How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

'Step-up SIP’ helps you to invest more money incrementally, like say when you get an annual salary hike. It converts your SIP from a marathon to a sprint. Under most circumstances, the 'step-up SIP' generates higher returns than the ‘normal SIP’, data shows.

1/14

Indian investors are more acquainted with the benefit of systematic investment plans (SIP) to invest in mutual funds (MFs). Now, almost Rs 25,000 crore is the monthly SIP contribution in MFs, which is expected to increase in the future. SIP enables you to regularly invest small sums in MFs to build wealth and reach your financial goals.

Learning how to make the most of the SIP facility is crucial if you want to build your corpus in double quick time. MF companies provide a variety of SIP options to help you accumulate a sizeable corpus and achieve your financial objectives at the earliest. One of these is ‘step-up SIP’, which differs marginally from ‘normal SIP’.

Learning how to make the most of the SIP facility is crucial if you want to build your corpus in double quick time. MF companies provide a variety of SIP options to help you accumulate a sizeable corpus and achieve your financial objectives at the earliest. One of these is ‘step-up SIP’, which differs marginally from ‘normal SIP’.

2/14

Under ‘normal SIP’, you invest a fixed amount at a regular interval. The ‘step-up SIP’ allows you to gradually increase your contributions, which are in direct proportion to your rising income. It makes use of your rising income to build a larger corpus in a relatively brief span of time.

‘Step-up SIPs’ are especially advantageous for salaried individuals who get regular salary hikes or bonuses. As your salary increases annually, it is always a good idea to increase your contributions once a year.

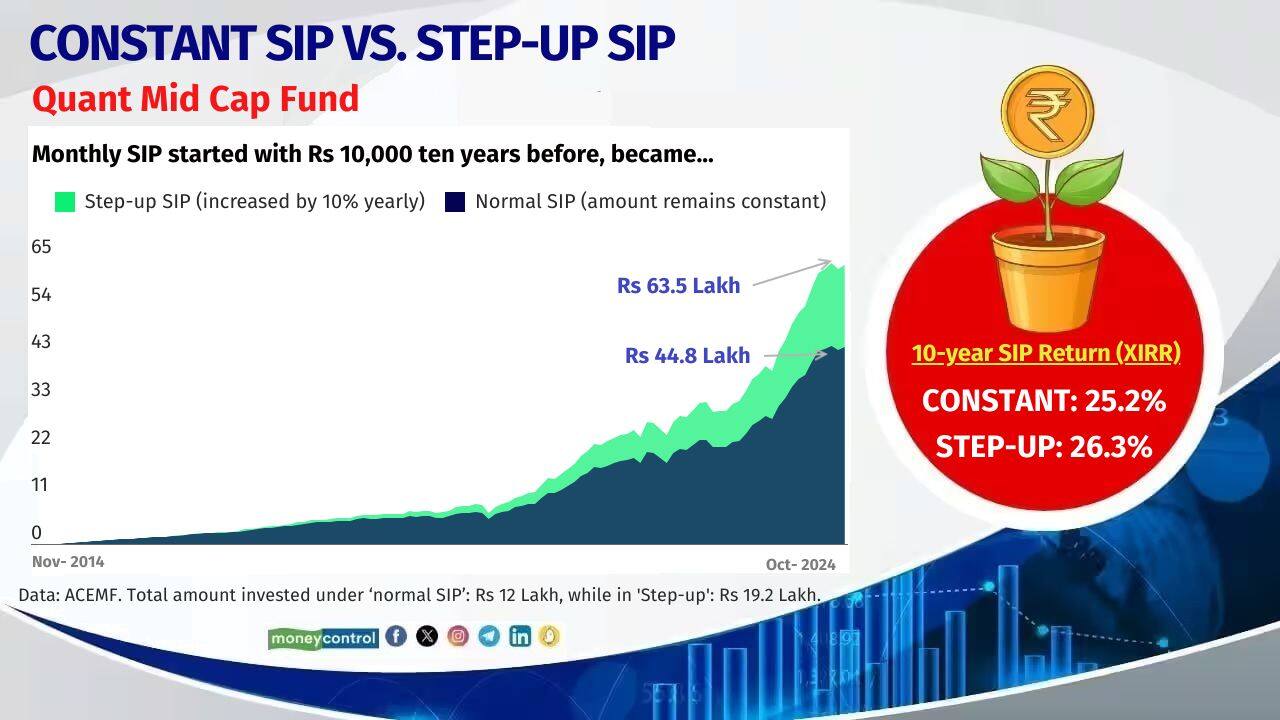

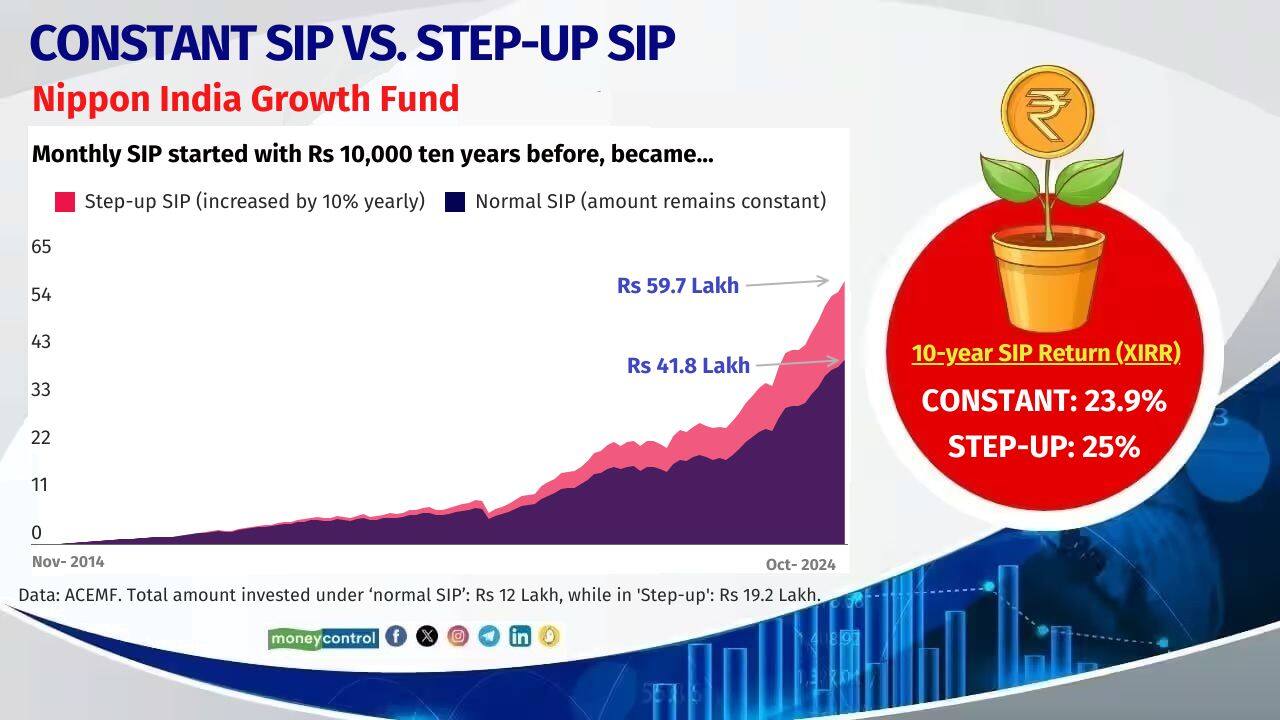

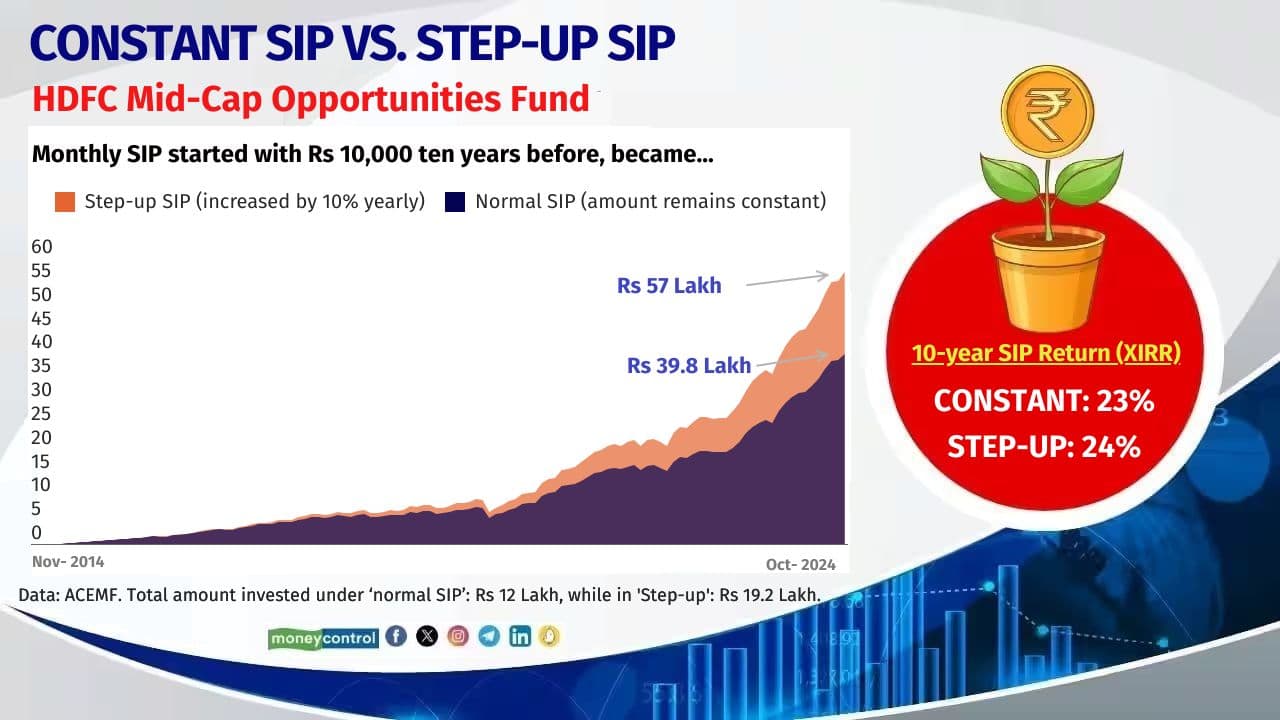

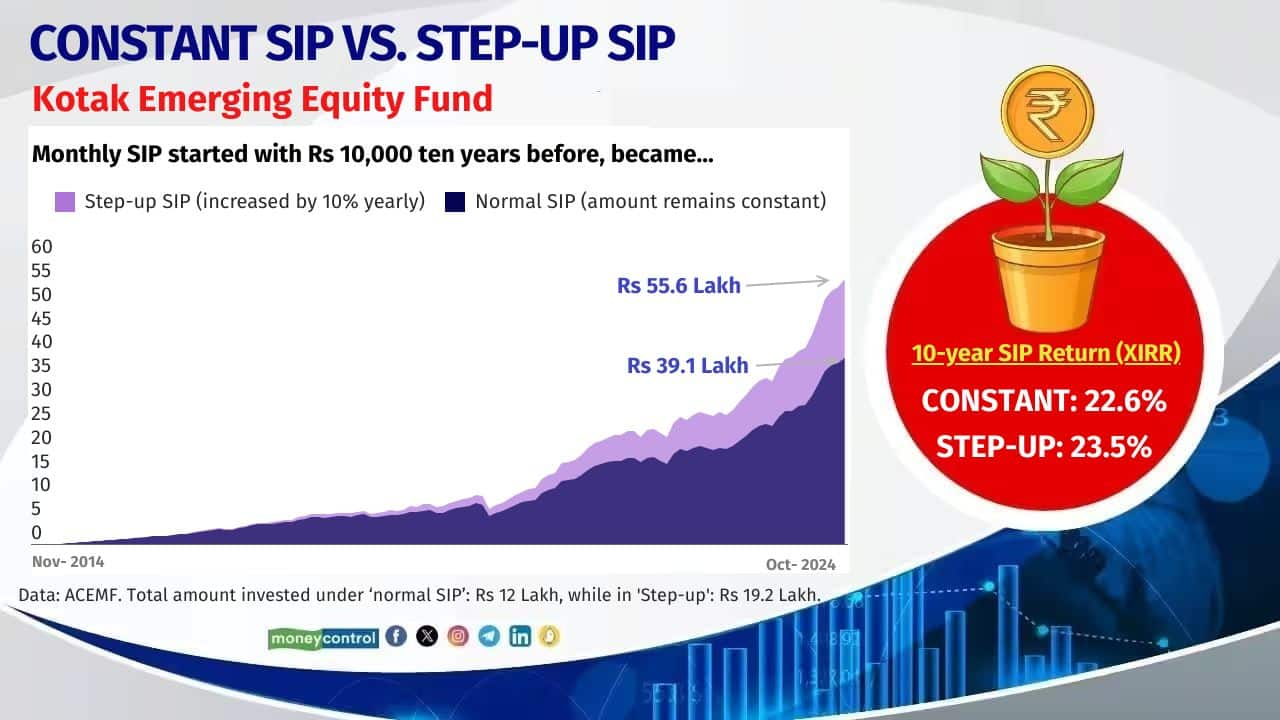

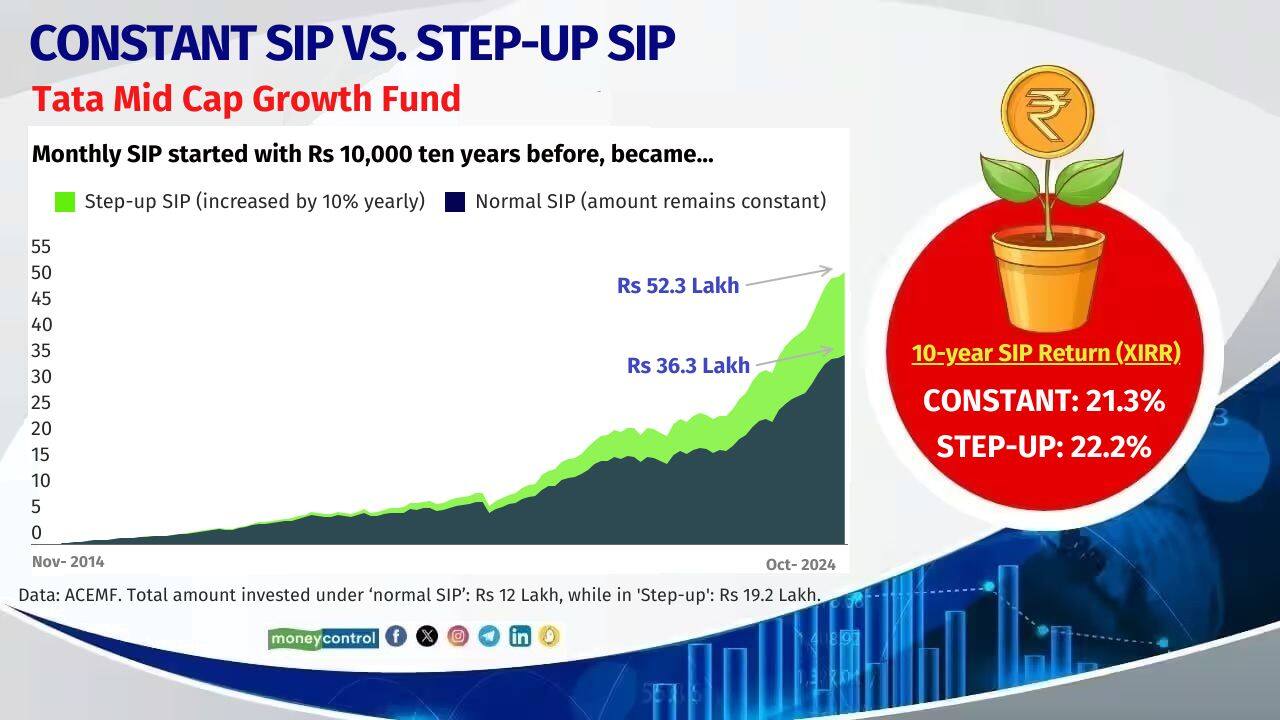

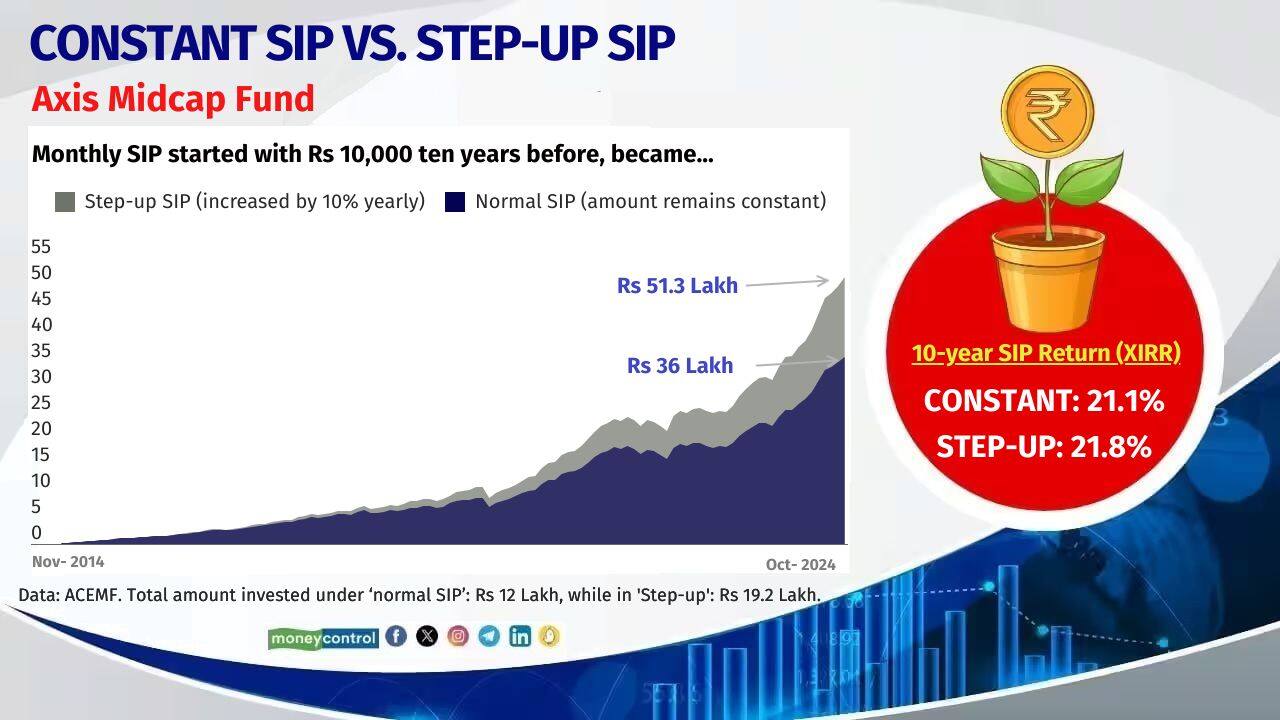

Here, we compare ‘step-up SIP’ with ‘normal SIP’ in the best-performing mid-cap schemes for investments made over the past 10 years. With 10 per cent annual step-up, the SIP has grown significantly, as compared to ‘normal SIP’. Data shows that the ‘step-up SIP’ delivered higher returns than the ‘normal SIP’ under most circumstances (except those in a prolonged bear market).

Source: ACEMF

‘Step-up SIPs’ are especially advantageous for salaried individuals who get regular salary hikes or bonuses. As your salary increases annually, it is always a good idea to increase your contributions once a year.

Here, we compare ‘step-up SIP’ with ‘normal SIP’ in the best-performing mid-cap schemes for investments made over the past 10 years. With 10 per cent annual step-up, the SIP has grown significantly, as compared to ‘normal SIP’. Data shows that the ‘step-up SIP’ delivered higher returns than the ‘normal SIP’ under most circumstances (except those in a prolonged bear market).

Source: ACEMF

3/14

Motilal Oswal Midcap Fund

Fund Managers: Niket Shah, Ajay Khandelwal, Santosh Singh and Rakesh Shetty

Also see: Wealth managers are recommending multi-asset funds amid volatility in equities

Fund Managers: Niket Shah, Ajay Khandelwal, Santosh Singh and Rakesh Shetty

Also see: Wealth managers are recommending multi-asset funds amid volatility in equities

4/14

Quant Mid Cap Fund

Fund Managers: Ankit Pande, Vasav Sahgal and Sanjeev Sharma

Fund Managers: Ankit Pande, Vasav Sahgal and Sanjeev Sharma

5/14

Nippon India Growth Fund

Fund Managers: Rupesh Patel

Fund Managers: Rupesh Patel

6/14

Edelweiss Mid Cap Fund

Fund Managers: Trideep Bhattacharya, Dhruv Bhatia and Raj Koradia

Also see: Why buying Sovereign Gold Bonds in secondary markets may not be a good idea

Fund Managers: Trideep Bhattacharya, Dhruv Bhatia and Raj Koradia

Also see: Why buying Sovereign Gold Bonds in secondary markets may not be a good idea

7/14

HDFC Mid-Cap Opportunities Fund

Fund Managers: Chirag Setalvad

Fund Managers: Chirag Setalvad

8/14

Kotak Emerging Equity Fund

Fund Managers: Atul Bhole

Fund Managers: Atul Bhole

9/14

Invesco India Midcap Fund

Fund Managers: Aditya Khemani and Amit Ganatra

Also see: With rate cuts on the horizon, is it too late to invest in debt mutual funds?

Fund Managers: Aditya Khemani and Amit Ganatra

Also see: With rate cuts on the horizon, is it too late to invest in debt mutual funds?

10/14

Tata Mid Cap Growth Fund

Fund Managers: Satish Chandra Mishra

Fund Managers: Satish Chandra Mishra

11/14

Axis Midcap Fund

Fund Managers: Shreyash Devalkar, Nitin Arora and Krishnaa N

Fund Managers: Shreyash Devalkar, Nitin Arora and Krishnaa N

12/14

HSBC Midcap Fund

Fund Managers: Cheenu Gupta and Venugopal Manghat

Also see: Chasing Chinese dragons: What's in store for Indian mutual fund investors?

Fund Managers: Cheenu Gupta and Venugopal Manghat

Also see: Chasing Chinese dragons: What's in store for Indian mutual fund investors?

13/14

PGIM India Midcap Opp Fund

Fund Managers: Sharma Vivek, Utsav Mehta, Vinay Paharia and Puneet Pal

Fund Managers: Sharma Vivek, Utsav Mehta, Vinay Paharia and Puneet Pal

14/14

SBI Magnum Midcap Fund

Fund Managers: Bhavin Vithlani

Also see: Top microcap multibagger stocks added by mutual funds, amidst volatility

Fund Managers: Bhavin Vithlani

Also see: Top microcap multibagger stocks added by mutual funds, amidst volatility

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!