India’s real GDP growth for Q1 FY26 came in at a robust 7.8% year-on-year, marking the highest pace in six quarters. If taken at face value, this suggests strong underlying economic activity. All major components of domestic demand—household consumption, government revenue expenditure, and investments—posted growth above 7%, while exports grew by 6%, which is respectable in the current global context.

On supply side, real GVA growth came at 7.6% (vs. 6.8% in Q4 FY25) led by 3.7% y-o-y growth in agriculture (vs. 5.4% in Q4), 6.3% growth in industry (vs. 6.5%) and 9.3% growth in services (vs. 7.3%). Within industry, manufacturing grew by 7.7% and construction by 7.6%. These figures, however, appear inconsistent with IIP trends and corporate earnings, raising questions about their reliability.

Downside of single deflation method

It is widely acknowledged that official GDP data—especially in real terms—often fails to capture the true underlying trends. The use of single deflation by the Statistics Office, instead of the more accurate double deflation method, can lead to an overestimation of real growth, particularly during periods of falling commodity prices.

The WPI, which is heavily weighted towards commodities, registered just 0.3% inflation in Q1 FY26, while CPI stood at 2.7%. Given this backdrop, most market participants, including us, anticipated an artificially elevated real GDP print alongside a subdued nominal figure. Yet, the 7.8% real growth print has surprised many, further deepening scepticism around the credibility of India’s GDP statistics.

Importance of nominal GDP data

Hence, while we have laid down the table on real growth, we would rather refer to nominal growth, which is somewhat a better representation of reality.

In nominal terms, GDP growth slowed to 8.8%, a three-quarter low, and could weaken further in Q2. High-frequency indicators up to August remain lacklustre, and both WPI and CPI are trending lower, with CPI falling below 2%. Nominal household consumption grew by 9.2%, the second weakest quarterly performance since the pandemic. Historically, household spending has grown at 12–13% annually over the past decade. Gross capital formation (investments) was even weaker at 8.0%. Nominal exports remained healthy at 8%, likely reflecting front-loaded orders.

Government revenue expenditure surged by 9.7% y-o-y, consistent with fiscal data showing increased spending by both the Centre and states in Q1.

On the supply side, nominal agriculture growth fell sharply to 3.2% from the previous 9–15% range, which is concerning given the recent optimism around rural recovery. Manufacturing posted a surprisingly strong 10% growth, while services grew by 11.3%, driven largely by government spending in community, social, and personal services.

Outlook: Caution ahead, but reform opportunities emerge

Some of these trends may reverse in the coming quarters. Export momentum could fade, and government spending may appear weaker on a y-o-y basis in H2. September could see temporary softness due to weaker export orders and the impact of high tariffs. If GST rate cuts are delayed, consumer purchases may be postponed, further dampening demand. Official data may not fully capture this slowdown.

Amid the growth shock, we see an important positive aspect emerge. We believe the government may be keen to undertake economic reforms to push growth higher. The GST announcement was an important signal of intent (even though its growth impact remains uncertain). Now appears to be the best time to undertake trade and domestic reforms.

On the trade front, fast-tracking trade deals, improving India-China relations, lowering import tariffs on inputs, and easing FDI norms are already in progress. On domestic reforms, GST rationalisation, and deregulation (across centre and state governments) could come in focus. The domestic growth inflation backdrop also warrants additional monetary support in India though RBI seems to be signaling otherwise for now.

Nominal growth break-up

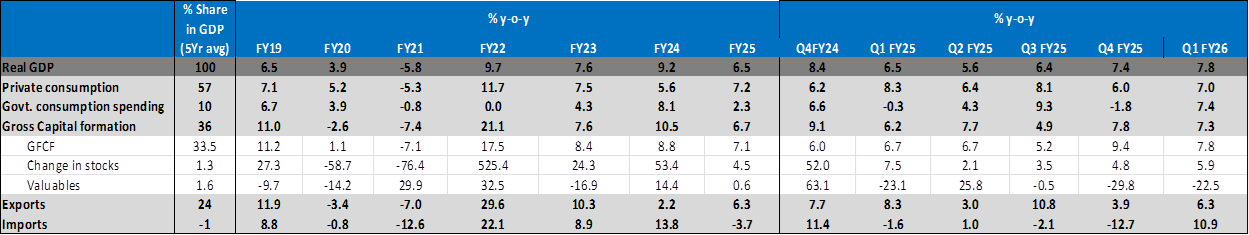

Real growth Break-up: demand side

Real GVA growth: supply side demand

(Namrata Mittal, Chief Economist at SBI Mutual Fund.)

(Views are personal and do not represent the stand of this organisation.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!