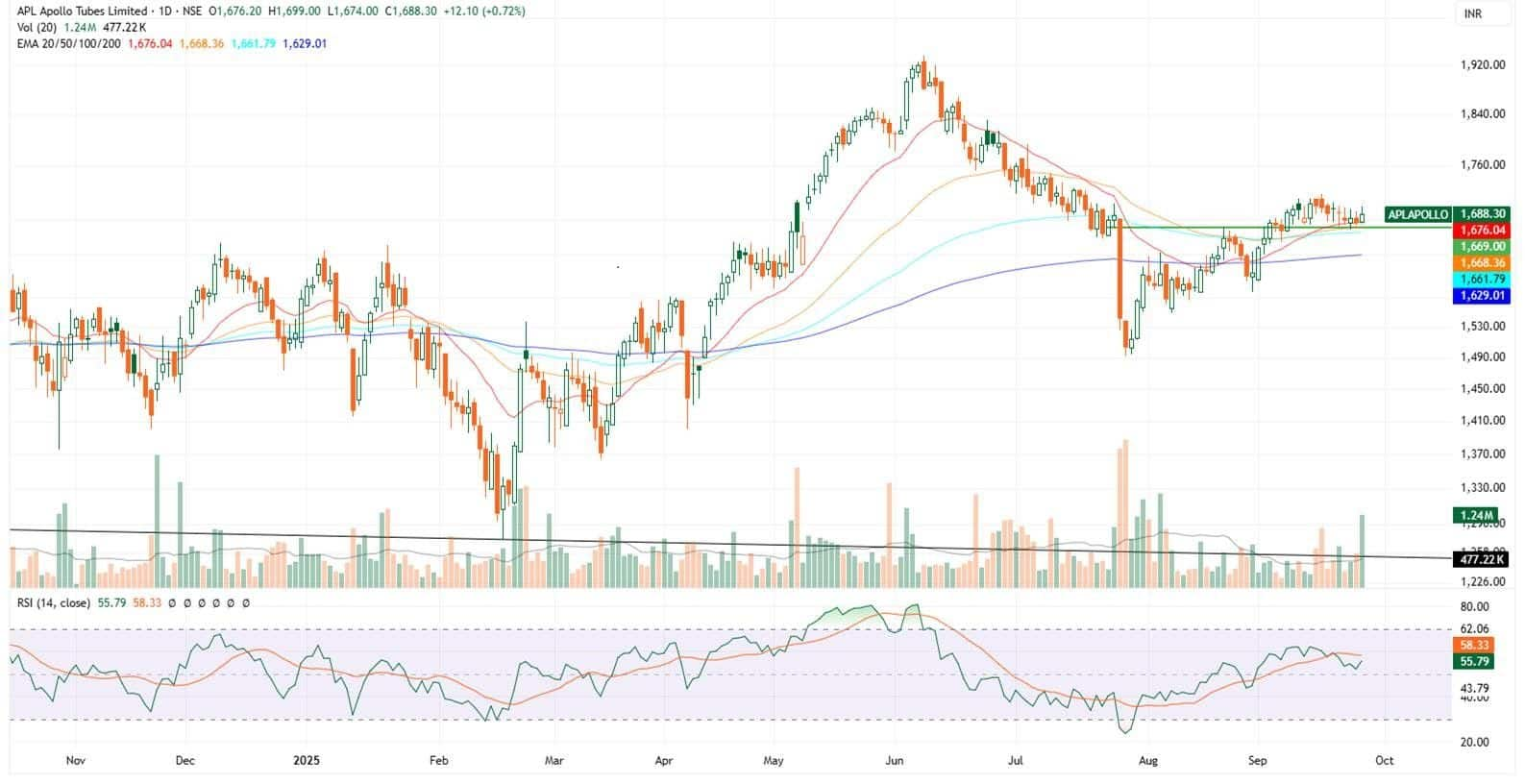

APL Apollo Tubes | CMP: Rs 1,688.3

APL Apollo Tubes has broken out above a consolidation zone near Rs 1,669 and is currently stabilizing in a narrow range around the retest level, with multiple spinning top patterns forming over the past few sessions. The latest session reflects renewed strength. A notable increase in positive volume, exceeding average levels, and solid delivery volume have been observed in recent sessions. The price trades above all major EMAs, which will act as strong support, converging near Rs 1,660. Both weekly and daily momentum indicators remain in positive territory.

Strategy: Buy

Target: Rs 1,740, Rs 1,770

Stop-Loss: Rs 1,644

Gujarat Fluorochemicals | CMP: Rs 3,782.5

Gujarat Fluorochemicals has surpassed a long-term trendline in place since October 2024, with the past two weeks on the weekly chart showing strong candles backed by robust volume, confirming a breakout above consolidation and the trendline. Recent sessions featured a throwback to support, followed by a solid rebound in the latest session, forming a hammer pattern. The price is above all key EMAs, which will act as strong support in any dips, and weekly and daily momentum indicators are in positive territory.

Strategy: Buy

Target: Rs 4,120, Rs 4,250

Stop-Loss: Rs 3,530

BEML | CMP: Rs 4,358.7

BEML recently broke out above a double bottom pattern, finding support at the 200-day EMA, with the breakout fueled by a significant volume spike. It is now trading within a small descending channel, resembling a tight consolidation range formation. The price remains above all key EMAs, which will act as dynamic support going forward, and momentum indicators are in bullish territory. A move above Rs 4,470 could trigger further upside, potentially sustaining a bullish rally. The latest session showed strength with above-average volume, and weekly and daily momentum indicators are positive.

Strategy: Buy

Target: Rs 4,750, Rs 4,850

Stop-Loss: Rs 4,150

Hitesh Tailor, Technical Research Analyst at Choice Broking

SBI Cards & Payment Services | CMP: Rs 887

SBI Cards & Payment Services is showing strong bullish momentum. The stock has formed a Cup and Handle pattern and is poised for a breakout above its resistance zone. Rising volumes further support the strength of this setup, while a close above the 20, 50, and 200 EMA indicates sustained bullish bias. RSI at 64.35 is displaying a bullish crossover, signaling continued momentum. Immediate resistance is placed at Rs 900, and a breakout above this level could trigger fresh buying interest.

Strategy: Buy

Target: Rs 975

Stop-Loss: Rs 845

AU Small Finance Bank | CMP: Rs 741.6

AU Small Finance Bank is forming a trading channel pattern, nearing a breakout from the range. The move is supported by key Exponential Moving Averages acting as support from the downside, adding strength to the setup. The RSI is at 58.09 and has broken out from the oversold zone, indicating a potential rising trend. On the upside, immediate resistance is placed at Rs 750. A breakout and sustained move above this level could trigger bullish momentum, with an upside target of Rs 835. Short-term traders may consider fresh buying at current levels, with a stop-loss placed at Rs 695 for risk management.

Strategy: Buy

Target: Rs 835

Stop-Loss: Rs 695

Om Mehra, Technical Research Analyst, SAMCO Securities

Vedanta | CMP: Rs 461.65

Vedanta broke out of a flag pattern, signalling renewed upward momentum. The price has moved above both the 20-SMA and 50-SMA, with a positive crossover strengthening the short-term outlook.

A piercing pattern candle in the recent session further supports the bullish outlook. The RSI has improved to 60 with an upward slope, while the MACD continues to hold a positive crossover with supportive histogram bars, both reflecting momentum strength. The metal sector remains positive, adding strength.

Strategy: Buy

Target: Rs 485

Stop-Loss: Rs 448

Poonawalla Fincorp | CMP: Rs 493.45

Poonawalla Fincorp is sustaining above the breakout zone near Rs 477 after a strong up-move. The stock has reclaimed both the 20-SMA and 50-SMA, which now act as immediate supports. The recent breakout was backed by a surge in volumes, confirming strong participation.

The RSI has climbed to 65, holding firm above the neutral zone, while the MACD maintains its positive crossover with widening histogram bars, reflecting momentum strength.

The stock is forming a triangle formation, lending further confidence to the ongoing trend.

Strategy: Buy

Target: Rs 520

Stop-Loss: Rs 470

Bharat Electronics | CMP: Rs 403.15

Bharat Electronics has rebounded from the support zone near Rs 390, where earlier resistance has now turned into a base. The 20-SMA has crossed above the 50-SMA, lending additional strength to the short-term setup.

The RSI stands at 59, holding firm above the neutral zone, while the MACD sustains its positive crossover with supportive histogram bars. BEL is stabilising after the recent pullback, as displayed in the hourly chart, and is positioned for further upside.

Strategy: Buy

Target: Rs 422

Stop-Loss: Rs 388

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.