Chinese lenders followed the central bank by keeping their benchmark lending rates unchanged Monday, with analysts expecting possible reductions in coming months to support the economic recovery.

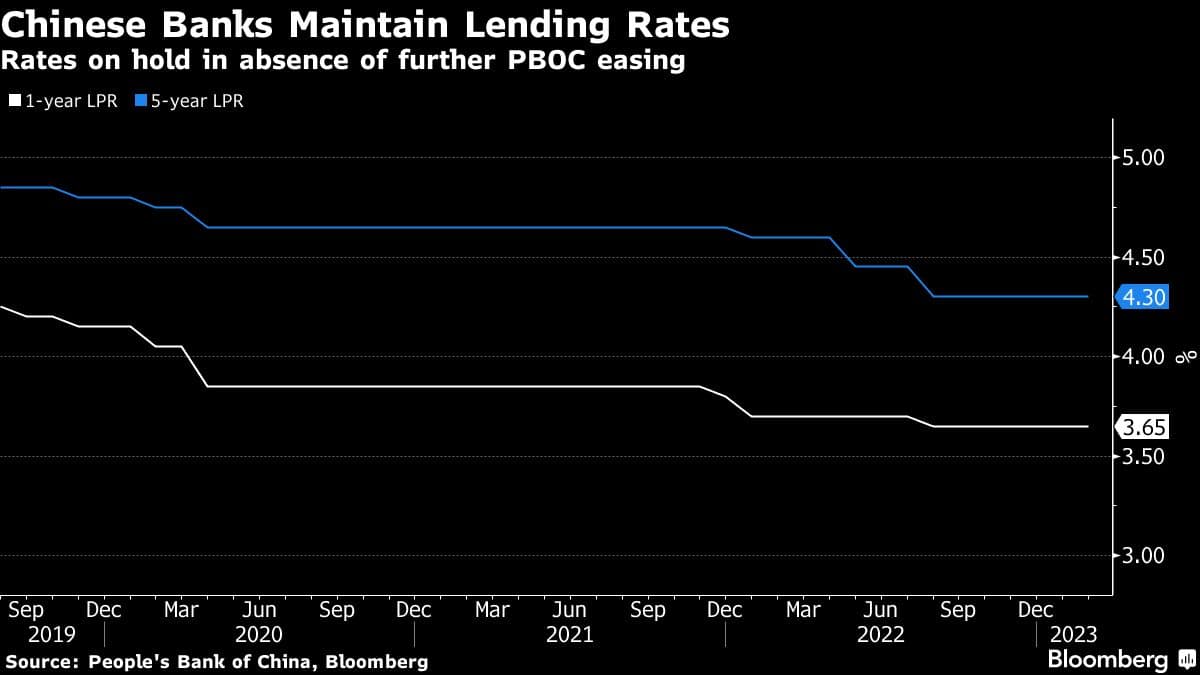

The one-year loan prime rate was held at 3.65% for a sixth consecutive month, in line with the forecasts from all 13 economists surveyed by Bloomberg. The five-year rate, a reference for mortgages, was also kept at 4.3%, as expected, data from the People’s Bank of China showed.

The loan rates are based on one of the PBOC’s key interest rates, which was kept unchanged last week amid signs of a recovery in corporate loan demand. The central bank is assessing the economy’s need for further stimulus as latest indicators point to a faster-than-expected recovery following the scrapping of Covid restrictions.

Even so, the PBOC could still cut its key rates and drive bank loan rates lower in coming months, according to several analysts, given challenges to the growth outlook from a property downturn, weakening exports and fragile consumer confidence.

“There are decent signs of recovery in the service sector, which has been hammered by the pandemic, but household confidence remains weak due to the overhang of Covid-related income shocks, and the property recovery is still shaky,” said Michelle Lam, Greater China economist at Societe Generale SA.

The LPRs are based on the interest rates that 18 banks offer their best customers and are published by the PBOC monthly. They are quoted as a spread over the rate on the medium-term lending facility — the PBOC’s one-year loans — which has been kept unchanged since August.

What Bloomberg Economics Says ...

We still think the recovery will require an extra monetary boost, though, and see rates heading down in the next month or so — all the more so if activity data in the first quarter disappoint.

... We expect a 10-bp cut in the MLF rate in March or April. That should guide LPR rates lower too.

— Eric Zhu, economist

The uneven recovery is evident in the latest loan data. Companies’ borrowing surged in January after the PBOC urged banks to “front-load” credit extension and help support the economy. Consumers, however, stayed cautious and rushed to make early repayment of their mortgages.

Stronger demand for loans partly led to a tightening in liquidity conditions and a rise in interbank borrowing rates in recent weeks. The central bank stepped in last week to add more cash into the interbank market to ease the cash shortage.

Cuts to the PBOC’s policy rates are “still possible if optimism fades and growth begins to fizzle out” in a few months, said Winson Phoon, head of fixed income research at Maybank Securities Pte Ltd in Singapore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.