Effective July 1, 2023, the Indian government has raised the tax collection at source (TCS) rate on foreign remittances under the Liberalised Remittance Scheme (LRS) from 5 percent to 20 percent. The LRS allows resident Indians to transfer funds abroad without restrictions, up to a specified limit. However, recent developments, including the removal of an exemption for international credit card usage and clarifications regarding certain transactions, have brought about significant changes in the landscape of foreign remittances and their taxation. Let's delve deeper into the details and implications of these updates.

The genesis

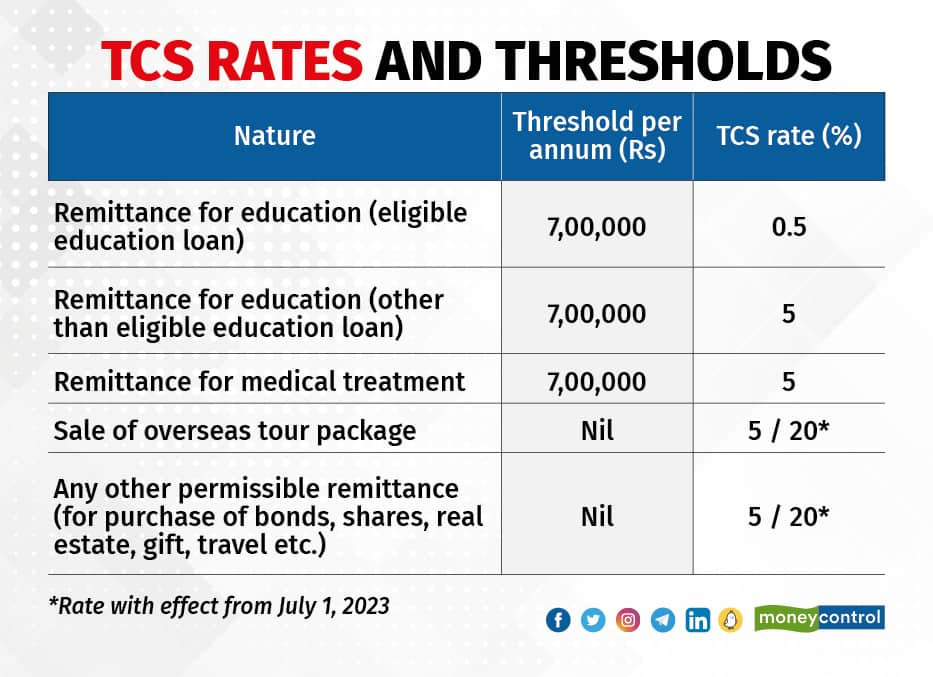

With a view to widen and deepen the tax base, Section 206C(1G) of the Income-tax Act, 1961 (the Act) was introduced effective from October 1, 2020. This provides for collecting TCS on foreign remittances through the LRS and on the sale of overseas tour packages. While there is a threshold of Rs 7 lakh per annum, over which TCS would apply for foreign remittances, there is no such threshold for sale on overseas tour program packages.

To give some perspective, the LRS scheme allows resident Indians to remit funds outside India without any restrictions or obtaining prior approval of the Reserve Bank of India (RBI). All resident individuals (including minors) can remit up to US$250,000 per financial year under LRS for any permissible current or capital account transaction. For remittance exceeding the specified limit, prior approval of RBI is required. As per Rule 5 of Foreign Exchange Management (Current Account Transactions) Rules, 2000, individuals can avail foreign exchange for the purposes mentioned in Schedule III of the said Rules. This covers private visits to any country (except Nepal and Bhutan), gifts or donations, going abroad for employment, emigration, maintenance of close relatives abroad, travel for business, expenses in connection with medical treatment abroad, studies abroad and any other current account transaction. This excludes payment made from funds held in Resident Foreign Currency Account.

Also read: How tax on foreign tour spends on credit cards will affect your holidays

Recent development

The Government of India, vide its notification dated 16 May 2023, has omitted Rule 7 of the FEM (CAT) Rules, 2000. The aforesaid Rule 7 exempted use of international credit cards from LRS for payments by a person towards meeting expenses while such person is abroad. Thus, while payments through credit cards from India or payments through debit cards were covered under LRS, if international credit cards were used outside India, an exemption was available earlier under Rule 7. Thus, credit card transactions too have been brought on the same footing as debit card transactions. The rationale behind the same as explained by the FAQs issued by the Finance Ministry was to bring spending overseas through international credit cards under the LRS and to curb individuals from exceeding their LRS limit.

The rates and threshold for TCS (applicable from July 1, 2023) vary according to the amount per financial year and the purpose of remittances. <see table>

Impact on credit card spend

As the usage of credit cards would not fall under remittance for education, medical treatment or sale of overseas tour packages, it would fall under ‘any other remittance’. It would therefore be subject to TCS at the rate of 20 percent with effect from July 1, 2023.

However, relaxation has been extended to business visits of employees and it has been clarified that LRS would not cover expenses incurred on such trips and they would be deemed as current account transactions, subject to verifying the bona fide of the transaction.

Further, due to concerns raised from various quarters, it has been clarified by the Ministry of Finance vide its clarification dated May 19, 2023, that any payments by an individual using their debit or credit cards up to Rs 7 lakh per financial year would be outside the purview of LRS.

It has also been clarified in the FAQs that TCS on remittance for travel and incidental expenses related to education and medical treatment, would be same as that applicable for education and medical treatment itself. This would be a relief to persons remitting for education or medical treatment abroad.

Thus, the new changes could impact high networth individuals making investments overseas and those making payments for the purchase of overseas tour packages. It may be noted that TCS on credit cards could be adjusted against the taxes payable.

Also read: TCS doesn’t apply only to your foreign currency spending, domestic purchases too can bear its brunt

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.