Asia’s emerging-market currencies are proving attractive to investors willing to bet on local central banks keeping interest rates high and the fading strength of the dollar.

In the view of Brendan McKenna, an emerging market strategist at Wells Fargo & Co., the Indonesian rupiah, Philippine peso and Thai baht are among the best bets. Other experts point the fact that Asian central banks have enough firepower to defend their currencies. All monetary authorities in the region now have foreign-exchange reserves that can cover well over three months of imports.

“Asia can outperform the next few months of the year — a bit of a Santa rally,” said McKenna. “I like the currencies associated with some of the more hawkish central banks.”

More broadly, sentiment appears to be turning in favor of emerging markets. MSCI’s currency index for the asset class jumped 0.9% in the week, the best performance since July, as a cooling US labor market reinforced expectations that the Federal Reserve is done hiking rates. A Bloomberg gauge of Asian currencies are headed for the biggest three-day rally since July, with the South Korean won and the Indonesian Rupiah gaining more than 1% in early trading Monday.

It reflects a sharp rebound after what’s been a bruising year for investors. For Asia, in particular, some metrics are reflecting early optimism. In the options market, traders are least bearish on currencies in countries including China, India, Taiwan and South Korea, according to Bloomberg-compiled data on the three-month risk reversal.

They’re also relatively calmer. The yuan, Indian rupee and Malaysian ringgit are among the least volatile exchange rates in the asset class over the last 30 days.

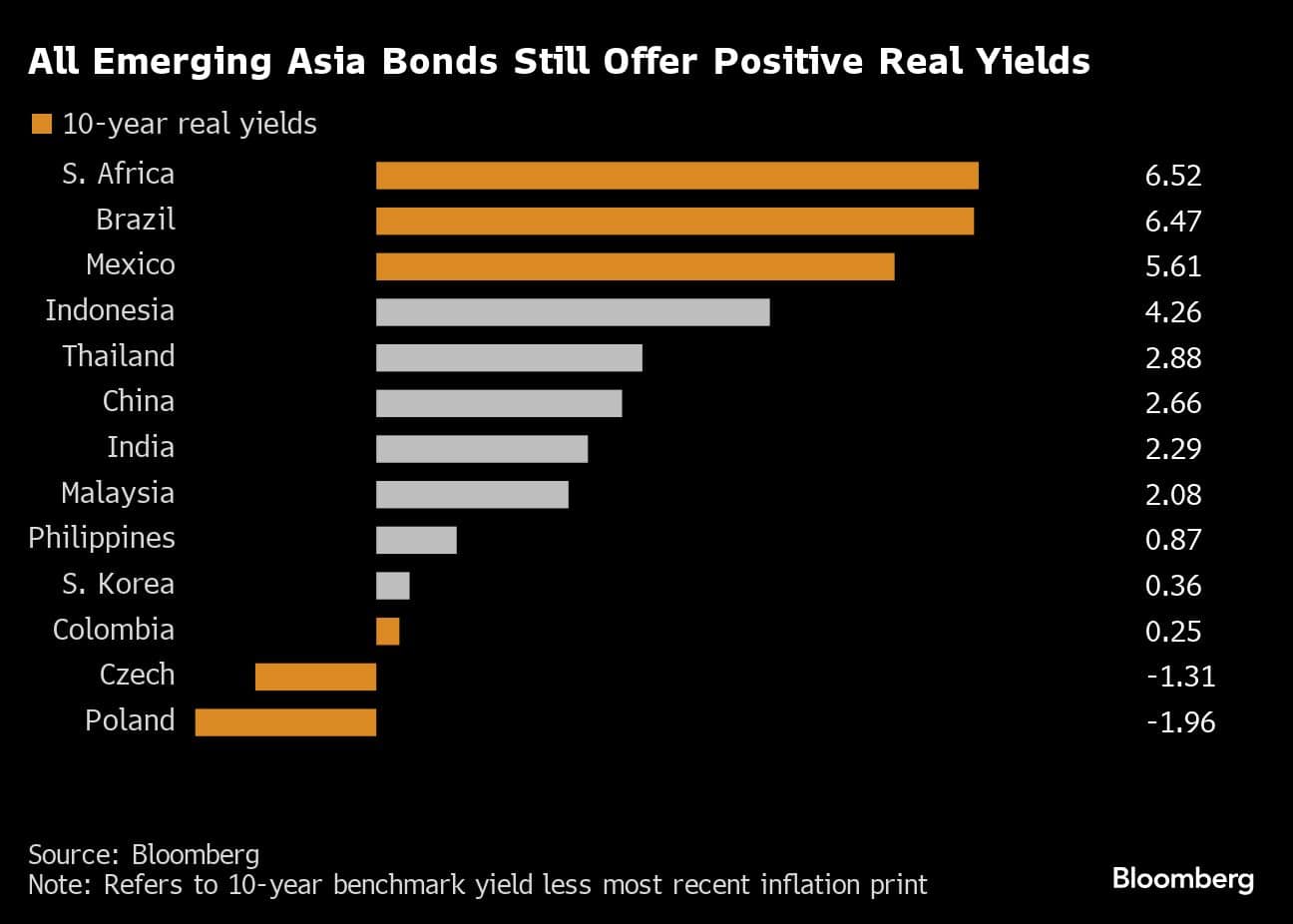

Some analysts say that Asian currencies will benefit as local central banks are still committed to tightening to prevent their yield gap with the US from widening. Indonesia last month raised its rate to bolster the rupiah, while the Philippines flagged it may hike again to curb price pressures.

“There’s enough exchange rate flexibility, policy market buffers, fundamentals are nowhere nearly as bad and short term debts are better,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management in Singapore. “So, the current underlying growth dynamism does not come close” to the vulnerabilities of the Asian Financial Crisis crisis, he said.

In contrast, many investors, like McKenna, the Wells Fargo strategist, say they’re being cautious about investing in Latin American currencies, especially as central banks in Brazil, Chile continue to cut rates.

That doesn’t bode well for currencies in the region, said Phoenix Kalen, head of emerging markets research at Societe Generale SA in London.

What to Watch

Inflation data is due from Czech Republic, Brazil, Chile, Colombia, Mexico, Taiwan, Thailand, Philippines and China. Investors will look for clues that monetary authorities are doing enough to curb price pressures following a warning from Singapore’s central bank that a surge in global food and energy prices may lead to more hikes or keep rates elevated

Producer price, trade and loan data from China will provide more insight into the health of the world’s second-biggest economy

Indonesia’s growth is expected to slow in the third quarter, while investors will get an update on its foreign reserves. Expansion in the Philippines is expected to have accelerated

Bloomberg Intelligence expects Peru’s central bank to cut its reference rate for a third straight time

Poland is expected to lower its key rate by another 25 basis points, while Romania’s central bank should keep rates steady

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.