Macroeconomic theory says that the difference between inflation rates in two countries explains, to a large extent, the movement in their exchange rate. Thus, a country (say India) with a higher inflation rate compared to another (say the US) will see its currency rupee depreciate against the latter’s dollar. This has been the narrative for the past many years.

Now, we are seeing a rare moment in economic history when the inflation rate in developed economies is higher than the inflation in select developing economies such as India. In the US, for instance, inflation is at a 40-year high and exceeds that of India by more than a percentage point. Yet, the rupee continues to depreciate against the US dollar. Does this mean that the macroeconomic theory no longer holds? We explain below.

How is inflation connected to exchange rates?

Inflation means a rise in aggregate prices in an economy. Exchange rate means a price with which we buy and sell goods and services from other countries. If prices are higher in one country compared to another, it should reflect in the exchange rate too, else there will be arbitrage.

Say, inflation is higher in India compared to the US. Assuming exchange rates do not change and there is no trade friction, then a trader can sell from the US to India. The import of foreign goods will lead to a rise in demand for US dollars, resulting in appreciation of the USD against INR.

In the real world, we hardly see such frictionless markets and more so in international trade. Therefore, the inflation differential and its impact on exchange rate plays out over a long term. So, economists say that countries which have higher inflation, face depreciation of the exchange rate over time.

How does this relationship play between developed and developing economies?

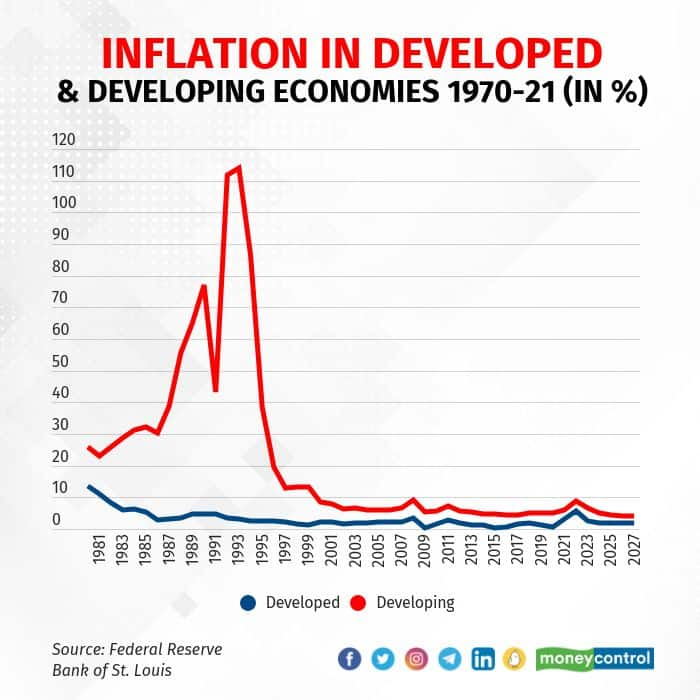

Graph 1 shows that developing economies have had higher inflation than developed economies in each year since 1980. The differences have narrowed down in recent years due to better inflation management in developing economies. Thus, developing economies collectively see their exchange rate depreciate against developed economies. While one can always estimate inflation for developed and developing economies by averaging inflation of all the economies in the two categories, we cannot get similar estimates for exchange rates. Hence we need to select one economy and then estimate the inflation differential and impact on exchange rates. Let’s discuss this relationship with respect to India.

Graph 1

Graph 1

How do India’s inflation and exchange rate compare with developed economies?

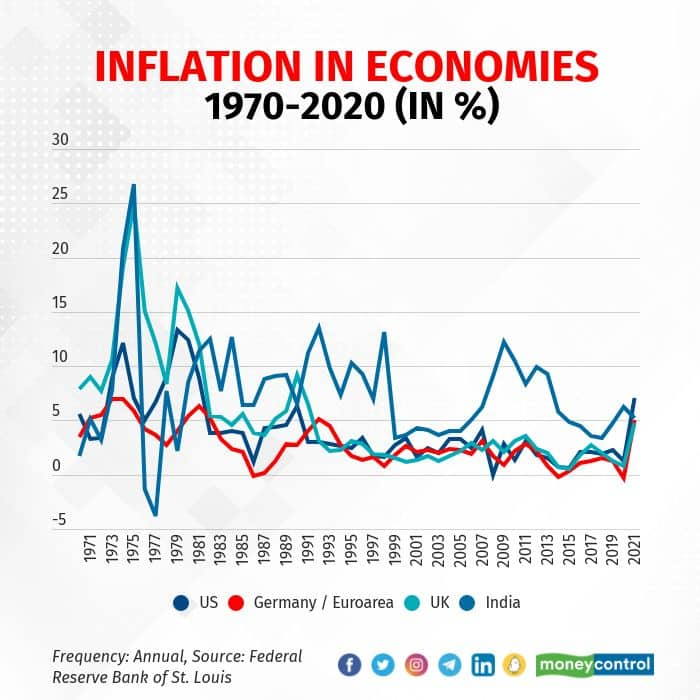

India’s inflation has been higher than advanced economies in most of the years in the 50 year history (See Graph 2).

Graph 2

Graph 2

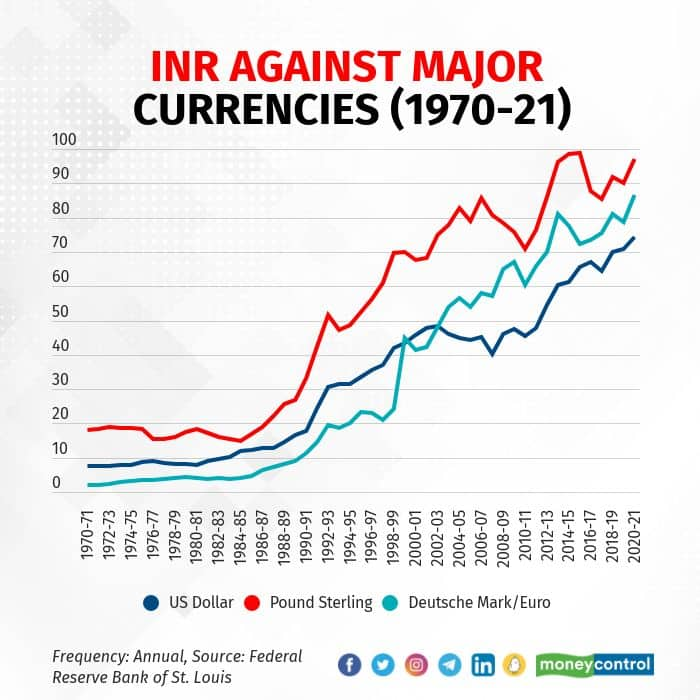

Accordingly, the INR has depreciated against the currencies of major advanced economies (See Graph 3). This does not imply inflation differential is the only factor responsible for depreciation of the INR but one of the major factors behind rupee depreciation.

Graph 3

Graph 3

What changed in 2021?

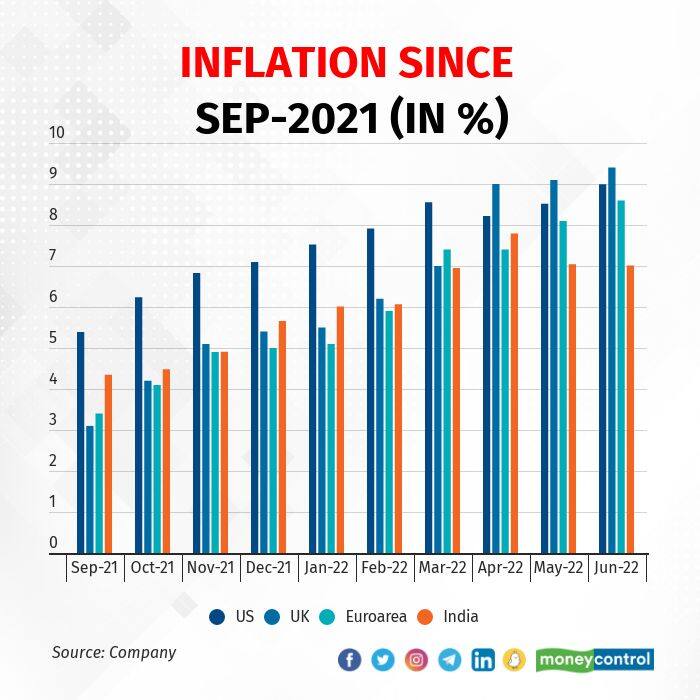

In the second half of 2021, the inflation differential between India and developed countries has reversed. The inflation has been higher in select developed countries than inflation in India! (See Graph 4) India’s inflation has been lower than that of the US since September 2021, lower than that of the UK since February 2022 (and in some other months too) and lower than Euro area since March 2022.

Graph 4

Graph 4

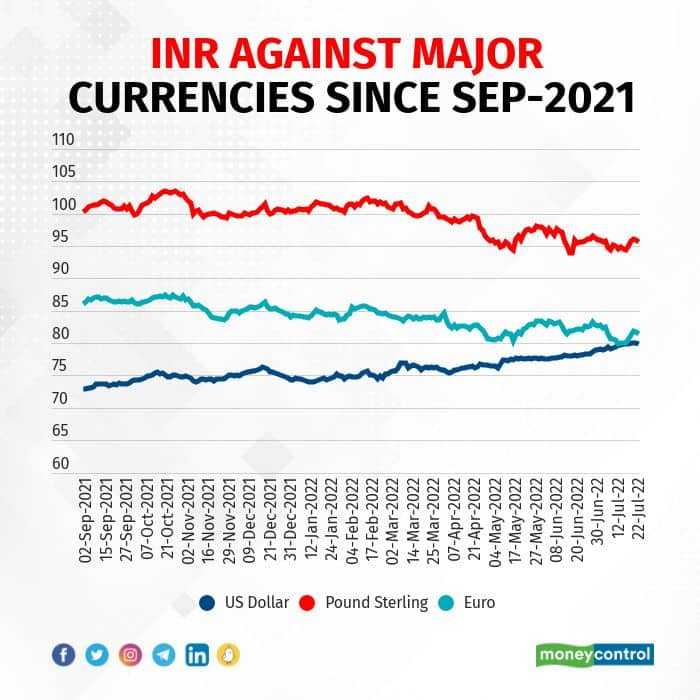

On analysing the impact of inflation differentials on the exchange rate (See Graph 5), we see that has appreciated against the pound (from Rs 100 per pound in September 2021 to Rs 95 per pound in July 2022) and euro (from Rs 86 per euro in September 2021 to Rs 81 per euro in July 2022) which is in line with the inflation differential. However, INR has depreciated against the USD in the same period from Rs 73 per USD to near 80 levels in July 2022.

Graph 5

Graph 5

The Chief Economic Adviser also recently commented that INR may have depreciated against USD but has appreciated against other currencies. He also added that other currencies have depreciated more against USD than INR. In particular, euro has depreciated recently and reached parity with USD (1 EUR = I USD) for the first time in 20 years.

What explains INR depreciation against USD despite India having lower inflation than US?

I attended a conference around the time of the 2008 crisis in Mumbai. US economist Larry Summers famously said in the conference: “USD depreciates only against Mars”! His point was that in case of a global economic crisis, the foreign capital leaves local shores and is invested in the US. The rise in demand for US dollars leads to appreciation of USD and depreciation of the other currency.

In the 2008 crisis, US was at the centre of the crisis which should have led to depreciation but saw appreciation as capital flew to the country. The Federal Reserve cut interest rates to near zero levels yet it did not impact currency flows. Investors believe that investing in other economies might be risky but USD with its global currency status remains a safe bet.

In 2022, we are seeing similar sentiments play across the world economy. The Federal Reserve has started to aggressively increase interest rates for taming inflation. The higher interest rates and rise in global risks have led capital to once again flow to the US, leading to large-scale appreciation of USD against most currencies. Investors also view the Federal Reserve policy stance as more credible than that of central banks of England and Euro area. Another important aspect are inflation expectations. Even if inflation is higher in India compared to developed countries, inflation in future is expected to trend lower

The INR is also in the same basket as other currencies and has depreciated against USD. The Reserve Bank of India (RBI) and the government have taken measures to increase capital inflows and also a small yet significant step to internationalise the rupee. The RBI has increased policy rates and selling foreign exchange reserves to defend INR. Despite the measures, INR continues to depreciate like other currencies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.