Decoding the EV ecosystem, stocks, sectors: Nifty EV and New Age Automotive ETF

Mirae Asset Nifty EV and New Age Automotive ETF was launched on June 24. This ETF aims to capitalise not just from electric vehicles but also future disruptions like hydrogen fuel cell and autonomous vehicles.

1/13

Mirae Asset Mutual Fund has launched the Mirae Asset Nifty EV and New Age Automotive ETF (MNEV), a passively managed exchange traded fund (ETF) that tracks the Nifty EV New Age Automotive Index. This index tracks the performance of companies active in the electric vehicle (EV) or new-age automotive vehicle segment. It’s a niche, thematic fund that aims to invest in disruptive companies in the automobile segment. Swarup Anand Mohanty, Vice Chairman and CEO, Mirae Asset Investment Managers, says, "This is the future of mobility. We aim to provide avenues for long-term capital appreciation while supporting sustainable development in the automotive sector.”

2/13

The ETF is likely to cover the entire EV ecosystem

The MNEV ETF tries to provide diversified exposure to the emerging Indian mobility space, capturing not only current disruptions like EVs, hybrid vehicles, and batteries, but also possibly future disruptions like hydrogen fuel cell and autonomous vehicles.

Recent years have seen a dramatic shift in the Indian automobile sector, with increasing emphasis on environmentally friendly and sustainable mobility options. Proactive measures from the government, such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, and production linked incentives (PLI) are likely to create a strong EV ecosystem in India.

An autocarpro.in report indicates that this launch comes at a time when the Indian automotive industry is poised for significant growth, driven by increasing consumer demand, government support, and technological advancement. Per industry reports, the Indian EV market is expected to grow at a CAGR of over 40 percent between 2021 to 2027, reaching a market size of over $150 billion by 2027.

The MNEV ETF tries to provide diversified exposure to the emerging Indian mobility space, capturing not only current disruptions like EVs, hybrid vehicles, and batteries, but also possibly future disruptions like hydrogen fuel cell and autonomous vehicles.

Recent years have seen a dramatic shift in the Indian automobile sector, with increasing emphasis on environmentally friendly and sustainable mobility options. Proactive measures from the government, such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, and production linked incentives (PLI) are likely to create a strong EV ecosystem in India.

An autocarpro.in report indicates that this launch comes at a time when the Indian automotive industry is poised for significant growth, driven by increasing consumer demand, government support, and technological advancement. Per industry reports, the Indian EV market is expected to grow at a CAGR of over 40 percent between 2021 to 2027, reaching a market size of over $150 billion by 2027.

3/13

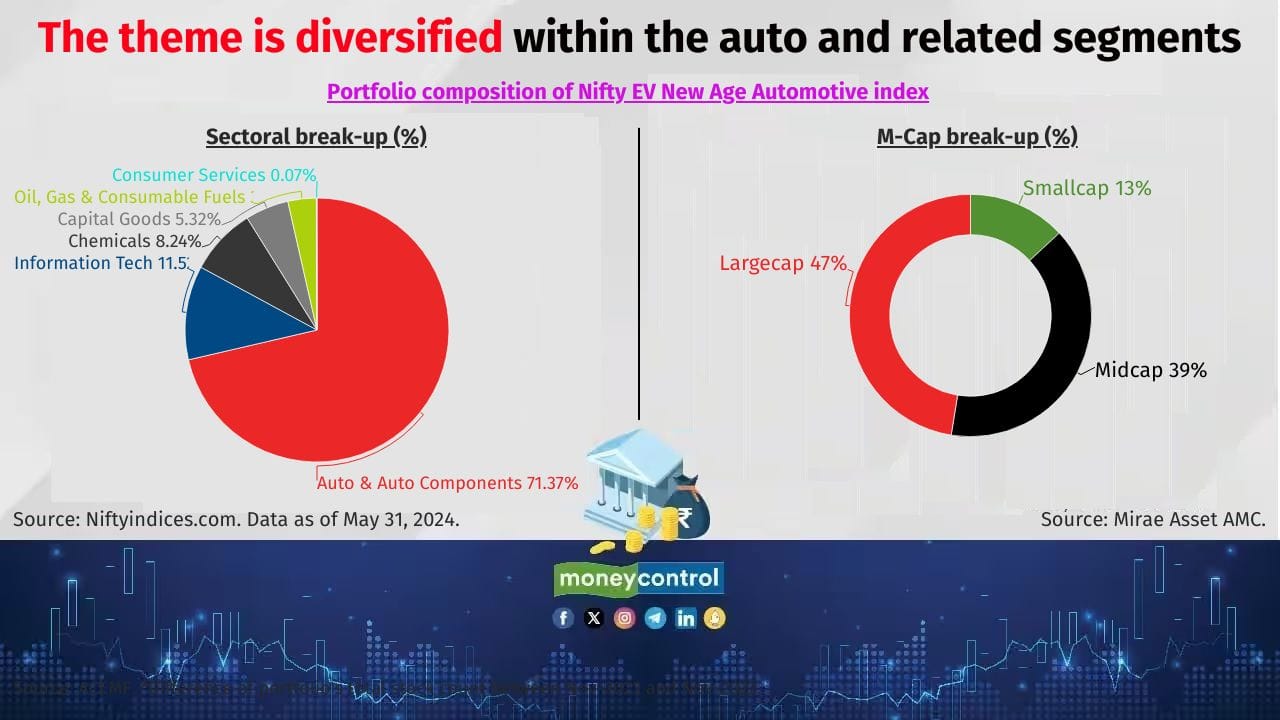

The theme is diversified within the auto and related segments

The Nifty EV New Age Automotive Index chooses 33 stocks from the Nifty 500 index, which must be involved in the production and supply of electric or new-age automotive vehicles, batteries, components, raw materials, and technology. The total weight of stocks of electric two, three, and four-wheeler, and passenger and commercial vehicle (including new-age vehicle) manufacturers is capped at 40 percent. It has a flexicap mandate of holding assets across market capitalisations.

Also see: Midcap and smallcap funds: How should retail investors approach them?

The Nifty EV New Age Automotive Index chooses 33 stocks from the Nifty 500 index, which must be involved in the production and supply of electric or new-age automotive vehicles, batteries, components, raw materials, and technology. The total weight of stocks of electric two, three, and four-wheeler, and passenger and commercial vehicle (including new-age vehicle) manufacturers is capped at 40 percent. It has a flexicap mandate of holding assets across market capitalisations.

Also see: Midcap and smallcap funds: How should retail investors approach them?

4/13

Nifty Auto vs Nifty Transport & Logistics vs Nifty EV New Age Automotive Index

Currently, 10 mutual fund schemes, both actively and passively managed, invest predominantly in auto and related sectors. The three indices they follow are the Nifty Auto, Nifty EV New Age Automotive, and Nifty Transport & Logistics.

Explaining the difference in the investment nature of these indices, Siddharth Srivastava, Head, ETF Products, Mirae Asset Investment Managers, says, “The Nifty Auto Index Covers only auto and auto ancillary companies, while the Nifty EV New Age Automotive Index also covers companies across sectors which are involved in the EV and other new-age automotive value chain, like chemical companies, IT companies, etc.” The Nifty Transport & Logistics index, on the other hand, allocates to auto and auto ancillary companies, as well as services and capital goods firms.

Nifty Auto is a sectoral index with a largecap mandate, and has 15 companies, with the biggest stock having a weight of 21.8 percent. The Nifty EV New Age Automotive index is a thematic index with a flexicap approach, and includes 33 companies, with the biggest stock having a weight of 9.7 percent, Srivastava explains.

Currently, 10 mutual fund schemes, both actively and passively managed, invest predominantly in auto and related sectors. The three indices they follow are the Nifty Auto, Nifty EV New Age Automotive, and Nifty Transport & Logistics.

Explaining the difference in the investment nature of these indices, Siddharth Srivastava, Head, ETF Products, Mirae Asset Investment Managers, says, “The Nifty Auto Index Covers only auto and auto ancillary companies, while the Nifty EV New Age Automotive Index also covers companies across sectors which are involved in the EV and other new-age automotive value chain, like chemical companies, IT companies, etc.” The Nifty Transport & Logistics index, on the other hand, allocates to auto and auto ancillary companies, as well as services and capital goods firms.

Nifty Auto is a sectoral index with a largecap mandate, and has 15 companies, with the biggest stock having a weight of 21.8 percent. The Nifty EV New Age Automotive index is a thematic index with a flexicap approach, and includes 33 companies, with the biggest stock having a weight of 9.7 percent, Srivastava explains.

5/13

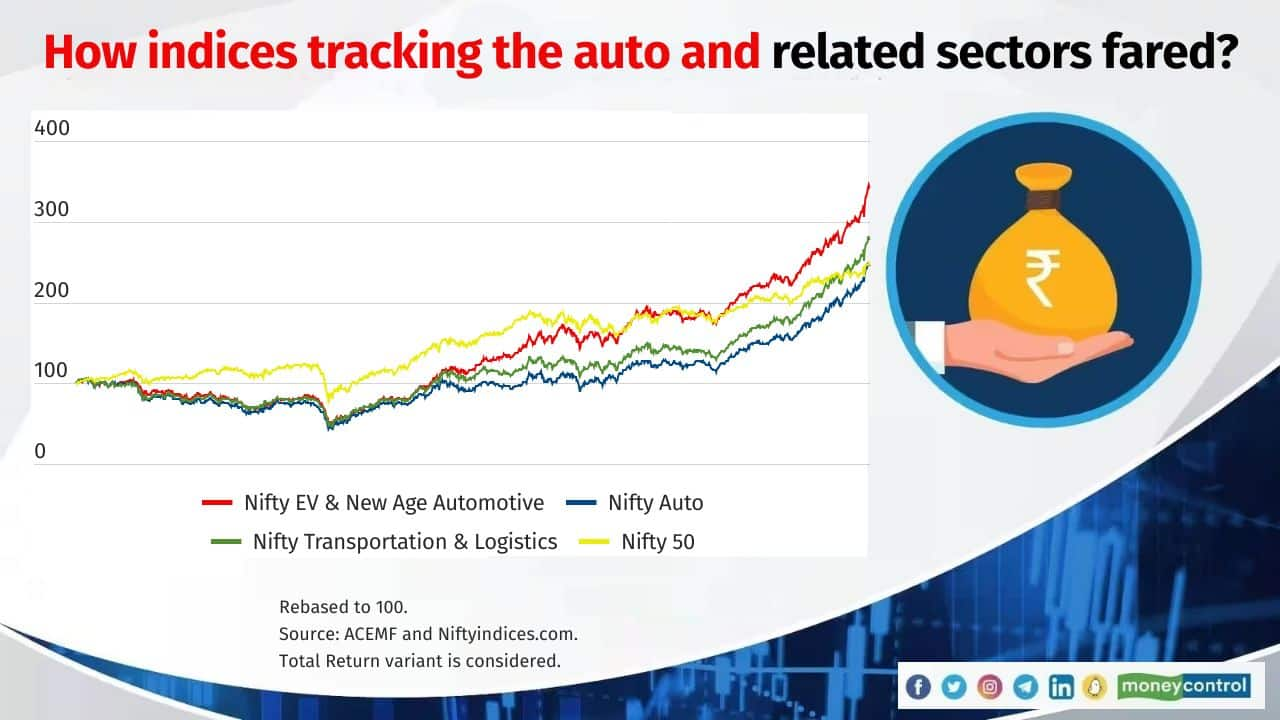

How have indices tracking the auto and related sectors fared?

Among the three indices, the Nifty EV New Age Automotive index has managed to outperform Nifty Auto and Nifty Transport & Logistics over the last six years.

The government’s decarbonisation agenda and reforms have led to a rise in EV sales. Rising EV penetration has caused the order books of auto ancillary firms to grow manifold. However, Deepak Jasani, Head, Retail Research, HDFC Securities, says that, “While the thrust on EV sales continues in India, the changes in subsidy payouts have hindered progress.” Falling battery costs can revive the growth in EV sales.

Per a paper by Niti Aayog and the Rocky Mountain Institute, if FAME II and other measures are successful, India could realise EV penetration of 30 percent of private cars, 70 percent of commercial cars, 40 percent of buses, and 80 percent of two and three-wheelers by 2030, Jasani says. He explains that while the outlook for EV sales seems bright, India may adopt a multi-pronged approach to decarbonisation, including hybrids, LNG, etc.

Below are the smallcap constituents of the Nifty EV New Age Automotive index. Source: Niftyindices.com and ACEMF.

Also see: Quant MF cherry-picked these smallcap stocks lately. Do you own any?

Among the three indices, the Nifty EV New Age Automotive index has managed to outperform Nifty Auto and Nifty Transport & Logistics over the last six years.

The government’s decarbonisation agenda and reforms have led to a rise in EV sales. Rising EV penetration has caused the order books of auto ancillary firms to grow manifold. However, Deepak Jasani, Head, Retail Research, HDFC Securities, says that, “While the thrust on EV sales continues in India, the changes in subsidy payouts have hindered progress.” Falling battery costs can revive the growth in EV sales.

Per a paper by Niti Aayog and the Rocky Mountain Institute, if FAME II and other measures are successful, India could realise EV penetration of 30 percent of private cars, 70 percent of commercial cars, 40 percent of buses, and 80 percent of two and three-wheelers by 2030, Jasani says. He explains that while the outlook for EV sales seems bright, India may adopt a multi-pronged approach to decarbonisation, including hybrids, LNG, etc.

Below are the smallcap constituents of the Nifty EV New Age Automotive index. Source: Niftyindices.com and ACEMF.

Also see: Quant MF cherry-picked these smallcap stocks lately. Do you own any?

6/13

Amara Raja Energy & Mobility

Sub-sector: Batteries

M-Cap (BSE Full): Rs 25,245 crore

Total no. of active equity schemes holding the stock: 16

Sub-sector: Batteries

M-Cap (BSE Full): Rs 25,245 crore

Total no. of active equity schemes holding the stock: 16

7/13

Himadri Speciality Chemical

Sub-sector: Chemicals

M-Cap (BSE Full): Rs 19,334 crore

Total no. of active equity schemes holding the stock: 4

Also see: PMS fund managers fell in love with these 12 midcap gems in May. Do you own any one?

Sub-sector: Chemicals

M-Cap (BSE Full): Rs 19,334 crore

Total no. of active equity schemes holding the stock: 4

Also see: PMS fund managers fell in love with these 12 midcap gems in May. Do you own any one?

8/13

JBM Auto

Sub-sector: Auto Ancillary

M-Cap (BSE Full): Rs 24,424 crore

Total no. of active equity schemes holding the stock: NIL

Sub-sector: Auto Ancillary

M-Cap (BSE Full): Rs 24,424 crore

Total no. of active equity schemes holding the stock: NIL

9/13

Jupiter Wagons

Sub-sector: Railways Wagons

M-Cap (BSE Full): Rs 28,036 crore

Total no. of active equity schemes holding the stock: 13

Sub-sector: Railways Wagons

M-Cap (BSE Full): Rs 28,036 crore

Total no. of active equity schemes holding the stock: 13

10/13

Minda Corporation

Sub-sector: Auto Ancillary

M-Cap (BSE Full): Rs 11,811 crore

Total no. of active equity schemes holding the stock: 26

Also see: 'Strong buy' micro-cap multibagger stocks picked by mutual funds in May

Sub-sector: Auto Ancillary

M-Cap (BSE Full): Rs 11,811 crore

Total no. of active equity schemes holding the stock: 26

Also see: 'Strong buy' micro-cap multibagger stocks picked by mutual funds in May

11/13

Olectra Greentech

Sub-sector: Automobiles-Trucks/Lcv

M-Cap (BSE Full): Rs 14,273 crore

Total no. of active equity schemes holding the stock: NIL

Sub-sector: Automobiles-Trucks/Lcv

M-Cap (BSE Full): Rs 14,273 crore

Total no. of active equity schemes holding the stock: NIL

12/13

RattanIndia Enterprises

Sub-sector: Professional Services

M-Cap (BSE Full): Rs 11,744 crore

Total no. of active equity schemes holding the stock: NIL

Sub-sector: Professional Services

M-Cap (BSE Full): Rs 11,744 crore

Total no. of active equity schemes holding the stock: NIL

13/13

Varroc Engineering

Sub-sector: Auto Ancillary

M-Cap (BSE Full): Rs 10,337 crore

Total no. of active equity schemes holding the stock: 15

Also see: Index mutual funds grab investor attention; here’s how to get the best out of them

Sub-sector: Auto Ancillary

M-Cap (BSE Full): Rs 10,337 crore

Total no. of active equity schemes holding the stock: 15

Also see: Index mutual funds grab investor attention; here’s how to get the best out of them

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!