Nasdaq, Nasdaq Next, FANG, Total Market and Value: How to get the best out of US focused MFs?

Indian mutual funds that invest in US markets gave an average return of 33% in the last one year. But don’t get swayed by past returns. Here is a low-down on the sub-categories of these funds

1/13

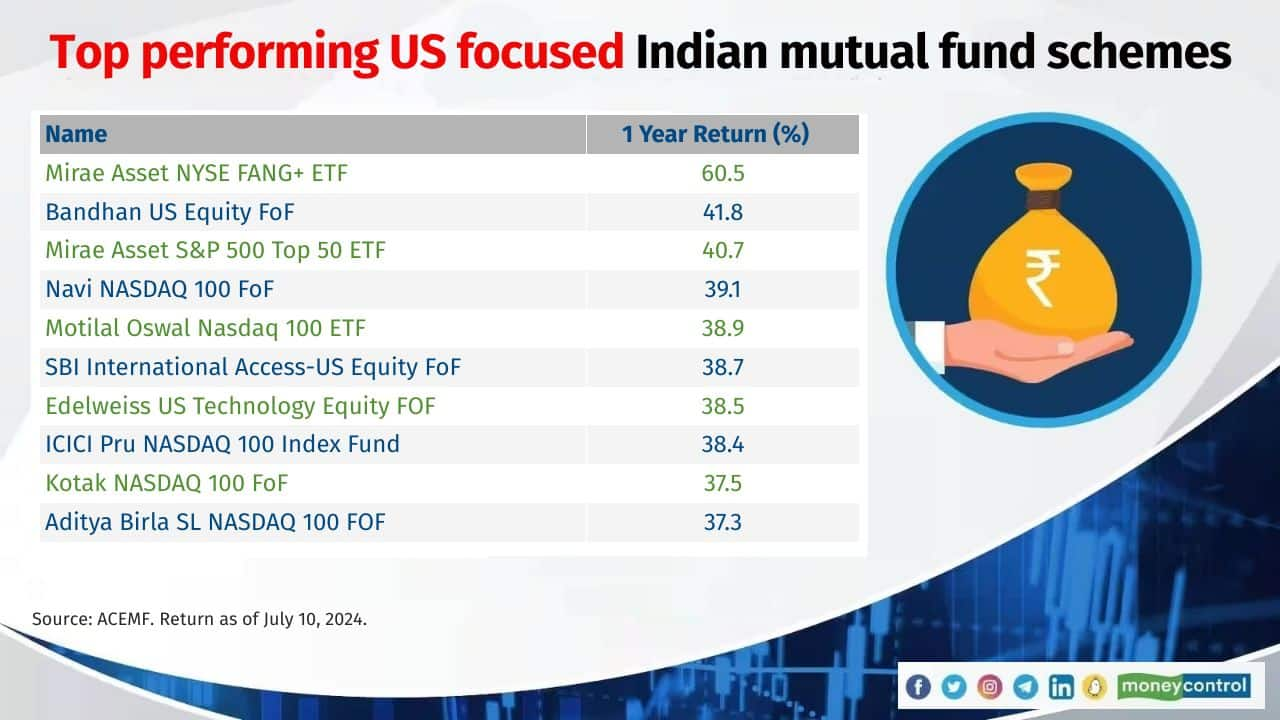

US-focused funds have done well over the past 15-18 months. For instance, Mirae Asset NYSE FANG+ ETF, Bandhan US Equity fund-on-fund (FoF) and Mirae Asset S&P 500 Top 50 ETF have delivered returns of 61 percent, 43 percent and 41 percent, respectively, over the last one year. Meanwhile, the Nifty 50 total return index delivered 27 percent during the period.

Of the 73 international funds, 20 schemes invest primarily in US stocks. Of these, seven track the performance of the Nasdaq 100 index. Other schemes cover the various segments of the US equity markets.

Of the 73 international funds, 20 schemes invest primarily in US stocks. Of these, seven track the performance of the Nasdaq 100 index. Other schemes cover the various segments of the US equity markets.

2/13

Following a dismal performance in 2022, US stocks bounced back and generated better returns. Schemes that have invested heavily in US tech stocks have generated relatively better returns.

“The US economy has demonstrated resilience, driven by a robust GDP growth, low unemployment, and strong consumer spending”, says Subho Moulik, Founder and CEO at Appreciate, a SEBI and IFSCA-registered fintech company.

A major positive has been the outstanding results from US tech companies, such as Nvidia, Meta and Google. Nvidia has risen by 211.47 percent in just one year while Meta grew by 80.53 percent and Google by 62.95 percent.

Earnings growth was seen in the backdrop of innovation and strong market demand for their products and services. Their leadership in areas like artificial intelligence and cloud computing have propelled their stock prices, adds Moulik.

“The US economy has demonstrated resilience, driven by a robust GDP growth, low unemployment, and strong consumer spending”, says Subho Moulik, Founder and CEO at Appreciate, a SEBI and IFSCA-registered fintech company.

A major positive has been the outstanding results from US tech companies, such as Nvidia, Meta and Google. Nvidia has risen by 211.47 percent in just one year while Meta grew by 80.53 percent and Google by 62.95 percent.

Earnings growth was seen in the backdrop of innovation and strong market demand for their products and services. Their leadership in areas like artificial intelligence and cloud computing have propelled their stock prices, adds Moulik.

3/13

Why should one invest in US stocks?

• Diversification benefits: It’s a different asset class. Indian market has one of the lowest correlations with the S&P 500.

• Exposure to niche themes unavailable in India: Investing in the US provides exposure to broader megatrends (e.g., Biotech, Cloud, Aerospace) that are still largely under-represented in India.

• Hedging future dollar expenses: As India becomes more prosperous, the share of dollar expenses is likely to increase. Holding some dollar-denominated assets can be useful to offset potential future dollar liabilities.

• Diversification benefits: It’s a different asset class. Indian market has one of the lowest correlations with the S&P 500.

• Exposure to niche themes unavailable in India: Investing in the US provides exposure to broader megatrends (e.g., Biotech, Cloud, Aerospace) that are still largely under-represented in India.

• Hedging future dollar expenses: As India becomes more prosperous, the share of dollar expenses is likely to increase. Holding some dollar-denominated assets can be useful to offset potential future dollar liabilities.

4/13

Indian investors benefited from the US tech rally through the MF route. The assets under management (AUM) of international funds went up between 2019 and 2021, till SEBI imposed restrictions on accepting fresh inflows.

In February 2022, SEBI notified $7 billion as the cap for mutual funds to invest in overseas securities and funds, and a separate limit of $1 billion for investing in overseas exchange-traded funds.

For more than two years now, the RBI hasn’t increased this limit. However, this can change any point.

Also see: Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

In February 2022, SEBI notified $7 billion as the cap for mutual funds to invest in overseas securities and funds, and a separate limit of $1 billion for investing in overseas exchange-traded funds.

For more than two years now, the RBI hasn’t increased this limit. However, this can change any point.

Also see: Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

5/13

But don’t get swayed by past performance. Arindam Mandal, Portfolio Manager at Marcellus Investment Managers, says that while the potential opportunities in AI are enormous, “we must remember that such disruptive technologies often go through a hype cycle. This cycle typically culminates in overly elevated expectations, followed by a period of disillusionment.”

Still, it’s good to diversify into the US markets, given the long-term growth potential and an exposure to new technologies.

Below, we reclassify US-focused funds further, based on their investment avenues and explain their performance, portfolio composition, and unique selling propositions.

Still, it’s good to diversify into the US markets, given the long-term growth potential and an exposure to new technologies.

Below, we reclassify US-focused funds further, based on their investment avenues and explain their performance, portfolio composition, and unique selling propositions.

6/13

Nasdaq 100 funds

1-year Return (CAGR): 39%

Also see: These smallcap multibaggers rewarded MF investors with up to 848% returns in a year

1-year Return (CAGR): 39%

Also see: These smallcap multibaggers rewarded MF investors with up to 848% returns in a year

7/13

Nasdaq Q 50 Fund

1-year Return (CAGR): 13%

1-year Return (CAGR): 13%

8/13

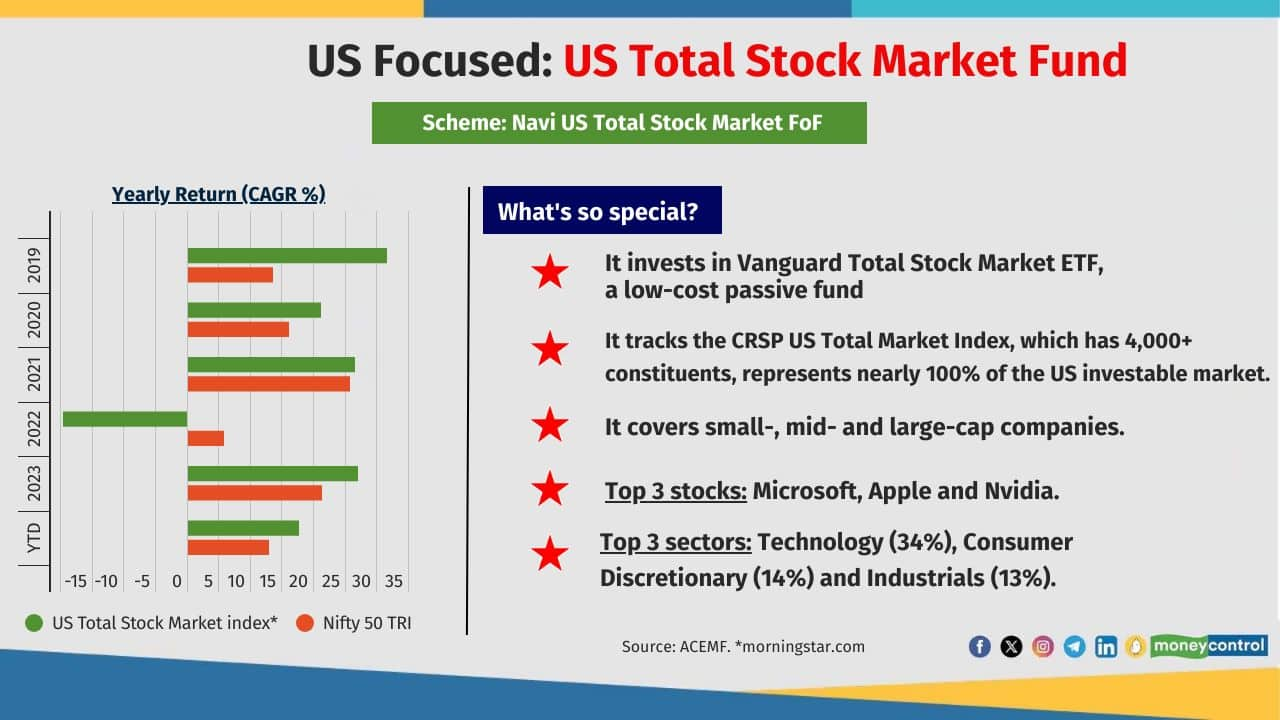

US Total Stock Market Fund

1-year Return (CAGR): 28%

1-year Return (CAGR): 28%

9/13

10/13

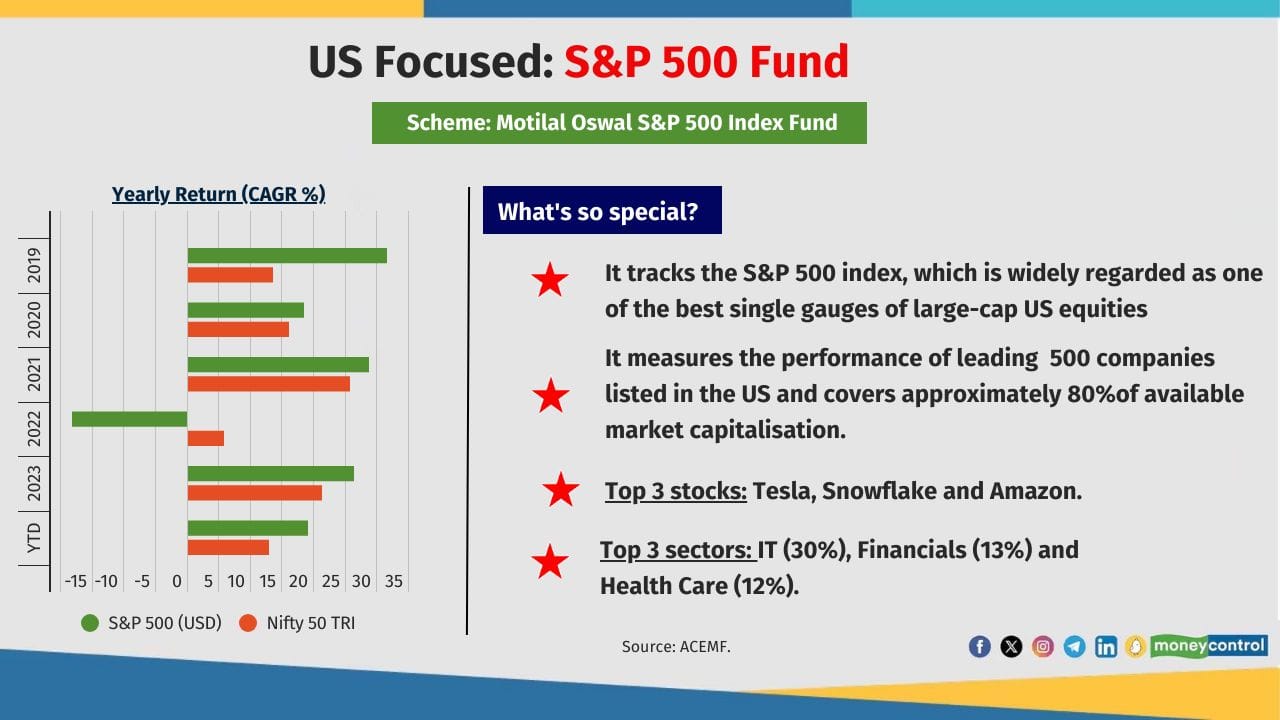

S&P 500 Fund

1-year Return (CAGR): 29%

1-year Return (CAGR): 29%

11/13

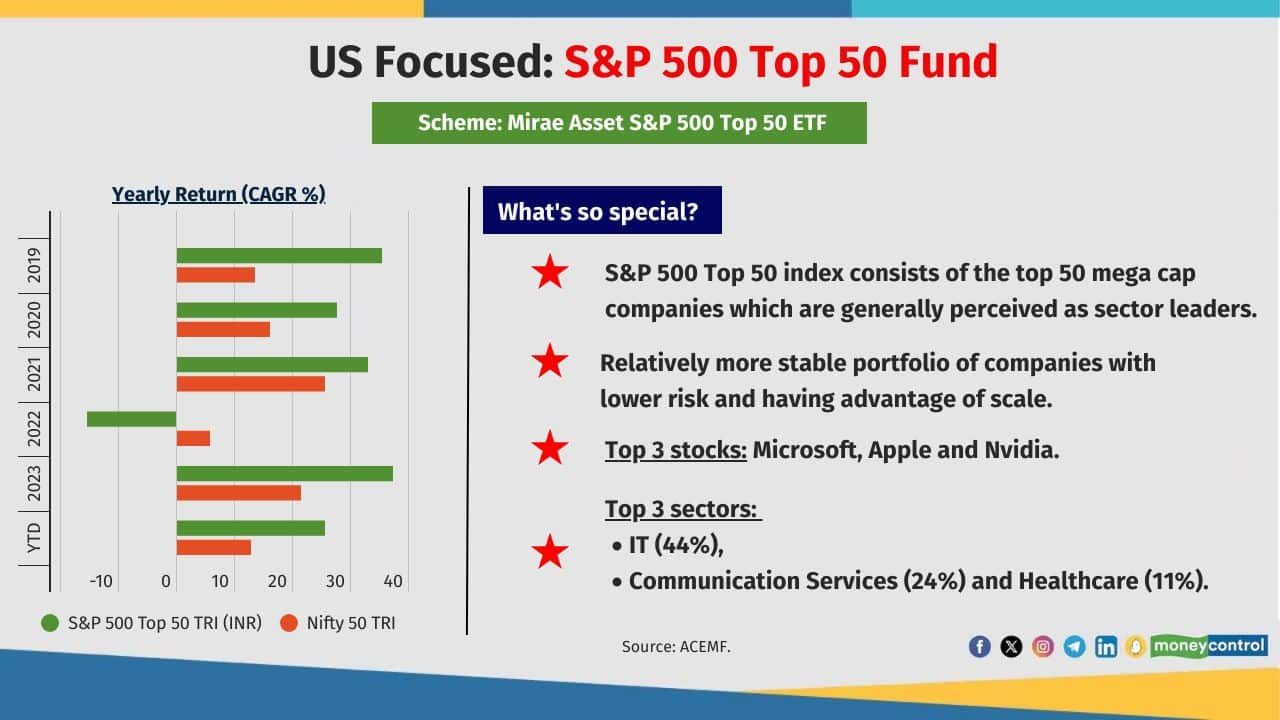

S&P 500 Top 50 Fund

1-year Return (CAGR): 41%

1-year Return (CAGR): 41%

12/13

Value Fund

1-year Return (CAGR): 14%

1-year Return (CAGR): 14%

13/13

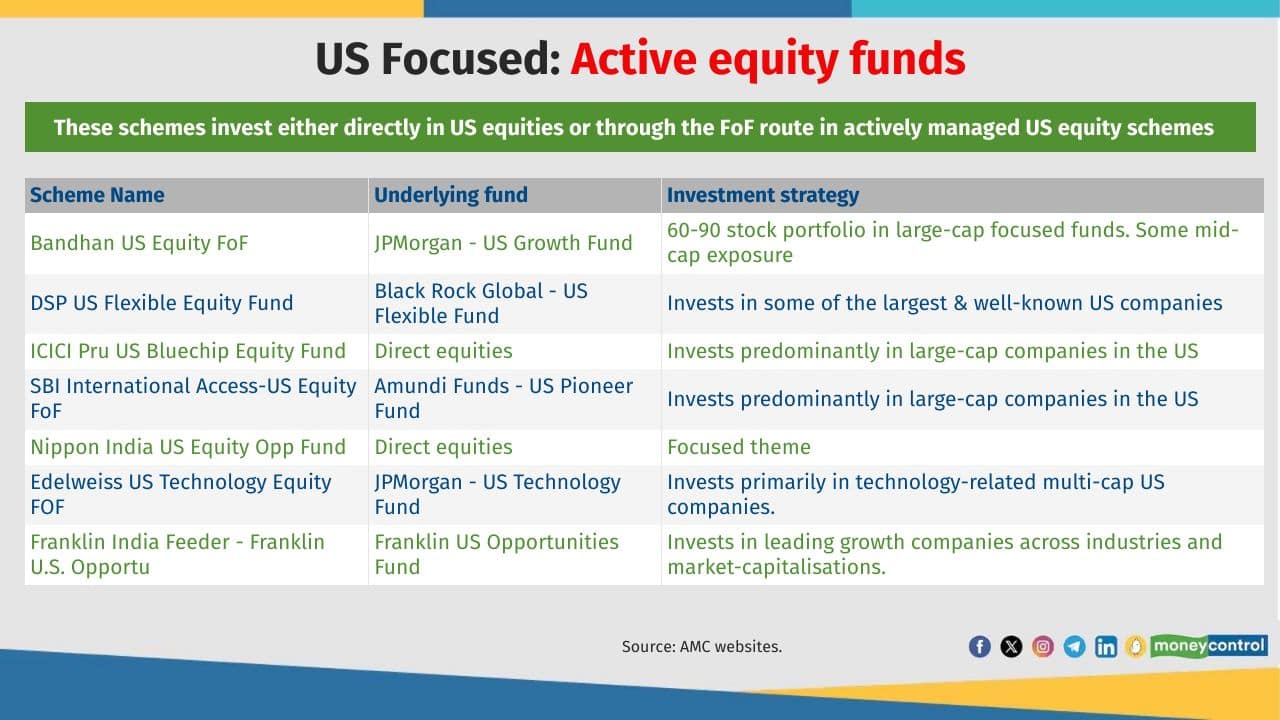

1-year returns of active equity funds:

Bandhan US Equity FoF (41.8%)

DSP US Flexible Equity Fund (21.7%)

ICICI Pru US Bluechip Equity Fun (9.5%)

SBI International Access-US Equity FoF (38.7%)

Nippon India US Equity Opp Fund (27.9%)

Edelweiss US Technology Equity FOF (38.5%)

Franklin India Feeder - Franklin U.S. Opportunities Fund (35.7%)

Also see: Top microcaps upgraded to smallcaps category on AMFI list. Do you own any?

Bandhan US Equity FoF (41.8%)

DSP US Flexible Equity Fund (21.7%)

ICICI Pru US Bluechip Equity Fun (9.5%)

SBI International Access-US Equity FoF (38.7%)

Nippon India US Equity Opp Fund (27.9%)

Edelweiss US Technology Equity FOF (38.5%)

Franklin India Feeder - Franklin U.S. Opportunities Fund (35.7%)

Also see: Top microcaps upgraded to smallcaps category on AMFI list. Do you own any?

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!