Axis Bank is expected to report a 42.7 percent rise profit over the last year when the country's fourth-largest private sector lender reports its Q1FY24 numbers after market hours on July 26, according to a poll of three brokerages conducted by Moneycontrol.

This will be Axis Bank's first full quarterly report since its integration with Citigroup's consumer and non-banking finance businesses in India. In March, Axis Bank completed a deal with Citigroup that marked the US lender's exit from its credit card and retail businesses in India.

Prabhudas Lilladher

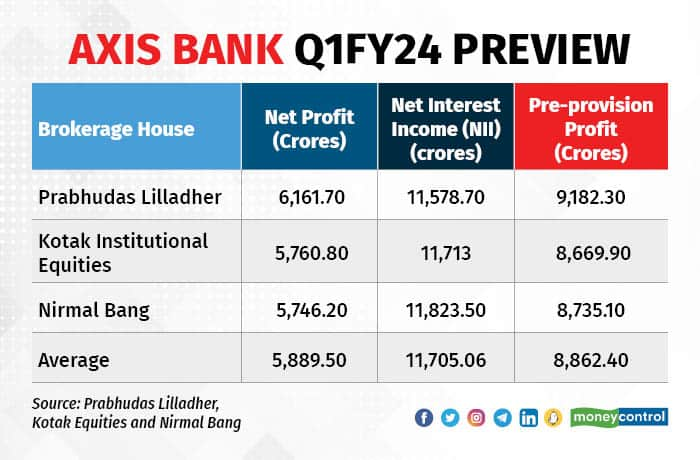

Prabhudas Lilladher expects Axis Bank to report a net profit of Rs 6,161.7 crore, up 49.4 percent year-on-year (down 8.9 percent quarter-on-quarter). Net Interest Income (NII) is expected to increase by 23.4 percent Y-o-Y (down 1.4 percent Q-o-Q) to Rs 11,578.7 crore, according to the brokerage firm. Pre-Provision Operating Profit (PPOP) is likely to rise by 56 percent Y-o-Y (up 0.2 percent Q-o-Q) to Rs 9,182.3 crore.

The brokerage house further stated that, "Loan growth might come in at 1.5 percent. Decline in NIM to be lower at 3 bps QoQ to 3.99 percent, compared to 8 bps for banks as a whole, as the preceding quarter had seen Citi integration impact which had depressed NIM."

Axis Bank Q1FY24 Preview

Kotak Institutional Equities

Brokerage firm Kotak Institutional Equities expects Axis Bank to report a net profit of Rs 5,760.8 crore, up 39.6 percent year-on-year (down 7.4 percent Q-o-Q). Net Interest Income (NII) is expected to increase by 24.8 percent Y-o-Y (down 0.2 percent Q-o-Q) to Rs 11,713 crore, according to the brokerage firm. Pre-Provision Operating Profit (PPOP) is likely to rise by 47.3 percent Y-o-Y (up 2.1 percent Q-o-Q) to Rs 8,669.9 crore.

Also Read: ICICI Bank's Q1 numbers drive stock to all-time highs; analysts weigh in

On the results expectations, Kotak Institutional Equities stated that “1QFY24 will have the full impact of Citi (acquired in March 2023) and hence, it is still a quarter that is not fully comparable. The sharp swing in profits (as compared to 4QFY23) is on account of no large one-offs but the bank has indicated that the operating expenses would be higher for integration. We are building a loan growth of ~22 percent yoy (marginally higher qoq). We expect NIM to decline by ~20 bps qoq led by higher cost of deposits”.

The brokerage house further stated, “We expect slippages of ~Rs 40 bn (~2% of loans) mostly led by small-ticket loans. Trends on slippages and overall asset quality should not be too worrisome and broadly stable. We should expect the bank to make higher provisions for expenses pertaining to the merger as well. Citi integration, near-term growth trends and progress of NIM would be the key discussion areas for the quarter.”

Also Read: Hold Kotak Mahindra Bank; target of Rs 2000: Emkay Global Financial

Nirmal Bang

Nirmal Bang expects Axis Bank to report a net profit of Rs. 5,746.2 crore, up 39.3 percent year-on-year. Net Interest Income (NII) is expected to increase by 26 percent Y-o-Y (up 0.7 percent Q-o-Q) to Rs 11,823.5 crore, according to the brokerage firm. Pre-Provision Operating Profit (PPOP) is likely to rise by 48.4 percent Y-o-Y (down 4.7 percent Q-o-Q) to Rs 8,735.1 crore.

Asset quality

Axis Bank's gross non-performing assets (NPAs) — or bad loans — as a percentage of total loans are estimated to be in the range of 1.9-2.1 per cent for the June quarter as against 2.02 per cent for the March quarter. The analysts peg the lender's net NPAs to remain unchanged on a quarter-on-quarter basis, at 0.39 per cent.

Axis Bank's performance for the quarter ended March 31, 2023

For the quarter ended March 31, 2023, Axis Bank reported a net loss of Rs 5,728.4 crore owing to an exceptional loss of Rs 12,489.8 crore. Excluding the exceptional loss, the lender registered a net profit of Rs 6,625 crore for the three-month period. Its NII increased 33.1 per cent on a year-on-year basis to Rs 11,742.2 crore, according to a regulatory filing.

Brokerage Views

Brokerage house LKP Securities is bullish on Axis Bank and has given a target price of Rs 1,032 for Axis Bank in a report dated May 1, 2023. Brokerage house KRChoksey has also assigned a 'buy' rating to the stock with a target price of Rs 1,160 in a report dated April 29. Meanwhile, Prabhudas Lilladher has given a target price of Rs 1,140 for the banking stock.

Stock Performance

Axis Bank has given a return of 7.31 percent over the last six months, whereas the Bank Nifty benchmark index has risen by 10.20 percent over the same duration.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.