These multi-bagger stocks held by mutual funds rose by up to 20 times from March 2020: Do you own any of these?

Many of these stocks are microcaps and fund managers managed to identify them early

1/12

Last week, BSE Sensex crossed the 60,000 mark, a remarkable milestone in the Indian equity markets. Over the last 18 months, the equity market has zoomed ahead despite multiple headwinds. The Sensex gained 130 percent during the period. Equity mutual funds registered up to 350 percent returns during the period. Here is the list of multi-bagger stocks held by mutual funds. These rose up to 20 times from March 2020 lows. Most of them were tiny and microcap stocks. Fund managers identified them near their lows and are now rewarded.

2/12

Balaji Amines, belongs to chemical sector, has been part of the Nifty Smallcap 250 index and Nifty 500 index. Apart from four passive funds, the Quant Active Fund too hold this stock in its portfolio. Quant Active added this stock just two months before.

3/12

Belonging to Software, Stocks of Tanla Platforms were held by four index schemes and BOI AXA Flexi Cap.

4/12

Schemes that hold the stock of CG Power and Industrial Solutions include Navi Long Term Advantage (since Dec 2020), HDFC Flexi Cap (more than three years), IDFC Tax Advt (more than three years) Axis Growth Opp (over the last six months).

5/12

Schemes like IDFC Core Equity, ICICI Pru Technology and IDFC Emerging Businesses have held the stock of Mastek over the last one year in their portfolio.

6/12

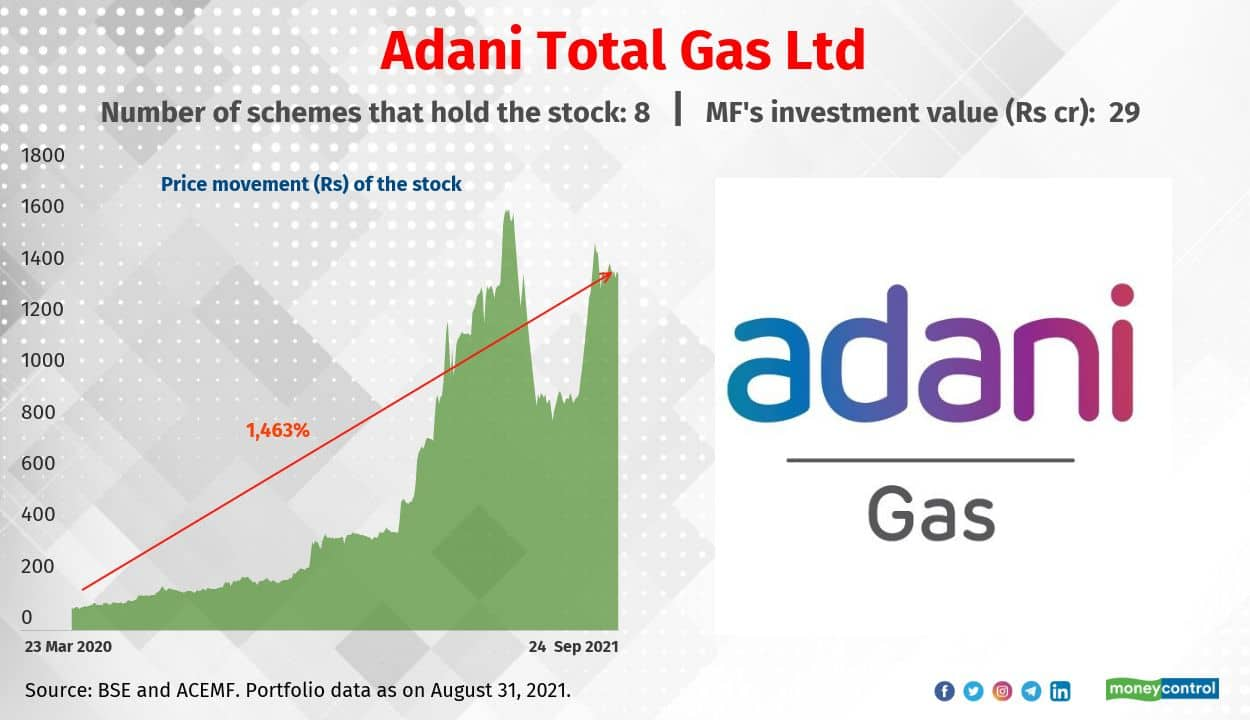

Eight ETF/index funds including ICICI Pru S&P BSE 500 ETF, Motilal Oswal Midcap 100 ETF, Nippon India ETF Nifty Midcap 150 held the stock of Adani Total Gas in their portfolio.

7/12

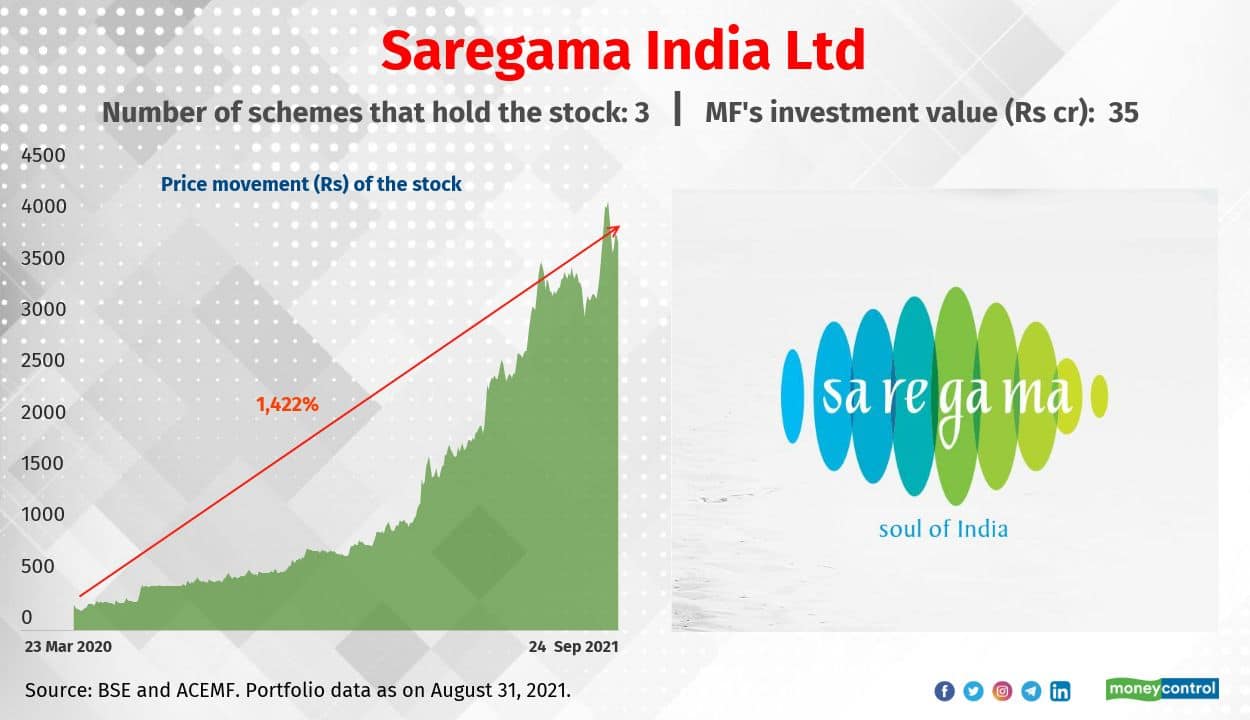

This media stock has been held by Tata Small Cap (over the last two years), BOI AXA Tax Advantage and Union Small Cap (over the last five months).

8/12

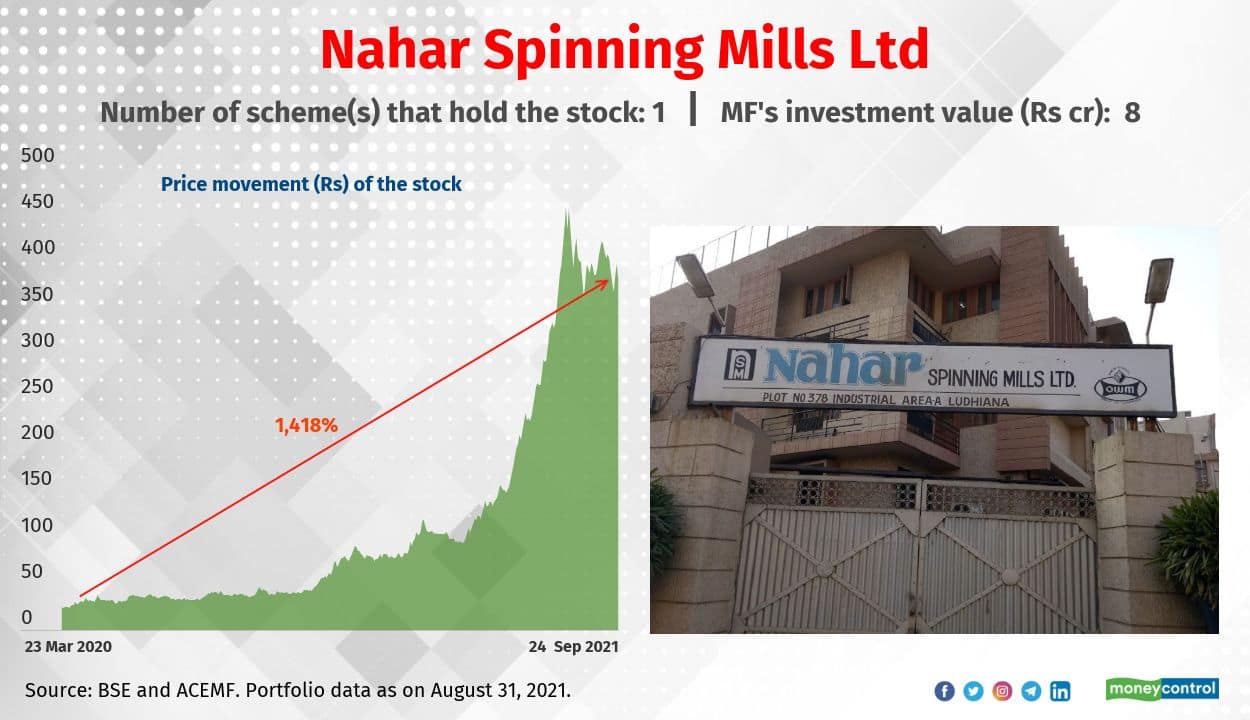

Quant Small Cap held this textiles stock over the last three months.

9/12

Intellect Design Arena: Eight schemes, including four passive funds held this stock. Nippon India Value and Nippon India Small Cap held the stock for more than three years.

10/12

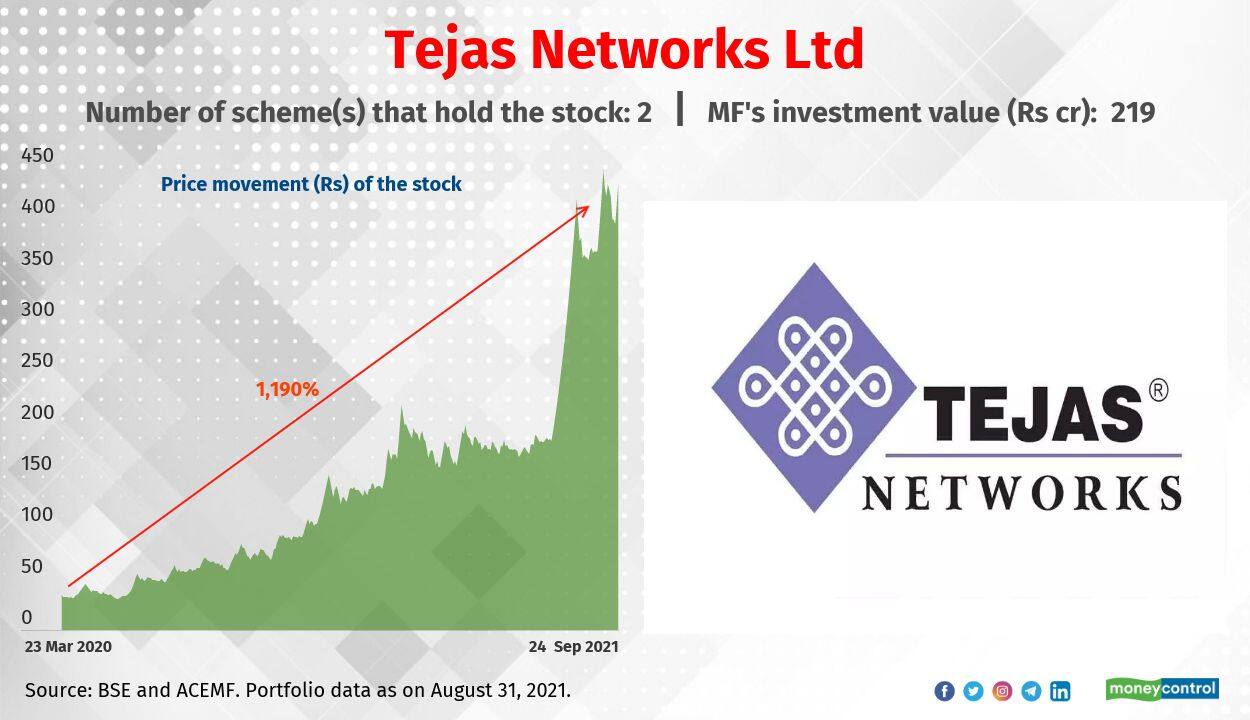

Tejas Networks: Nippon India Small Cap (over the last three years) and Edelweiss Small Cap (over the last one year) held the stock of the telecom company.

11/12

ICICI Pru Commodities Fund held this Ferrous Metal stock from June 2020.

12/12

Schemes that held high exposure to the stock of Adani Enterprises include the UTI Nifty200 Momentum 30 Index Fund and all the Nifty Next 50 funds and Sensex Next 50 funds. The other stocks held by mutual funds that rose 10x include Reliance Power, Manali Petrochemicals, Indo Count Industries and Tata Elxsi.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!