A board at the office of D2C startup Bombay Shaving Company declares its current share price: Rs 30,000 apiece. It is designed to look like a barometer that tops at Rs 1.5 lakh per share — that is the goal for 2025.

“We are now at double the price where our last round was at… The board is for our ESOPs (employee stock option plan). Employees come in, see the board, do the math… know what’s in it for them. Wealth creation is important across the board,” says Shantanu Deshpande, founder and chief executive officer of the startup, which boasts of consumer majors Reckitt and Colgate-Palmolive on its cap table.

Until a few years ago, ESOPs were not as attractive a proposition for startup employees, unless it was a blue-blooded company you were talking about, like Flipkart. Startup employees were not quite sure if the options would turn into a real shareholding and then into money.

But a string of successful initial public offerings (IPOs) such as Zomato, Paytm, Delhivery and frequent ESOP liquidity events by much smaller startups has changed the narrative.

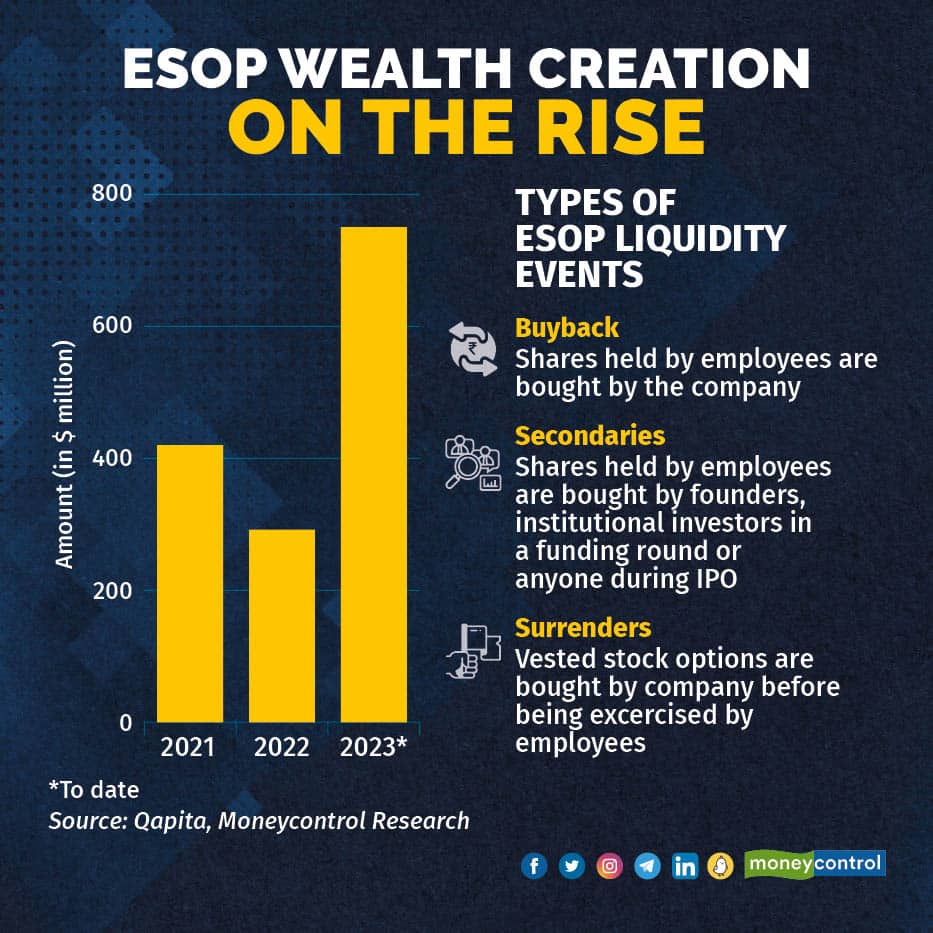

ESOP cashouts have led to $1.46 billion of wealth in the hands of startup employees since the beginning of 2021, according to data from Qapita.

Wealth multiplier

“When you join a startup as an employee, you join for a significant multiplier of wealth and that multiplier is the ESOP. The salary is at best on par with the market, but never really a differentiator. The challenge of course is that there is always an element of risk with ESOPs,” says Harshil Mathur, founder and CEO of fintech unicorn Razorpay.

“We have seen people at our company create life-changing wealth through ESOPs. They would have never been able to do that with salary increases even over a decade,” Mathur added.

Razorpay has done four ESOP buybacks in the last 10 years of its existence, with the latest taking place last year, when it bought back $75 million worth of shares from employees.

Mathur says that every time the company raises a new round of funding, it negotiates a secondary share sale by employees with incoming investors.

At the time of the startup funding boom of 2021-22, there were stories galore of how employees were negotiating more ESOPs and less cash payments as part of their salary negotiations with tech startups. To be sure, a large part of that enthusiasm to maximise the ESOP component of pay packages has been watered down due to the funding winter, which has put a lid on the rocketing valuations of private tech companies.

However, industry insiders say that as startups cut their cash burn amid the funding winter, the role of ESOPs as a significant attraction of the overall compensation will only increase.

Expect liquidity after a startup achieves scale

Another thing that is bound to change — or correct course to go back to the old normal — is that ESOP liquidity events will only happen after startups reach a certain scale of operations and funding.

During the funding boom, there were instances of startups that had just raised Series A or B rounds and operational for just 1-2 years conducting ESOP cashouts. For instance, fintech startup Grip Invest had announced a buyback programme in early 2022 just after raising its Series A funding of about $3 million.

“Those times are not coming back soon. Investors were agreeing to such things because of the FOMO factor during the funding boom. There has to be at least 2-3 years of value creation and validation by a startup before a liquidity event,” says the managing partner of a venture capital firm.

The silver lining is that because of such cases, startup employees have begun to trust ESOPs of even smaller companies, although, expectedly, the lion’s share of cashouts still happen from the giants in the ecosystem.

Almost half of the $1.46 billion of liquidity events in the last three years took place because of a mega $700 million cashout by Flipkart. This was done as fintech unicorn PhonePe was hived off from the e-commerce behemoth. As such, Flipkart ESOP holders were paid the value of PhonePe in cash. For every Flipkart ESOP held by an employee of the company, $43.67 (Rs 3,615) was given out as compensation for the separation of the two companies.

Adverse tax regime

One important thing to note is that these ESOP cashouts have been happening despite a taxation regime that is perceived by the industry as being adverse. While any shareholder in a listed company is taxed on gains after the shares are sold, ESOPs are taxed when they are availed by employees.

ESOP grants are typically structured such that only a part vests after every year of employment. For example, if A is granted 100 ESOPs as part of her pay package, typically 25 will get vested after the first year, 25 after the second year of employment and so on.

As the 25 ESOPs get vested, employees get the choice of converting the options into shares of the company at a certain exercise price or strike price, which is kept below the actual share price of the company.

Now, according to the taxation regime, a levy has to be paid on the difference between the exercise price and the actual share price of the company. This deters many employees from exercising their ESOPs as the tax could turn out to be very large.

“In advanced regimes like the US and Singapore, employees pay a tax only when they sell the shares. This interim taxation in India was created when there were not many startups like today. It was fit for the late 90s or 2000s, when most of the companies giving ESOPs were listed as there was immediate liquidity. But, in cases of private startups, you don’t know when there will be a liquidity event or even if there will be one,” says Suraj Malik, a financial advisor to family offices.

While the government has made a provision to grant a 48-month extension on the payment of this tax, industry insiders say that very few startups actually got any relief.

“You need to be recognised as a startup by DPIIT and then by an inter-ministerial board to get relief. There are only 1,200 startups that have those certifications against a backdrop of 99,000 startups in the country. My firm itself sees 700 startups every month in our dealflow,” says the VC partner quoted earlier.

“The tax on exercise is sometimes higher than a person’s rent or even salary. How is that feasible when you don’t even know when the cashout will happen,” he wonders.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.