India Shelter Finance Corporation IPO: Explained in 5 key charts

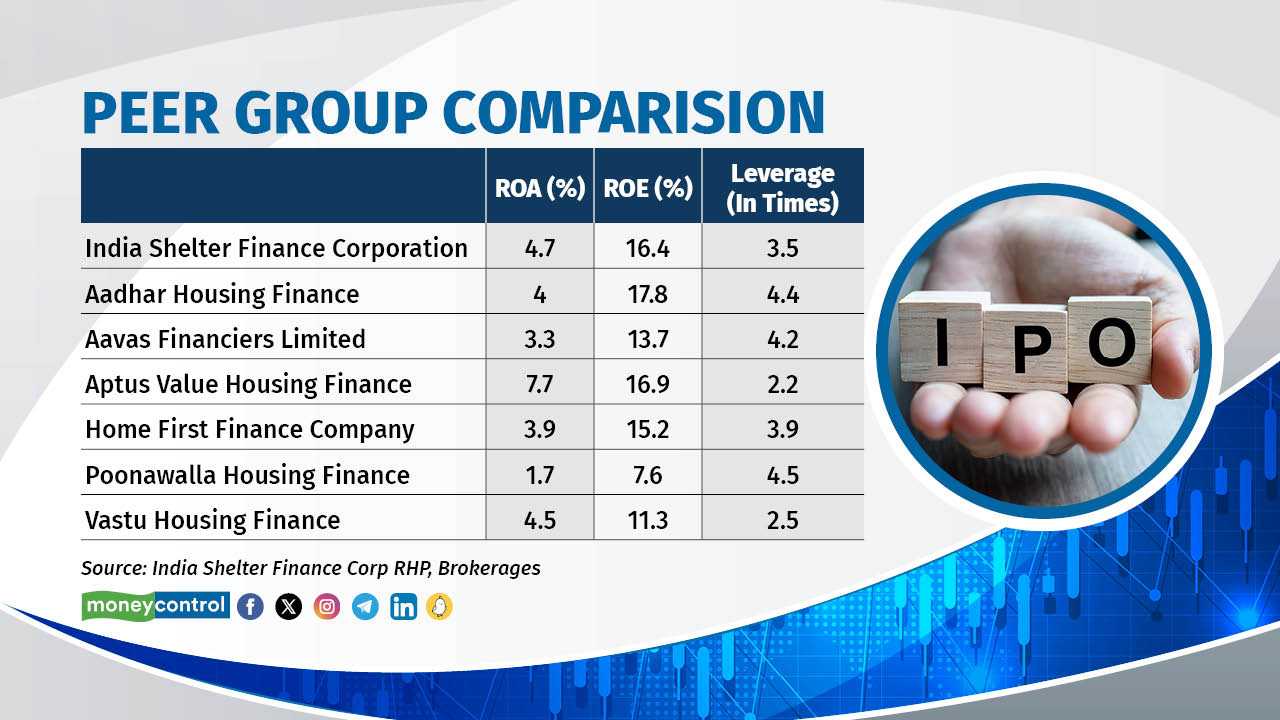

The company’s return on assets is higher than its counterparts while leverage is on the lower side.

1/5

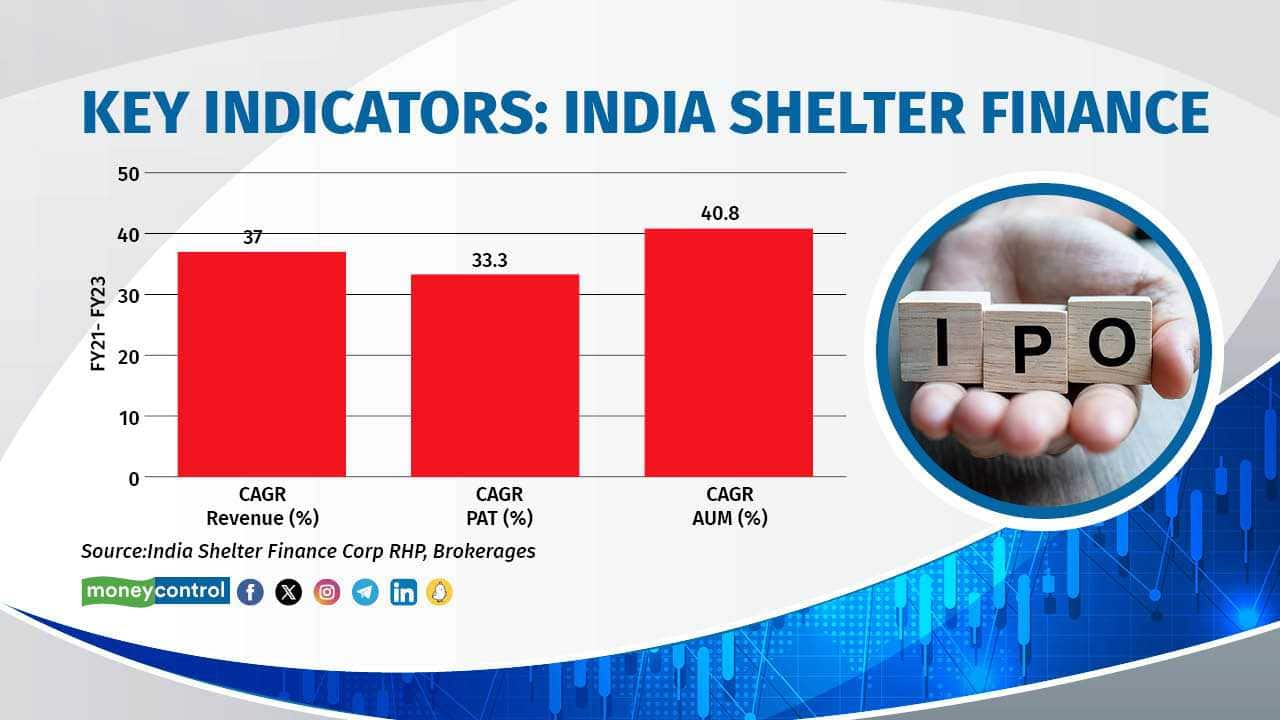

The company’s revenue growth has remained in the range of 30-40 percent. Though it slowed down in FY23 the momentum seems to be intact in the first six months of the financial year. The company’s capital adequacy (CAR) ratio, however, has come down to 52 percent from 71 percent for the financial year ended 2023. The assets under management have grown at 40 percent on a sustainable basis. This growth is driven by distribution and productivity of the company.

2/5

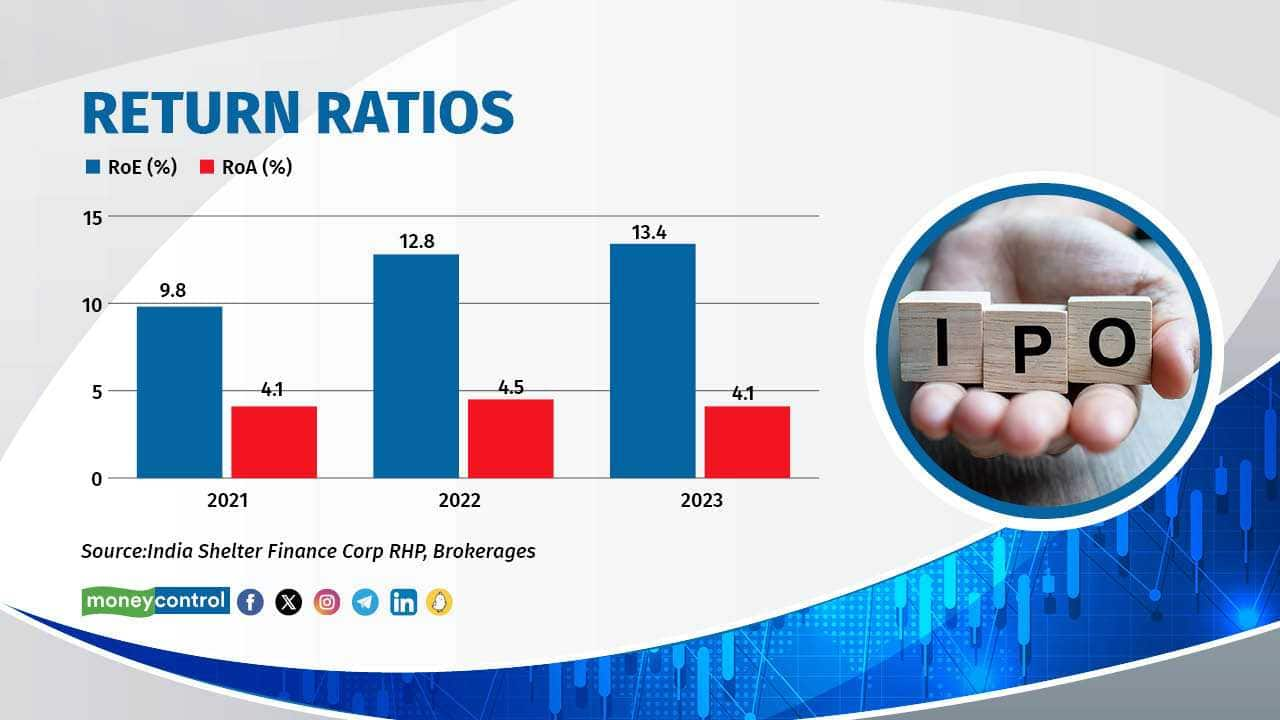

Return profile

India Shelter Finance Corporation’s return ratios have improved from 9.8 percent in 2021 to 13.4 percent in 2023. Although the return on assets (RoA) saw a slight moderation due to rising interest rates, the ratio is on an improving trajectory aided by low credit costs. The lender posted an RoA of above 4 percent in FY23.

India Shelter Finance Corporation’s return ratios have improved from 9.8 percent in 2021 to 13.4 percent in 2023. Although the return on assets (RoA) saw a slight moderation due to rising interest rates, the ratio is on an improving trajectory aided by low credit costs. The lender posted an RoA of above 4 percent in FY23.

3/5

Historical performance

The company’s asset under management (AUM) has crossed the Rs 5,000-crore milestone, reaching Rs 5,181 crore as of September (H1 FY24). Its AUM has grown at a two-year CAGR of around 40 percent. The company plans to diversify its distribution network to achieve deeper penetration. Presently, three states contribute to around 62.7 percent of the AUM for six months ended September 30.

The company’s asset under management (AUM) has crossed the Rs 5,000-crore milestone, reaching Rs 5,181 crore as of September (H1 FY24). Its AUM has grown at a two-year CAGR of around 40 percent. The company plans to diversify its distribution network to achieve deeper penetration. Presently, three states contribute to around 62.7 percent of the AUM for six months ended September 30.

4/5

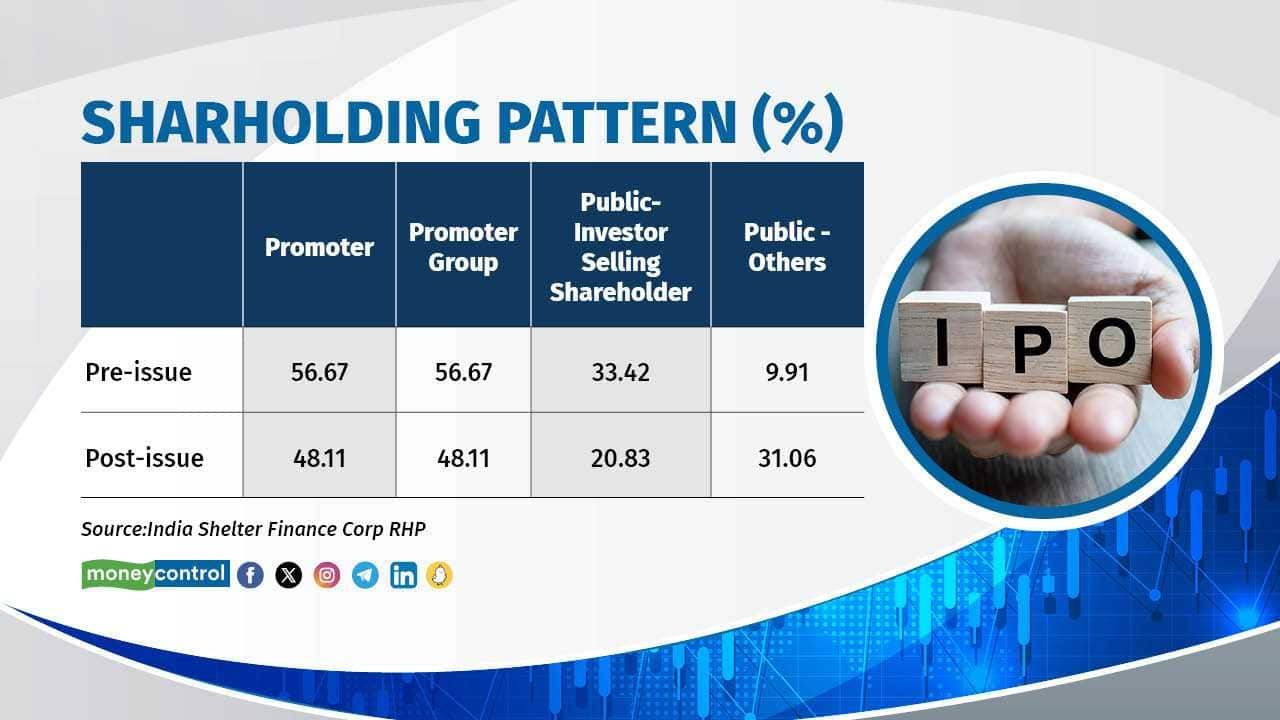

Shareholding pattern

In an exclusive interview with Moneycontrol, a senior company official said, “We have three major investors: WestBridge, Nexus, and Madison. WestBridge holds 56 percent, Nexus holds 28 percent, and Madison holds a 10 percent stake in our company. WestBridge also holds the promoter tag and is not selling anything in this IPO. They have a regulatory lock-in for the next 12 to 18 months due to their status as perpetual funds, signifying their long-term commitment. Nexus, an early investor in India Shelter since 2012, will be diluting around 15-20 percent of its current holdings, after which there will be no lock-in period for them. Madison plans to divest approximately 40-50 percent of their current stake in the company.”

In an exclusive interview with Moneycontrol, a senior company official said, “We have three major investors: WestBridge, Nexus, and Madison. WestBridge holds 56 percent, Nexus holds 28 percent, and Madison holds a 10 percent stake in our company. WestBridge also holds the promoter tag and is not selling anything in this IPO. They have a regulatory lock-in for the next 12 to 18 months due to their status as perpetual funds, signifying their long-term commitment. Nexus, an early investor in India Shelter since 2012, will be diluting around 15-20 percent of its current holdings, after which there will be no lock-in period for them. Madison plans to divest approximately 40-50 percent of their current stake in the company.”

5/5

India Shelter Finance’s performance versus peers

The company’s return on assets is higher than its counterparts while leverage is on the lower side. The company’s leverage for the quarter ended September 30, 2023, stood at around 3.5 times. The company is comfortable with a leverage of around 4 times, which aligns comfortably with the ecosystem, encompassing banks, rating agencies, and more. Upon this issuance, India Shelter Finance’s net worth is expected to surpass Rs 2,000 crore and leverage to reduce.

The company’s return on assets is higher than its counterparts while leverage is on the lower side. The company’s leverage for the quarter ended September 30, 2023, stood at around 3.5 times. The company is comfortable with a leverage of around 4 times, which aligns comfortably with the ecosystem, encompassing banks, rating agencies, and more. Upon this issuance, India Shelter Finance’s net worth is expected to surpass Rs 2,000 crore and leverage to reduce.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!