Pharmaceutical major Sun Pharmaceutical Industries is slated to release its April-June earnings on August 3, but analysts don't expect to see any fireworks. The company is expected to report muted growth for the quarter gone by, primarily due to weak numbers from its arm Taro Pharma, muted growth in US sales due to restrictions at the Mohali and Halol sites, higher research and development spends and remediation charges.

Last week, Taro Pharma posted a modest 1.4 percent rise in revenue at $159 million. However, its net profit declined by 29 percent on year to $10 million. Increased competition and lack of meaningful launches weighed on Taro Pharma's quarterly numbers.

On the other hand, Sun Pharma is also facing challenges at its Halol plant in Gujarat, as it continues to bear the costs of remediation following an import alert issued by the US Food and Drug Administration in December of the previous year.

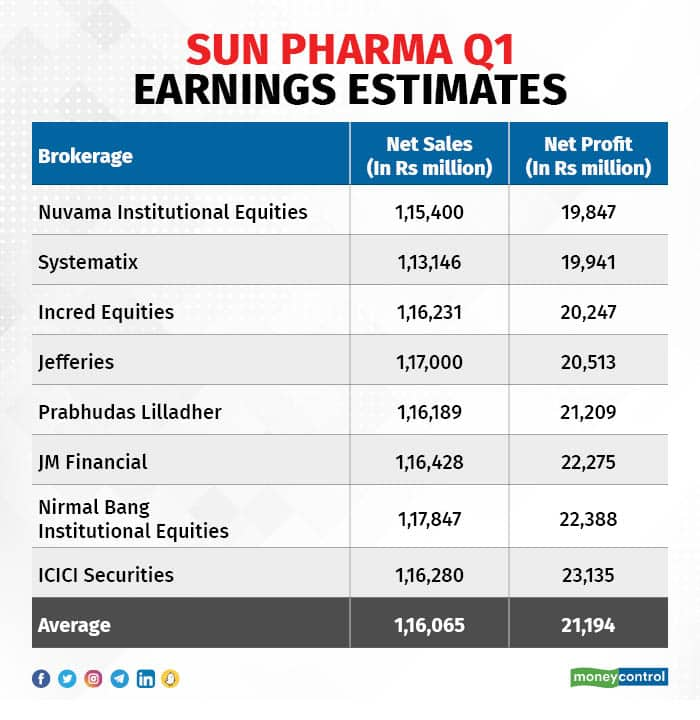

A poll of brokerages collated by Moneycontrol pegged the drugmaker's net profit for the quarter at Rs 2,1,19.4 crore, reflecting a marginal 2.8 growth from Rs 2,061 crore in the same period of the preceding fiscal.

An estimate of brokerages also see revenue for the drugmaker at Rs 11,606.5 crore, a near 8 percent increase from Rs 10,762 crore clocked in the base quarter.

Among the brokerages polled by Moneycontrol, Nuvama Institutional Equities had the lowest net profit projections for Sun Pharma, while ICICI Securities had the highest.

Nuvama Institutional Equities also expects domestic formulations growth to remain subdued in the first quarter of FY24 due to NPPA (National Pharmaceutical Pricing Authority) price hike impact, patent expiry of two big products licensed from Merck and a weak seasonality for acute drugs.

In the US market however, most brokerages predict a ramp-up in specialty products like Ilumya and Winlevi and contribution from the generic of Revlimid to limit the impact of restrictions at the Halol and Mohali plants.

"Nonetheless, higher R&D expenses and challenges in the Mohali unit may keep margins in check for Sun Pharma," brokerage firm JM Financial stated in its report. On that front, Nuvama forecasted EBITDA (Earnings before interest, taxes, depreciation, and amortization) margin to come around 24 percent, an on-year contraction of 100 basis points. The firm also attributed the consolidation cost of Concert Pharmaceuticals and cost inflation as factors behind the pressure on margins.

Aside from the earnings, investors will also remain focused on finding out the progress made at resolving regulatory challenges at Sun Pharma's Halol and Mohali units, along with an outlook on overheads and margin for FY24.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.