It’s the holiday season and many Indians are packing their bags and heading off for holidays abroad. However, they may need to relook their travel budget soon. A recent amendment to the Foreign Exchange Management rules (FEM (CAT) Rules, 2000) is all set to play spoilsport, particularly if you are using your credit cards for overseas spends.

All international transactions by individuals using credit cards when outside India have been brought under the RBI’s Liberalized Remittance Scheme (LRS), which permits Indian residents to send up to $250,000 in a financial year abroad, without prior approval from the central bank. This has come into effect from May 16, 2023, as per a notification by the Ministry of Finance in the Gazette of India.

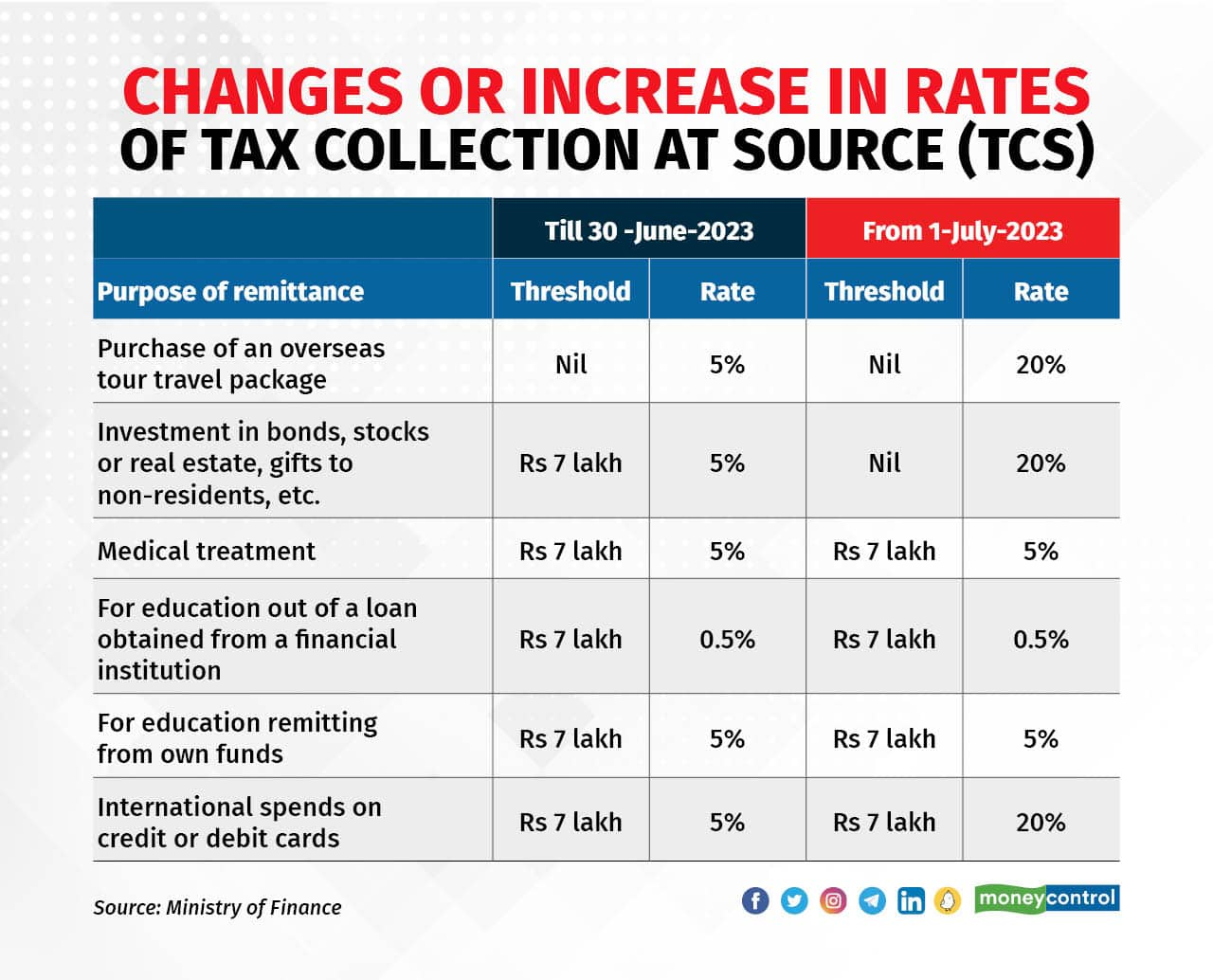

And by extension, such spends beyond a transaction value of Rs 7 lakh will now come under 5 percent tax collected at source (TCS). This rate is applicable only up to June 30, 2023. From July 1, 2023, these credit card transactions will attract a higher TCS rate of 20 percent. The Ministry of Finance in a release last night clarified that international spends of up to Rs 7 lakh by individuals on credit cards or debit cards will continue to be exempt from TCS even after June 30, 2023.

On the purchase of overseas tour packages, currently, a TCS of 5 percent is levied. From July 1, 2023, this will be hiked to 20 percent. Gautum Nayak, Partner, CNK & Associates LLP says that TCS is applicable whether the payment for the tour package is made in Indian rupees or not.

According to Sumanta Mandal, Founder TechnoFino if you make a holiday booking via an Indian travel agency, the latter will pass on the TCS-related extra cash outflow to the customer. In simple words, your travel agent will pay it on your behalf but will bill you for the TCS in your travel bill. Your PAN will be mentioned along with the booking and you will be able to claim TCS credit at the time of filing your tax returns.

So those planning summer trips to Europe will have to rejig their travel budgets. While you can always claim a refund on this TCS amount at the time of filing returns, you will have to shell out higher upfront costs initially.

As regards international transactions via credit cards, while one is in India, these are already covered under the LRS according to Nayak.

Simply put, the latest amendment means that you will have to set aside an additional 20 percent of your intended foreign remittance amount – meant to pay for travel and shopping expenses abroad, for instance – from July 1, 2023.

Unlike TDS (tax deducted at source) which gets levied on income (salary, interest income etc.), TCS gets deducted on certain expenses – with the tax authority intending to keep track of them. The TCS deducted can be claimed only at the time of filing your income tax returns. But until then, this money is blocked.

Taking the example of international travel, Parijat Garg, a digital lending consultant says, “Assuming a spend of Rs 1 lakh per passenger, for a typical family of 4, this may mean blocking nearly Rs 80,000 (Rs 20,000 per person) for 9-12 months. This would put more budgetary pressure on middle class families aspiring to travel abroad for holidays.”

Credit cards in the LRS net to track spendsMost tax consultants feel that the hike in TCS rate (introduced in Budget 2023) is a harsh move. “LRS is applicable to individuals only. Salaried employees already pay TDS. Business income and professional income is also subject to TDS. Then in addition, one has to pay TCS at 20 percent,” says Neeraj Agarwala, Director, Nangia Andersen India. He feels, if the tax authorities wanted to monitor transactions then 1 percent TCS would have been sufficient.

When the Finance Bill 2023 was passed, there was confusion on whether international transactions done via credit card transactions would attract TCS or not. “The amendment to the FEMA rules has eliminated this confusion. TCS will now be levied on all international transactions using credit cards just as it is for transactions through debit cards and forex cards, bank transfers or any other channel,” says Mandal.

Some industry players feel inclusion of credit cards under LRS was long overdue. Sudarshan Motwani, Founder & CEO, BookMyForex.com says, "Debit and credit cards are becoming common methods for payments to merchants, booking of international hotels and holidays, etc., and hence control over LRS without the inclusion of credit cards was not possible.”

How to claim TCSTo claim TCS, you will need a TCS certificate provided by the collector or deductor at the time of deduction. This certificate can be used during your income tax return filing process to claim the TCS credit. While filing income tax returns, provide the TCS details in the appropriate section of the tax return form. This typically includes the TCS amount, the TCS certificate number, and other relevant information.

The taxpayer can claim the TCS credit against their total tax liability, that is, tax payable. The TCS credit reduces the overall tax liability or can be refunded if the TCS amount exceeds the tax liability.

Remember, the deductor is responsible for issuing TCS certificates, to the taxpayer. These certificates contain details of the TCS amount collected. Once you receive the certificate, verify the details carefully to ensure the accuracy of the TCS amount reported. Any discrepancies should be resolved with the deductor. If there are discrepancies or mismatches, it may require additional effort to rectify the details and claim the correct TCS credit.

To ensure a smoother process of adjusting TCS while filing income tax returns, it is advisable to maintain clear communication with the deductor, keep records of TCS certificates and other relevant documents, and seek professional advice if needed. Being proactive in resolving any discrepancies or issues can help streamline the process of getting a refund

The operational process of how this TCS will be charged on credit card spends is still unclear says Gupta. He further points out that cancellations, refunds, cashback in a forex transaction may lead to more tax-related disputes, unless managed with deft use of technology. According to Agarwala, the TCS could possibly reflect in your credit card statement as an additional charge on your international spends (which are shown under a separate head from domestic credit card spends).

Limited options to save on TCS outgoAccording to Garg, with all banking transactions, whether done through a credit card or debit card or any other means getting covered under LRS, one cannot seemingly avoid the TCS impact.

While the government’s objective is to improve tax compliance, some tax experts are concerned that the stringent rules and higher rate could, in fact, backfire. “The new rule may encourage people to circumvent the rules by asking their friends and family members living abroad to make payments on their behalf and then be reimbursed by transfers to their Indian bank accounts,” says an expert who spoke on the condition of anonymity.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.