In the August Monetary Policy Committee (MPC) meeting, RBI Governor Shaktikanta Das said that the Indian Rupee (INR) has fared “much better than several reserve currencies as well as many of its EME and Asian peers”. The Governor also added that the INR has depreciated “more on account of the appreciation of US dollar rather than weakness in macroeconomic fundamentals of the Indian economy”.

Of late, there has been a lot of discussion around the INR. Towards the end of July, the rupee touched 80 against a US dollar, leading to discussions that it is a sign of a weakening Indian economy. But, is this the case?

First, exchange rate increasing or decreasing against a foreign currency is not a sign of weakness or strength. In fact depreciation of the currency is often cited as a positive development for the domestic economy. If a currency depreciates against a foreign currency, the exports become cheaper with respect to the other country, and imports become more expensive. This means exports will rise and imports will fall, leading to higher GDP for the country. The opposite happens with appreciation as exports become expensive and imports become cheaper. As a result, there is a school of economic thought which believes that keeping currency undervalued helps an economy in growth.

Second, the arguments for or against depreciation are not limited to growth in exports. If a country is reliant on imports for necessary consumption items such as food and crude oil, then depreciation means costlier imports and higher inflation. The higher inflation will lead to monetary policy tightening, and slowdown of the economy.

The Indian economy and several others are going through the above discussed dilemma of currency depreciation. While exports are getting competitive, the reliance on oil imports is leading to inflation and macroeconomic imbalances. Moreover, it takes time for exports to rise but imports get costlier right away. The macroeconomists term this impact of depreciation as the ‘J curve’ where initially there is a negative impact on the economy due to costlier imports, and then things improve overtime with higher exports. It is this negative effect which keeps policymakers awake at night.

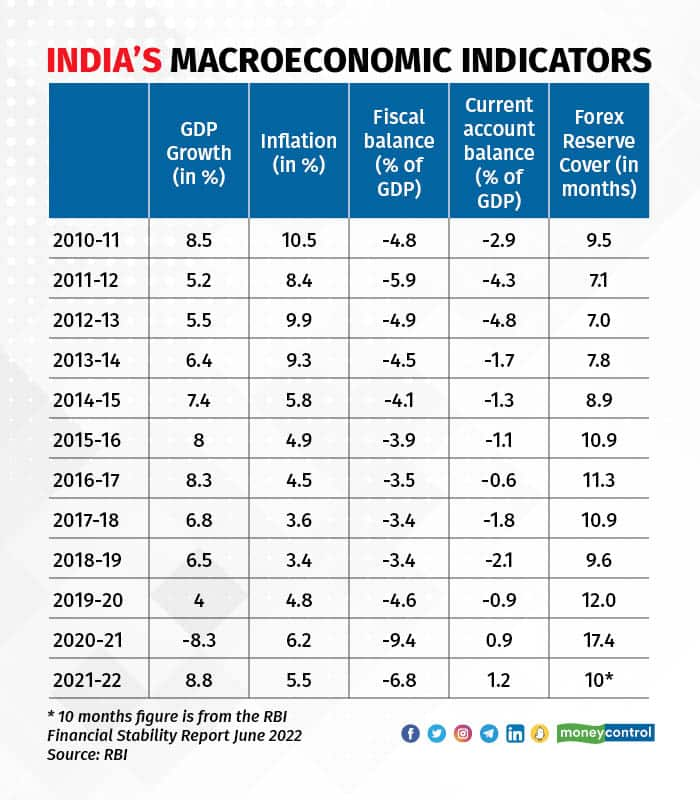

Indian policymakers learnt these harsh lessons in 2013. The fundamentals of the Indian economy had started deteriorating from 2011-12 onwards. The then US Federal Reserve chair Ben Bernanke announced that the central bank would begin to withdraw or taper the easy monetary policy. India’s economic fundamentals had already weakened, and the now higher interest rates in the US led to a sudden flight of capital from India. The result was sharp depreciation of the currency, and the INR depreciated by ~21 percent against the USD in the period 2011-14.

The lessons from the 2013 crisis were two-fold. First, maintain the macroeconomic indicators within threshold levels. Of all the macroeconomic indicators, high inflation and large fiscal deficits were the major problems.

For tackling inflation, the Government of India gave the RBI a mandate to target inflation at 4 percent, which has been reasonably successful so far. So much so, India currently has lower inflation than most developed economies. The fiscal deficit began to decline as well but it has again increased sharply during the pandemic. The growth rates have had a mixed record whereas current account deficit has been under control so far.

The second lesson was to build forex reserves. There are always instances when macroeconomic indicators are not in sync, and in those times forex reserves act as a cushion against the sudden external shocks. The forex reserve cover improved from seven months of imports in 2013-14 to 17 months in 2020-21.

The build-up of the forex reserves has helped the economy immensely in recent months. Just like in 2013, the US Federal Reserve has started to increase policy rates much more aggressively to tackle inflation. This has led to capital flows from India to the US, and depreciation of many currencies. As per the RBI Governor’s statement, whereas major currencies have depreciated by an average of 8 percent against the USD in the financial year till August 4, the INR has depreciated by 4.7 percent.

The RBI has prevented sharp rupee depreciation by selling its foreign exchange reserves. The reserves which stood at $642 billion in October 2021 has declined to $574 billion as of July 29. Currently the reserve cover is around 10 months, which is reasonable. Apart from selling foreign exchange reserves, the RBI has taken measures to attract capital inflows.

There is another problem that when we mention depreciation it is mostly against the USD. The INR has depreciated against the USD, but has appreciated against other major currencies. The RBI has also taken a step towards internationalising the INR, which hopefully will slowly lead to more external sector invoices in the INR, and lower the share of the USD in India’s trade.

To sum up, the INR has held up much better than other currencies due to efforts taken by policymakers in the earlier years. Having said that, there is no room for complacency. While selling foreign exchange reserves can help tide through short-term pains, it is not a long-term solution. The growth rates have lagged in the recent years, and private investments have not picked up. Our external sector policy has not been consistent as we have preferred to close the current account while liberalising the capital account. Inflation targeting is meeting its sternest test right now with elevated inflation. Macroeconomic management is always the toughest part, and focus has to remain on that front.

Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!