Midcap stocks that find no takers among active fund managers. Check your portfolio

Mid-cap stocks that are part of the portfolio of equity schemes have rewarded the investors. However, companies that lack business sustainability, are buried in debt, do not execute business strategies efficiently, and come with an unattractive valuation, rarely find a place in the portfolio of the actively managed mutual fund schemes.

1/13

A strong financial record, good quality management, scalable business and an attractive valuation are some of the parameters that fund managers look for while selecting stocks. Companies that fall short on such metrics rarely find a place in the portfolio of the schemes.

A Moneycontrol study shows that many stocks that are classified as midcaps by industry body, the Association of Mutual Funds in India, are not part of the portfolio of many actively managed schemes. AMFI has classified stocks that are ranked between 101 and 250 in terms of full market capitalisation as midcaps.

A Moneycontrol study shows that many stocks that are classified as midcaps by industry body, the Association of Mutual Funds in India, are not part of the portfolio of many actively managed schemes. AMFI has classified stocks that are ranked between 101 and 250 in terms of full market capitalisation as midcaps.

2/13

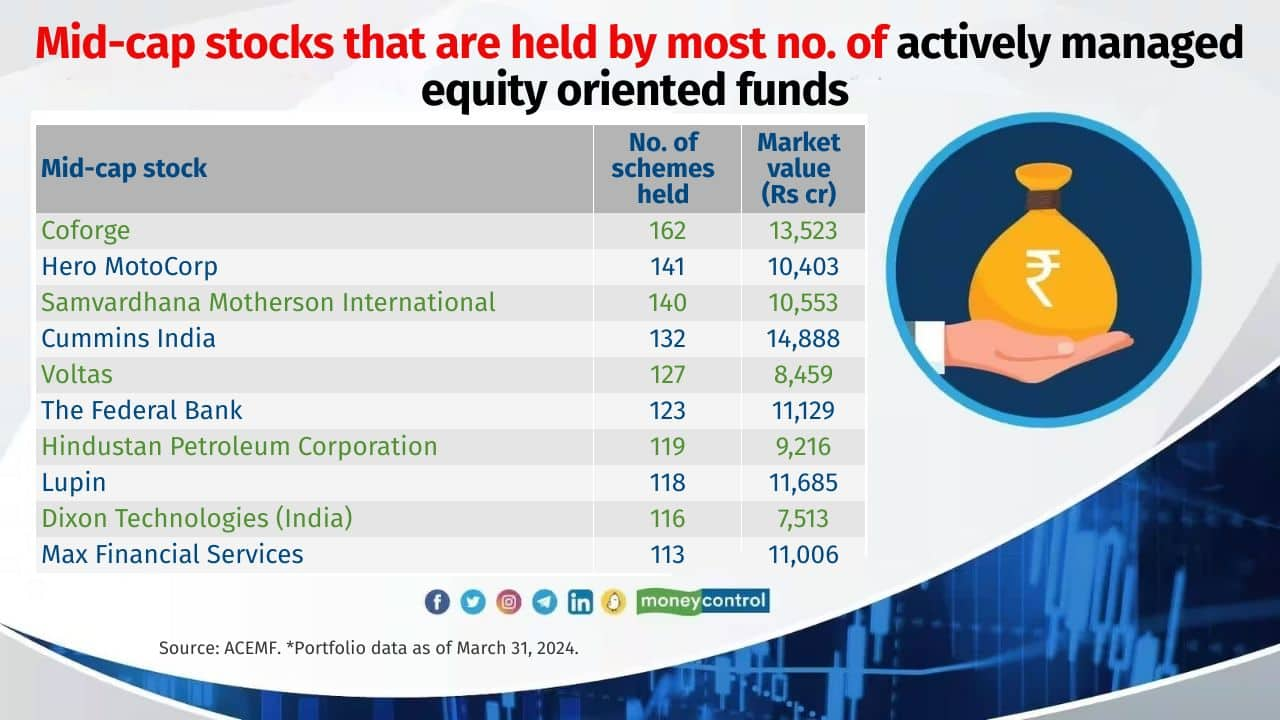

On the other hand, the most preferred midcap stocks are Coforge, Hero MotoCorp and Samvardhana Motherson International that are held by 162, 141 and 140 active schemes respectively.

The following are the midcap stocks (as defined by AMFI) that are either totally ignored or are least favoured by active mutual fund managers.

Experts believe that valuations of some businesses have gone up significantly. As and when these valuations cool down and leverage comes down significantly, they may become attractive on the watchlist of the fund managers.

Only actively managed equity funds and hybrid funds (623 schemes) were considered for the study. Arbitrage funds and passive funds (index funds and exchange-traded funds) were excluded. Data as of March 31, 2024. Source: ACEMF. Stocks returns data as per Moneycontrol.

The following are the midcap stocks (as defined by AMFI) that are either totally ignored or are least favoured by active mutual fund managers.

Experts believe that valuations of some businesses have gone up significantly. As and when these valuations cool down and leverage comes down significantly, they may become attractive on the watchlist of the fund managers.

Only actively managed equity funds and hybrid funds (623 schemes) were considered for the study. Arbitrage funds and passive funds (index funds and exchange-traded funds) were excluded. Data as of March 31, 2024. Source: ACEMF. Stocks returns data as per Moneycontrol.

3/13

YES Bank

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 60%

3-year return: 85%

Also see: These 15 high-PE stocks make your midcap funds expensive

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 60%

3-year return: 85%

Also see: These 15 high-PE stocks make your midcap funds expensive

4/13

Adani Wilmar

Sector: Edible Oil

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: -15%

3-year return: NA

Sector: Edible Oil

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: -15%

3-year return: NA

5/13

UCO Bank

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 110%

3-year return: 407%

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 110%

3-year return: 407%

6/13

Fertilizers And Chemicals Travancore

Sector: Fertilizers

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 103%

3-year return: 536%

Also see: MF stress test impact: Stocks that larger-sized smallcap funds increased exposure in March

Sector: Fertilizers

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 103%

3-year return: 536%

Also see: MF stress test impact: Stocks that larger-sized smallcap funds increased exposure in March

7/13

Central Bank Of India

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 143%

3-year return: 298%

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 143%

3-year return: 298%

8/13

Lloyds Metals And Energy

Sector: Sponge Iron

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 153%

3-year return: 5,529%

Sector: Sponge Iron

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 153%

3-year return: 5,529%

9/13

Punjab & Sind Bank

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 98%

3-year return: 263%

Also see: MF stress test, round 2: How did the 10 largest midcap funds do?

Sector: Banking

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 98%

3-year return: 263%

Also see: MF stress test, round 2: How did the 10 largest midcap funds do?

10/13

The New India Assurance Company

Sector: General Insurance

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 116%

3-year return: 49%

Sector: General Insurance

Total number of active schemes that held the stock: Nil

MFs’ investment value: Nil

1-year return: 116%

3-year return: 49%

11/13

Patanjali Foods

Sector: Edible Oil

Total number of active schemes that held the stock: 1

MFs’ investment value: Rs 33 crore

1-year return: 55%

3-year return: 109%

Sector: Edible Oil

Total number of active schemes that held the stock: 1

MFs’ investment value: Rs 33 crore

1-year return: 55%

3-year return: 109%

12/13

Rail Vikas Nigam

Sector: Civil Construction

Total number of active schemes that held the stock: 5

MFs’ investment value: Rs 4 crore

1-year return: 250%

3-year return: 925%

Sector: Civil Construction

Total number of active schemes that held the stock: 5

MFs’ investment value: Rs 4 crore

1-year return: 250%

3-year return: 925%

13/13

Bank Of Maharashtra

Sector: Banks

Total number of active schemes that held the stock: 5

MFs’ investment value: Rs 82 crore

1-year return: 130%

3-year return: 180%

Also see: Top mutual funds: 3 new schemes that enter Moneycontrol’s sparkling list of investment-worthy funds; MC30

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Sector: Banks

Total number of active schemes that held the stock: 5

MFs’ investment value: Rs 82 crore

1-year return: 130%

3-year return: 180%

Also see: Top mutual funds: 3 new schemes that enter Moneycontrol’s sparkling list of investment-worthy funds; MC30

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!