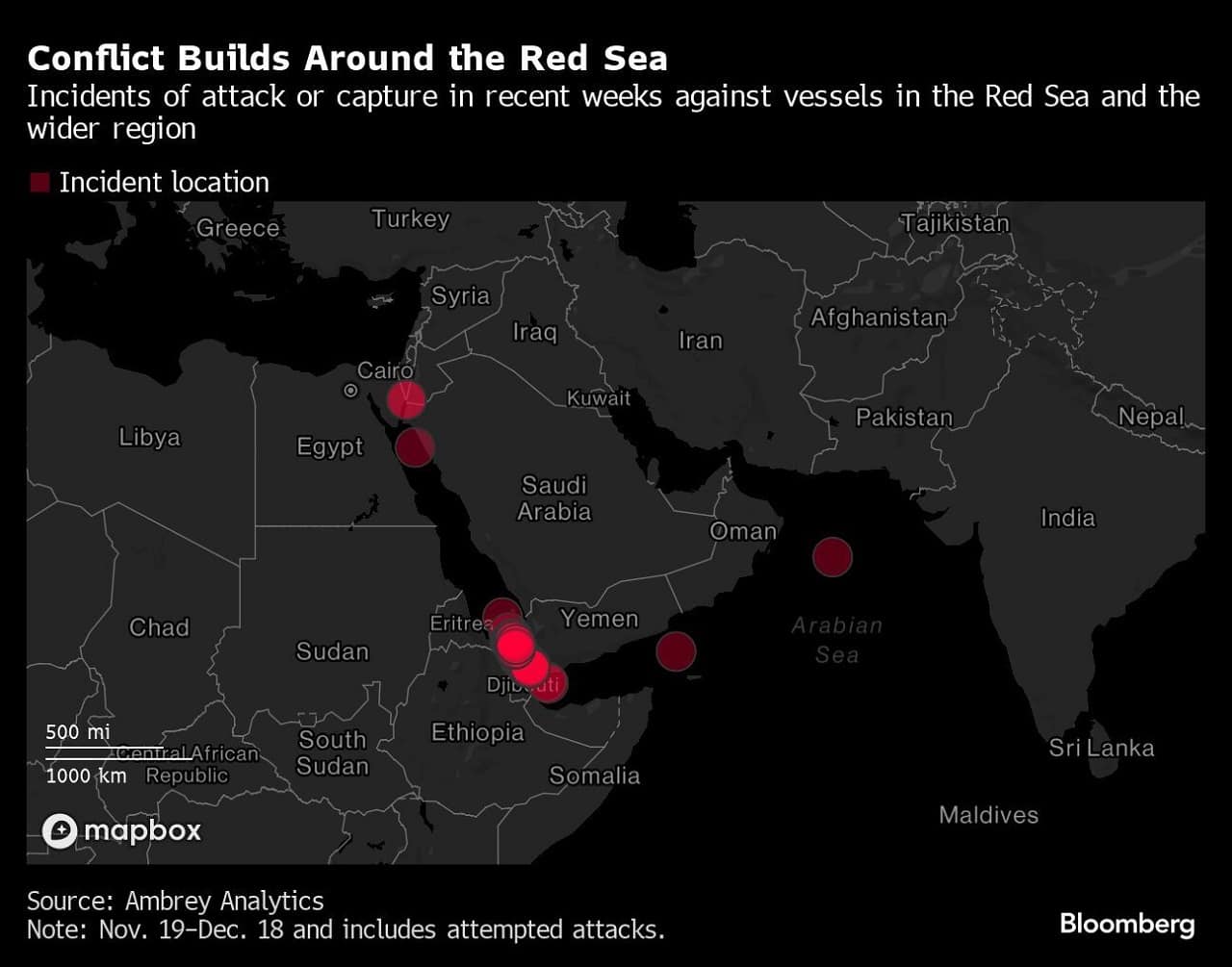

The Red Sea, a vital waterway for global commerce and energy shipped between Europe and Asia, is being temporarily abandoned by leading shipping firms following a spree of attacks on commercial vessels by Yemen's Houthi rebels.

This has spelled concern for international maritime trade, as the Red Sea is used for shipping through the Suez Canal, the world's arterial route for East-West trade. The 193-km long canal accounts for 12 percent of global trade, including 30 percent of all container movement, according to Egypt, which owns and operates it.

What happened?The Iran-backed Houthis, who control vast swathes of Yemen including its crucial western coast, have attacked commercial ships connected to Israel and Israeli businessmen since October, following the outbreak of the war in Gaza.

On December 9, the Houthis escalated their threat by announcing that they would target all ships heading towards or returning from Israeli ports, irrespective of their nationality. The group has demanded an end to the Israeli military offensive against Gaza.

The Houthis have so far attacked 13 commercial vessels, using drones and anti-ship missiles. The vessels have been targeted in Bab el-Mandeb, the strait that is the gateway to the Red Sea and is located between the Horn of Africa and the Gulf of Aden.

The Houthi threat particularly sparked concern on December 15, when the militants used anti-ship missiles against MSC PALATIUM III, a Liberian-flagged ship operated by the world's largest shipping carrier MSC.

Following the December 15 attack, MSC joined three of the world's other leading shipping companies -- CMA CGM, Hapag Lloyd, and AP Moller-Maersk -- to temporarily suspend its operations in the Red Sea. The four companies cumulatively account for 53 percent of global maritime trade, The Economist reported, citing industry estimates.

The company, in a statement, said it would be re-routing some of its services through the Cape of Good Hope. The trading route, that passes through the southern coastline of Africa, will delay shipments by 19 to 30 days, said Noam Raydan, senior fellow at the Washington Institute for Near East Policy.

“To protect the lives and safety of our seafarers, until the Red Sea passage is safe, our ships will not transit the Suez Canal Eastbound and Westbound," MSC said.

Maersk, the world's second largest shipping company with a 14.8 percent share in global trade, said on December 15 that it would be pausing its operations in the Red Sea. The announcement came a day after its vessel, Maersk Gibraltar, was attempted to be attacked by Houthi rebels.

“Following the near-miss incident involving Maersk Gibraltar yesterday and yet another attack on a container vessel today, we have instructed all Maersk vessels in the area bound to pass through the Bab al-Mandab Strait to pause their journey until further notice,” a company spokesperson told Moneycontrol.

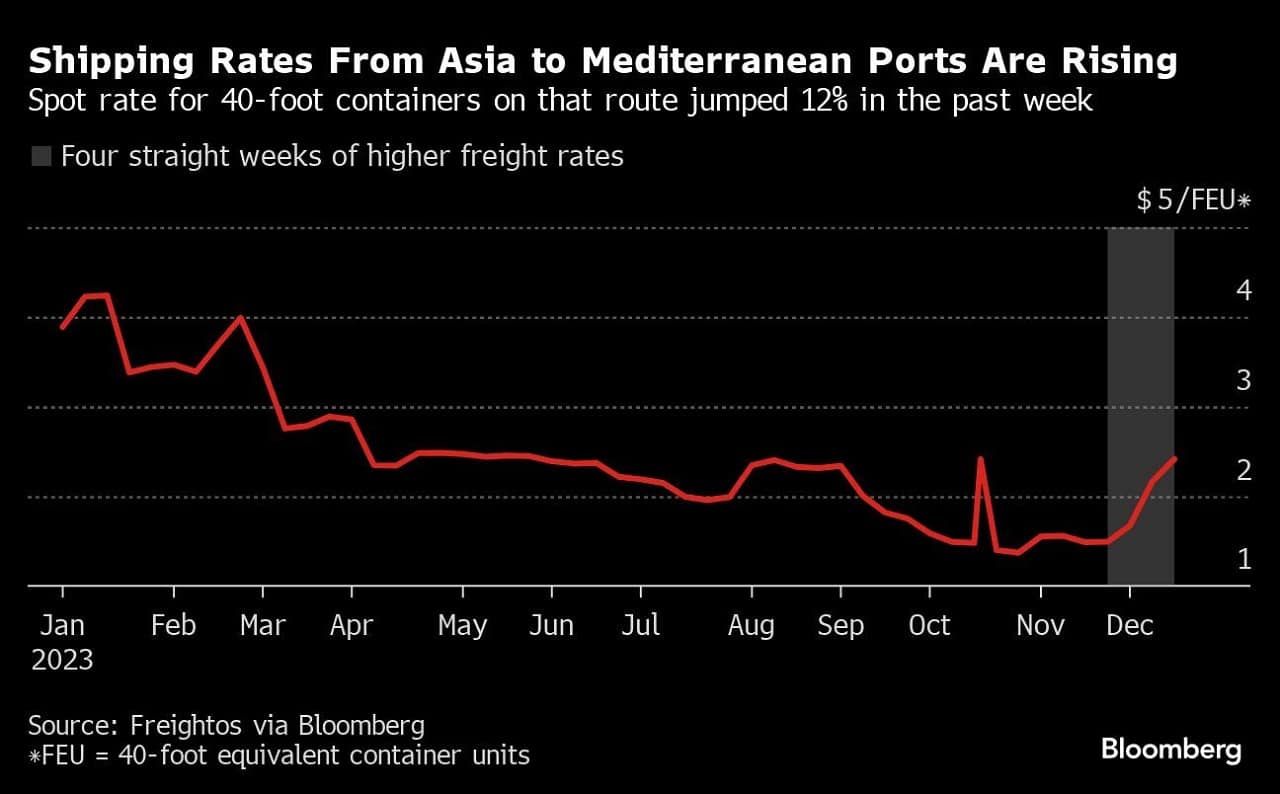

The crisis has been pushing up freight charges, with spot rates for 40-foot containers jumping by 12% over the past week (Source: Bloomberg)The importance of Suez Canal

The crisis has been pushing up freight charges, with spot rates for 40-foot containers jumping by 12% over the past week (Source: Bloomberg)The importance of Suez CanalThe significance of the Suez Canal was highlighted in March 2021, when the container ship Ever Given was stuck for six days. The 399.94 metre-long vessel obstructed the route, thereby halting all trading activities and leading to a global supply chain crisis.

The canal is one of the world's busiest waterways, with ships traversing through it to bring goods between Asia and Europe. "A total of 12 percent of the global trade volume flows through it annually," Egypt's State Information Service says in a note published on its website, adding that 30 percent of the global containers traverse through it.

A massive portion of Europe’s overall energy supplies, including oil and diesel fuel, come through that waterway, said John Stawpert, senior manager of environment and trade for the International Chamber of Shipping, which represents 80 percent of the world’s commercial fleet.

The canal is also key to the supply of food products like palm oil and grain, and anything else brought over on container ships, which are most of the world’s manufactured products.

How does it concern India?Suez Canal is used by India for maritime trade worth "around $200 billion", Pawan Kumar Agarwal, special secretary (logistics), had told CNBC TV-18 in 2021, when India was among the countries that had felt the pinch due to the blockage caused by the stranded Ever Given vessel.

The quantum of trade is expected to have gone up in the post-pandemic period. The stakes becoming higher for India was reflected in June this year when Egypt was ready to offer New Delhi a dedicated cluster in the industrial and logistics hub of the Suez Canal Economic Zone.

India's exports, via the Suez Canal, include food products, apparel, and electronics, among others to Europe, but its imports include the vital shipments of crude, analysts pointed out. "Since the crisis holds the potential to disrupt crude shipments from Russia, New Delhi is bound to be concerned," an independent researcher said.

Data from Kpler showed a 9 percent rise in India's monthly intake of Russian oil in November from the previous month to 1.73 million barrels per day (bpd). The shipments are presently routed through the Suez Canal, and a wider conflict in the region that disrupts maritime trade may compel India to look at alternatives, another analyst pointed out.

While India and Russia indicated in November that they would soon be using the Eastern Maritime Corridor -- connecting the Indian port city of Chennai with the Russian port of Vladivostok -- the route is yet to be turned operational.

The crisis in Red Sea is "definitely a point of concern" for India, said Sourish Ghosh, a Kolkata-based independent researcher. "There is a possibility that India may join other countries to safeguard the route from attacks. It may also use its Navy to sanitize the space but it is also a possibility that considering India's cordial relations with Iran, Houthis might spare India's interests in the region," he added.

International response so farThe US and the UK, which share naval ties with a number of Arab countries adjoining the Red Sea, have used their vessels to intercept Houthi drones. An American vessel shot down 14 suspected attack drones on December 16, whereas, one drone was struck down by a British warship based in the region.

US Defence Secretary Lloyd Austin, who has embarked on a visit to Middle East — covering Israel, Qatar, Kuwait and Bahrain — is expected to announce the formation of an expanded maritime protection force to protect commercial vehicles passing through the Bab al-Mandab Strait, news agencies reported.

The expanded force, to be provisionally titled as Operation Prosperity Guardian, will involve a number of Arab countries, the reports added.

"The Red Sea is critical to global trade and any escalation in this key shipping route will have impact on East-West Trade...the US Defence Secretary is likely to announce the formation of a new maritime protection task force to provide reassurance to commercial shipping companies that Houthi attacks will be prevented," said Sanket Joshi, Research Associate, Delhi Policy Group.

Saudi Arabia, which was at war with the Houthis from 2015 to earlier this year, has urged the US and its allies to exercise restraint in their response, Reuters reported, citing sources. Riyadh has been locked in negotiations with the Houthis in a bid to end the conflict in Yemen. The talks began in April, a month after China brokered a truce between Saudi and its regional rival, Iran.

"China also prioritises stability in the Middle East. Chinese Foreign Minister Wang Yi hosted the Deputy Foreign Ministers of Saudi Arabia and Iran for the first meeting of the China-Saudi Arabia-Iran trilateral joint committee on December 15. In light of the ongoing Houthi attacks on commercial ships in the Red Sea, this meeting may have a bearing on the situation," Joshi added.

Are oil prices likely to flare up?The global oil market initially shrugged off the escalation of the threat posed by Houthis in the Red Sea, but the jitters were felt over the weekend as crude prices climbed by nearly 1 percent.

On December 18, the jump in crude prices was sharper at 3 percent, as oil major BP announced temporary suspension of all transits through the waterbody.

Brent crude futures surged by $2.33, or 3.1 percent, to $78.88 per barrel by 11:20 a.m. ET (16:20 GMT), whereas, US West Texas Intermediate crude rose $2.27, or 3.2 percent, to $73.68. The jump in prices, however, also factored in lower exports from Russia.

"The bad weather in Russia has played a part in the stronger open this morning as has the Houthis attack on ships close to Yemen," Reuters quoted IG analyst Tony Sycamore as saying.

"BP's decision to halt shipping through the Red Sea may have crystallized concerns for the oil market," added Tim Evans, an independent oil analyst at Evans on Energy, while speaking to the news agency. "The re-routing of tankers does add cost and it does add transit time, so we are seeing... fewer barrels arriving at European refineries in the near term," he added.

"Deteriorating security for shipping lines in the Red Sea will have some short term impact on crude oil prices but we expect things to settle down soon and expect the crude oil prices to consolidate," Kranthi Bathini, Equity Strategist, Wealth Mill Securities, told Moneycontrol.

(With inputs from agencies)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.