Smart strategies to break free from debt stress

Practical tips can take you to manage loans, remain stress-free, and achieve long-term financial stability.

1/7

Why debt management is important

Debt is not necessarily evil—it can finance home purchase, college, or essential surgery. The problem arises when payments surpass wages, interest garnishes, or many loans are forgotten. Unchecked borrowing can wreck savings, lower your credit score, and induce long-term anxiety. Smart debt management is all about balance, allowing you to meet immediate needs without jeopardizing long-term financial well-being. Taking action early can prevent debt from spiralling out of control.

Debt is not necessarily evil—it can finance home purchase, college, or essential surgery. The problem arises when payments surpass wages, interest garnishes, or many loans are forgotten. Unchecked borrowing can wreck savings, lower your credit score, and induce long-term anxiety. Smart debt management is all about balance, allowing you to meet immediate needs without jeopardizing long-term financial well-being. Taking action early can prevent debt from spiralling out of control.

2/7

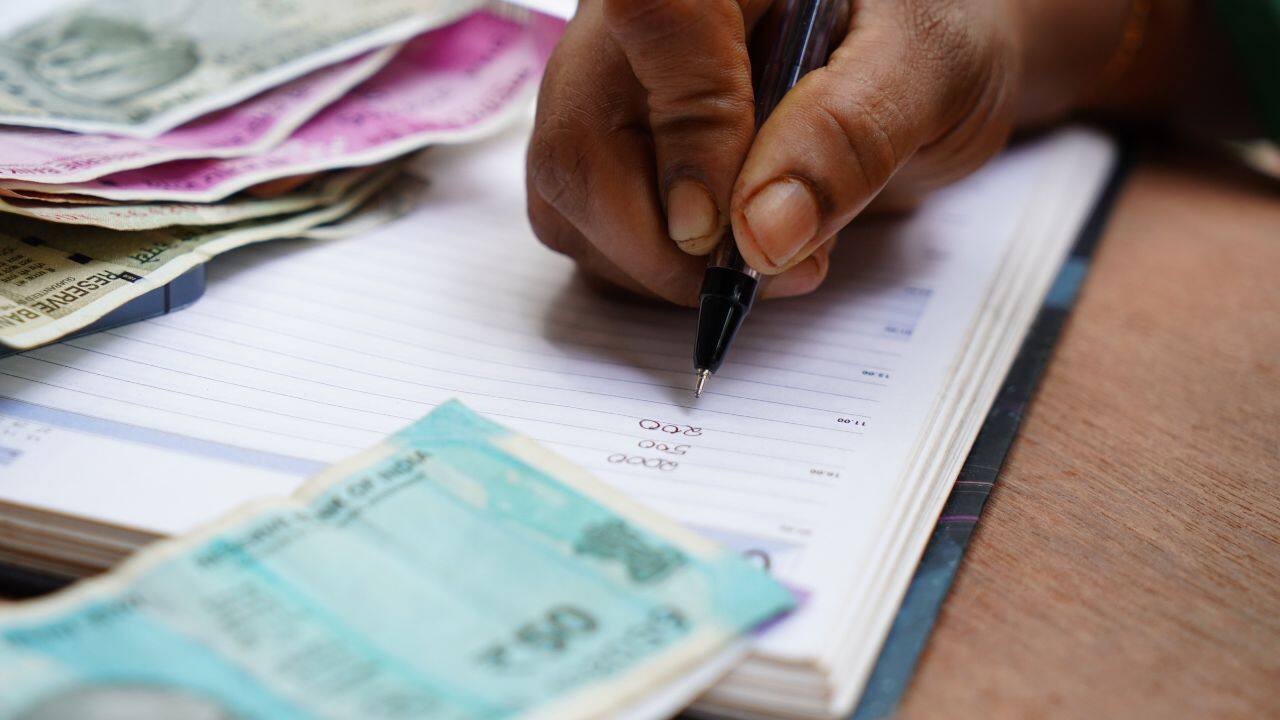

Account for all rupees you owe

The first step to resolving debt is to take an honest inventory of what you owe. Sit down and list every loan, from home loan to personal loan, car loan to credit card, and note down the balance, rate, and payment due date. That clarity prevents missed payments, cuts out duplicate debt, and makes room for priority repayment. That knowledge is the first step towards a debt strategy that maintains you in good financial health.

The first step to resolving debt is to take an honest inventory of what you owe. Sit down and list every loan, from home loan to personal loan, car loan to credit card, and note down the balance, rate, and payment due date. That clarity prevents missed payments, cuts out duplicate debt, and makes room for priority repayment. That knowledge is the first step towards a debt strategy that maintains you in good financial health.

3/7

Prioritize high-cost debt

Not all debts owe you as much, so prioritize. Credit card debt and personal unsecured loans typically have interest rates over 30 percent, but home mortgage or school loans are much lower. Paying off the most expensive loans first prevents them from snowballing and consuming your income. Even an extra payment on these balances saves you money over time and in total.

Not all debts owe you as much, so prioritize. Credit card debt and personal unsecured loans typically have interest rates over 30 percent, but home mortgage or school loans are much lower. Paying off the most expensive loans first prevents them from snowballing and consuming your income. Even an extra payment on these balances saves you money over time and in total.

4/7

Consolidate or restructure where feasible

If you’re managing several debts at once, consolidation can simplify the process. Combining multiple high-interest loans into a single personal loan at a lower rate helps reduce monthly outflow. Similarly, restructuring options, like extending the repayment period, lower EMI pressure. While longer tenures increase total interest, they provide breathing space in periods of financial stress. This approach is especially useful if job loss or emergencies reduce your ability to pay.

If you’re managing several debts at once, consolidation can simplify the process. Combining multiple high-interest loans into a single personal loan at a lower rate helps reduce monthly outflow. Similarly, restructuring options, like extending the repayment period, lower EMI pressure. While longer tenures increase total interest, they provide breathing space in periods of financial stress. This approach is especially useful if job loss or emergencies reduce your ability to pay.

5/7

Establish an emergency buffer

Unexpected crises will derail your finances and burden you with debt before you know it. Health problems, business downsizing, or family obligations typically push people to max their cards or borrow at outrageous interest rates. Having a three- to six-month store of essential costs as an emergency fund removes this risk. Small sums, set aside over time, protect you from having to turn to costly credit in emergencies so that you can keep more control over your financial health.

Unexpected crises will derail your finances and burden you with debt before you know it. Health problems, business downsizing, or family obligations typically push people to max their cards or borrow at outrageous interest rates. Having a three- to six-month store of essential costs as an emergency fund removes this risk. Small sums, set aside over time, protect you from having to turn to costly credit in emergencies so that you can keep more control over your financial health.

6/7

Avoid new debt while paying off old

Avoiding new borrowing is one of the hardest but most important habits to adopt when paying off debt. Luxury spending, vacations, or impulse buys can wait until you've paid. Every new loan or card charge only postpones the obligation. By not borrowing more than you should, you accelerate payoff on outstanding balances, reduce future expenses, and have future income available to save. The less new debt you create, the more quickly you'll regain control.

Avoiding new borrowing is one of the hardest but most important habits to adopt when paying off debt. Luxury spending, vacations, or impulse buys can wait until you've paid. Every new loan or card charge only postpones the obligation. By not borrowing more than you should, you accelerate payoff on outstanding balances, reduce future expenses, and have future income available to save. The less new debt you create, the more quickly you'll regain control.

7/7

Seek help if needed

Sometimes, debt just overwhelms you despite your best efforts, and that is when expert help is needed. Financial planners will guide you through repayment schedules, and credit counsellors can negotiate on your behalf with lenders for reduced rates or extended terms. Talking to banks in advance if you anticipate encountering problems can open restructuring opportunities. Seeking help is not a sign of weakness but a proactive effort to protect your financial health and break out of the deeper cycle of debt.

Sometimes, debt just overwhelms you despite your best efforts, and that is when expert help is needed. Financial planners will guide you through repayment schedules, and credit counsellors can negotiate on your behalf with lenders for reduced rates or extended terms. Talking to banks in advance if you anticipate encountering problems can open restructuring opportunities. Seeking help is not a sign of weakness but a proactive effort to protect your financial health and break out of the deeper cycle of debt.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!