Sovereign Gold Bonds (SGBs) have emerged as a popular choice among Indian investors for allocating investments to gold.

With the absence of new SGB issuances, there has been a notable demand for select series in the secondary markets. This has resulted in SGB units trading at a premium of 5-10 percent to their reference rates.

SGBs are government-backed gold bonds issued by the Reserve Bank of India (RBI). They score over other gold investment products due to the additional coupon rate and the tax exemption upon maturity.

Many small investors are enticed to purchase old SGB series from the secondary markets despite the fact that the majority of them are not actively traded. We look at the potential drawbacks of purchasing SGBs at a premium.

The RBI issued 67 tranches of SGBs between FY2016 and FY2024. There have been no new issuances since then.

Moneycontrol was the first to report that the government might reduce or even discontinue the scheme as it is turning out to be an expensive proposition.

Why are SGBs trading at a premium?

All the SGB series launched so far have been listed on the secondary markets and are available for trading in the cash segment of the BSE and NSE. Investors can buy and sell them using their demat accounts. One unit of an SGB is equal to one gram of gold.

Also see: Israel-Iran war: Should you invest in gold funds to hedge your portfolio?

Most of them are trading at a premium to the reference rate. India Bullion and Jewellers Association’s (IBJA) 999 purity gold rate is the reference rate for SGBs. For instance, the traded price of series ‘SGBDEC25’ was Rs 8,700 as on October 23, 2024, which was about Rs 830, or 10 percent higher than the IBJA’s reference rate of Rs 7,869.

To begin with, unlike other gold asset classes such as gold exchange-traded funds (ETFs) and physical gold, SGBs offer an annual coupon rate of 2.5 percent or 2.75 percent, which is an added advantage. Also, SGBs have an edge over others on the taxation front. If units are redeemed at maturity (after eight years), the capital gains are exempted from tax.

In addition to that, in the absence of new SGB issues, the demand for these bonds has gone up and led to a further rise in the price of these bonds against the reference prices.

See here: How to choose the right annuity plan in NPS?

Alekh Yadav, Head of Investment Products at Sanctum Wealth, says, “Recently, the government highlighted the complexities associated with issuing SGBs, raising concerns about whether there will be any new issuances in the future. As a result, investors may find themselves without the option to invest in fresh SGBs.”

Further, “Almost all SGB series are trading at a premium, as current market prices also factor in the additional 2.5 percent returns guaranteed by SGBs,” says NS Ramaswamy, Head of Commodities at Ventura Securities.

Above all, most of the SGB series are thinly traded. Simply put, the illiquidity leads to a higher premium in the traded price in such cases when the buyers are more than the sellers in the exchanges.

Vishal Jain, CEO, Zerodha Fund House, explains, “Most investors would follow a HTM strategy due to the taxation benefits available at a later point. This results in thinner volumes in the secondary market which can result in larger premiums/discounts to reference rates.”

Also see: 30 Sovereign Gold Bonds coming up for premature redemption: Should you surrender or hold units?

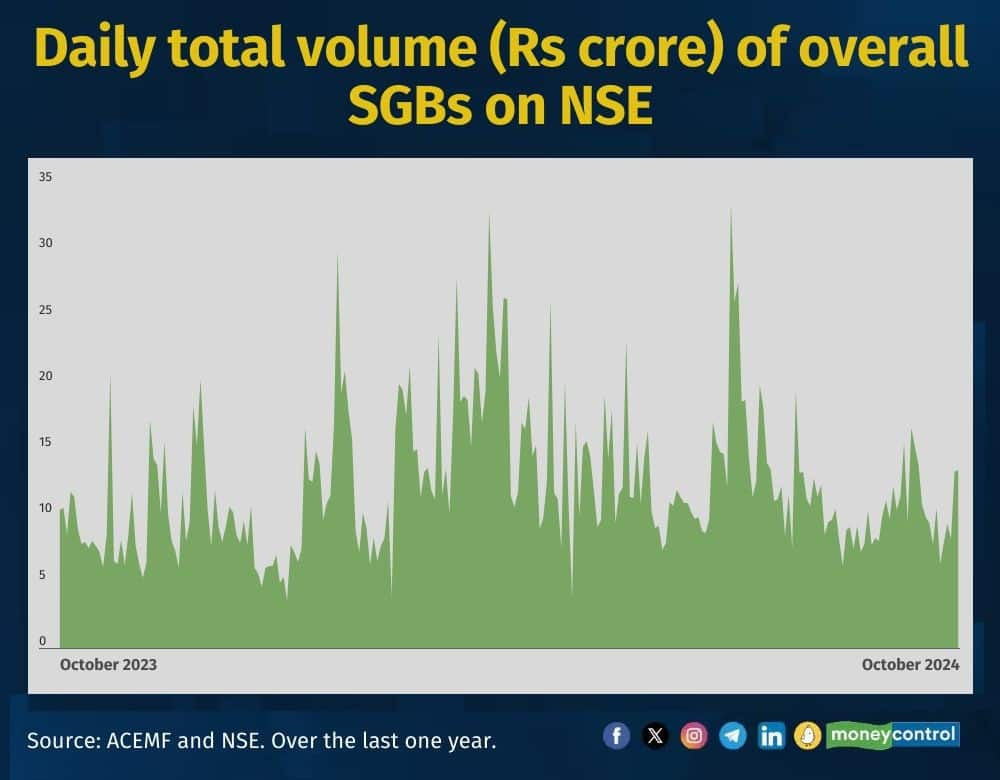

The daily average traded volume of overall SGBs on both the NSE and BSE was about Rs 14 crore. Of the 62 SGB series, only 15 series were traded with a daily average volume of more than Rs 30 lakh in the last three months.

Buying SGBs at a premium?

Investors who buy SGBs at a premium today in the secondary markets could face several challenges over the next 5-6 years.

One, Nirav Karkera, Head of Research at Fisdom, says, “if gold prices do not appreciate enough to offset the premium, then the investment may underperform.”

Keep in mind that your redemption price of the SBG units (either upon maturity or at premature redemption window) will be fixed in line with the prevailing market price as represented by the IBJA Gold (999 purity) rate.

See here: Why are Sovereign Gold Bonds trading at 5-12% premium?

Two, Peeyush Pandey, a Bhopal-based registered investment advisor, says, “Many large investors saw taking a tactical position in SGB series that are traded with decent volume. But, for small investors, it would be a risky endeavour because you can't be certain when you'll sell or if you'll be able to sell at a premium, fair price, or discount.”

Holding till maturity makes sense for small investors as you get rid of illiquidity risk, adds Pandey.

Third, liquidity could be a concern in the secondary market if demand for SGBs declines in the future and the government resumes fresh SGB issuances, cautions Karkera. There were periods in the past wherein many of the SGBs series traded in line or discount to the prevailing reference rate.

Finally, the 2.5 percent annual interest earned on SGBs is taxable, which could reduce net returns, Karkera adds.

Keep in mind that the 2.5 percent annual coupon rate is determined using the price that was set at the beginning of the bond issuance, not the price you paid for it in the secondary market.

According to our back of our envelop calculation, if you purchase SGB units at the current trading price, the coupon yield decreases from 2.5 percent to 1.27 percent (an average for 62 series).

Gold ETFs, funds turn attractive

SGBs are available with a residual maturity of up to seven and half years in the secondary markets. Although experts have a positive outlook for gold in the short to medium term, it would be difficult to forecast the next five to six years, so it is better for small investors to purchase gold at the current market prices.

Read here: Why are gold ETFs so appealing now?

“With current premiums in the SGB series in the secondary market, alternatives like gold ETFs or gold mutual funds might offer more flexibility. ETFs provide market-linked prices with better liquidity, and gold mutual funds allow systematic investments,” says Karkera.

These options avoid the risk of premium erosion if new SGB issuances resume, making them suitable for investors seeking short-term or tactical gold exposure, adds Karkera.

The Union Budget for 2024 reinstated favourable tax treatments for gold ETFs and gold funds.

Gold has been considered as a hedge against inflation and economic uncertainties. The yellow metal should be looked at as an asset allocation product rather than only from a returns perspective. Allocation to gold can form 5-10 percent of your portfolio at any point in time.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Also read: Chasing Chinese dragons: What's in store for Indian mutual fund investors?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.